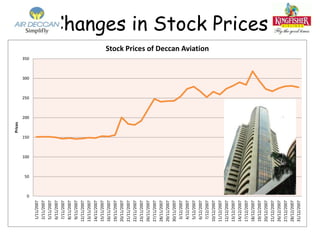

This document summarizes the merger between Kingfisher Airlines and Air Deccan in India. It discusses the key factors that led to the merger, including increasing costs, competition, and the need for consolidation in the Indian aviation industry. The merger combined Kingfisher's luxury model with Air Deccan's low-cost approach, and was aimed at achieving synergies through cost reductions, increased market share, and an expanded route network. However, integrating the two different airline cultures also posed challenges around job cuts, leadership styles, and impact on fares and employees. The aftermath section evaluates issues around market share, stake divestment, and the companies' current financial situations.