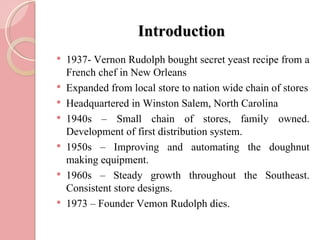

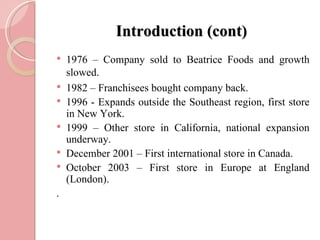

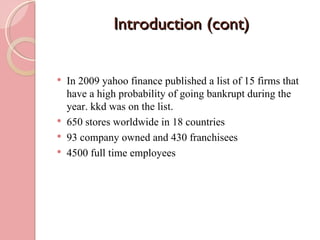

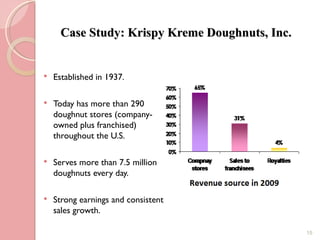

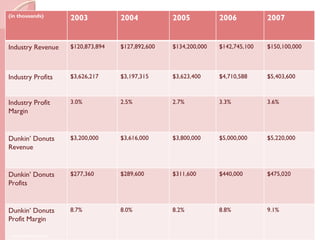

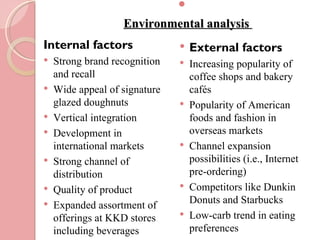

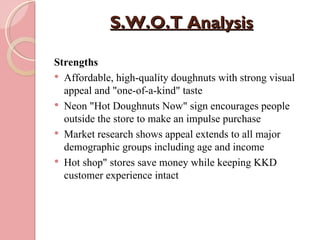

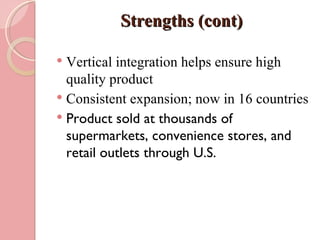

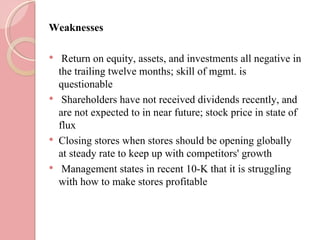

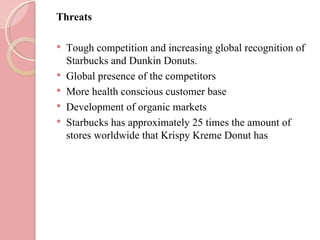

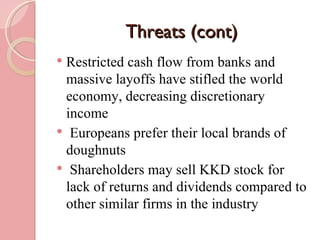

The document outlines various aspects of Krispy Kreme Doughnuts' business operations, including their vision, mission, values, store layouts, marketing strategies, competitors, and financial indicators. It also performs a situational analysis, examining Krispy Kreme's internal strengths and weaknesses as well as external opportunities and threats. The analysis finds that while Krispy Kreme has a strong brand, their marketing strategies may not be sufficient to maintain competitive advantage in the long run.