Kim Fuller needs accounting information like incomes, expenses, assets and liabilities for his new business. This includes a truck, trailers, machines, supplies and a warehouse. He also needs non-accounting info like contracts signed and hiring employees.

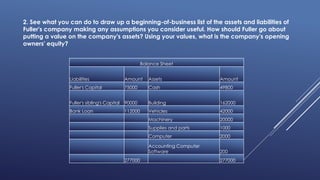

To value assets, Fuller adds up individual assets totaling $277,000. Opening owner's equity is $165,000 which is Fuller's and siblings' capital.

To determine profit and loss, Fuller needs expense and income data. Expenses include trade and office costs while incomes include operating and non-operating revenues. He should do analysis quarterly as the business is young.

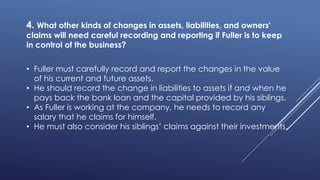

Fuller must carefully record changes to asset values, liabilities if loans are paid