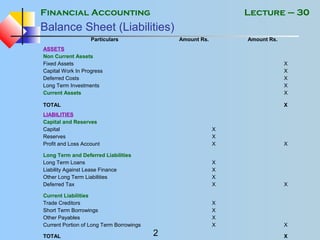

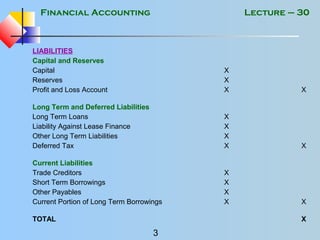

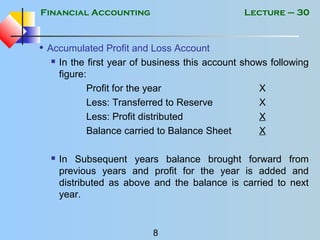

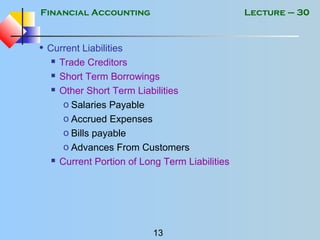

The document outlines key concepts of financial accounting, focusing on classifications of investments, liabilities, capital, reserves, and profit/loss accounts. It defines long-term and short-term loans, the portion of loans payable within a year, and provisions as anticipated expenses. Additionally, it explains the use of reserves for future purposes and details the various types of current liabilities.