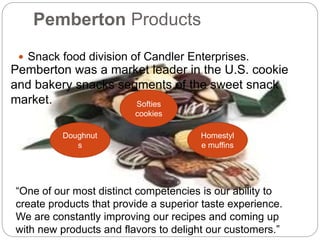

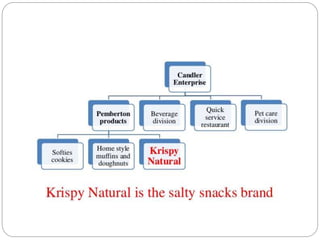

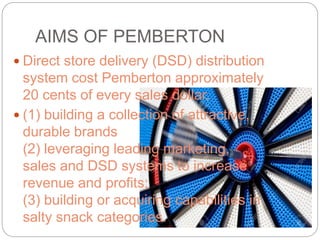

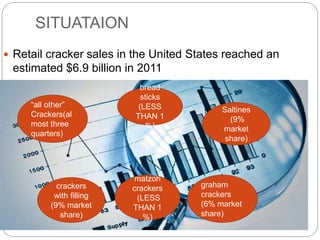

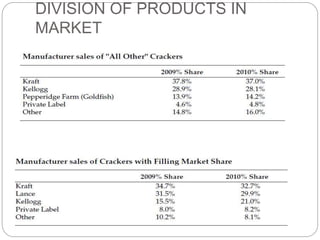

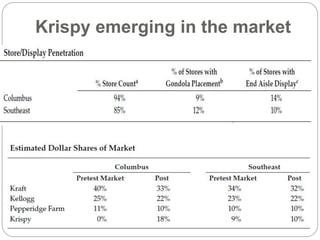

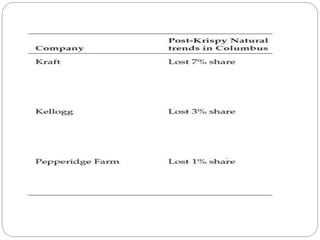

Pemberton Products, a leading snack food company, acquired Krispy Inc. which produced crackers. However, Krispy's initial product line performed poorly. Pemberton rebranded Krispy as "Krispy Natural" with improved flavors and packaging. Their marketing strategy included aggressive advertising, discounts, and expanding distribution. While Krispy Natural was gaining popularity regionally, it would face significant competition nationally from Frito-Lay, the largest salty snack maker. For national expansion, Pemberton needed to focus on quality, promotions, distribution improvements and expanding their product line.