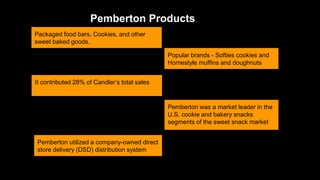

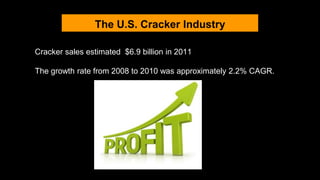

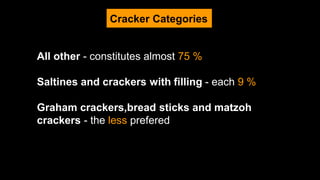

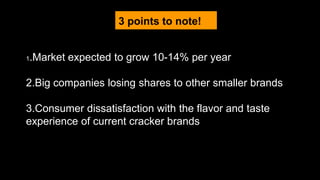

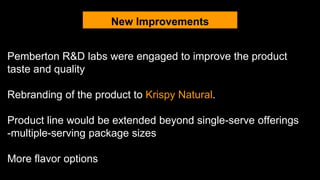

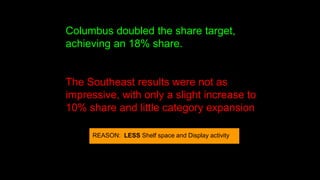

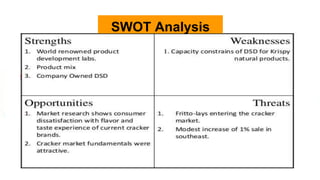

Candler Enterprises' snack food division, Pemberton, plans to enter the salty snacks market by acquiring Krispy Inc., a manufacturer of single-serve crackers. Despite initial sales falling short of expectations due to a limited product line and flavor dissatisfaction, the company rebranded its offerings as 'Krispy Natural' and aims for a national rollout based on promising test market results. Pemberton's strategy focuses on improving product taste, expanding package sizes, and leveraging targeted marketing to capture market share in the competitive cracker industry.