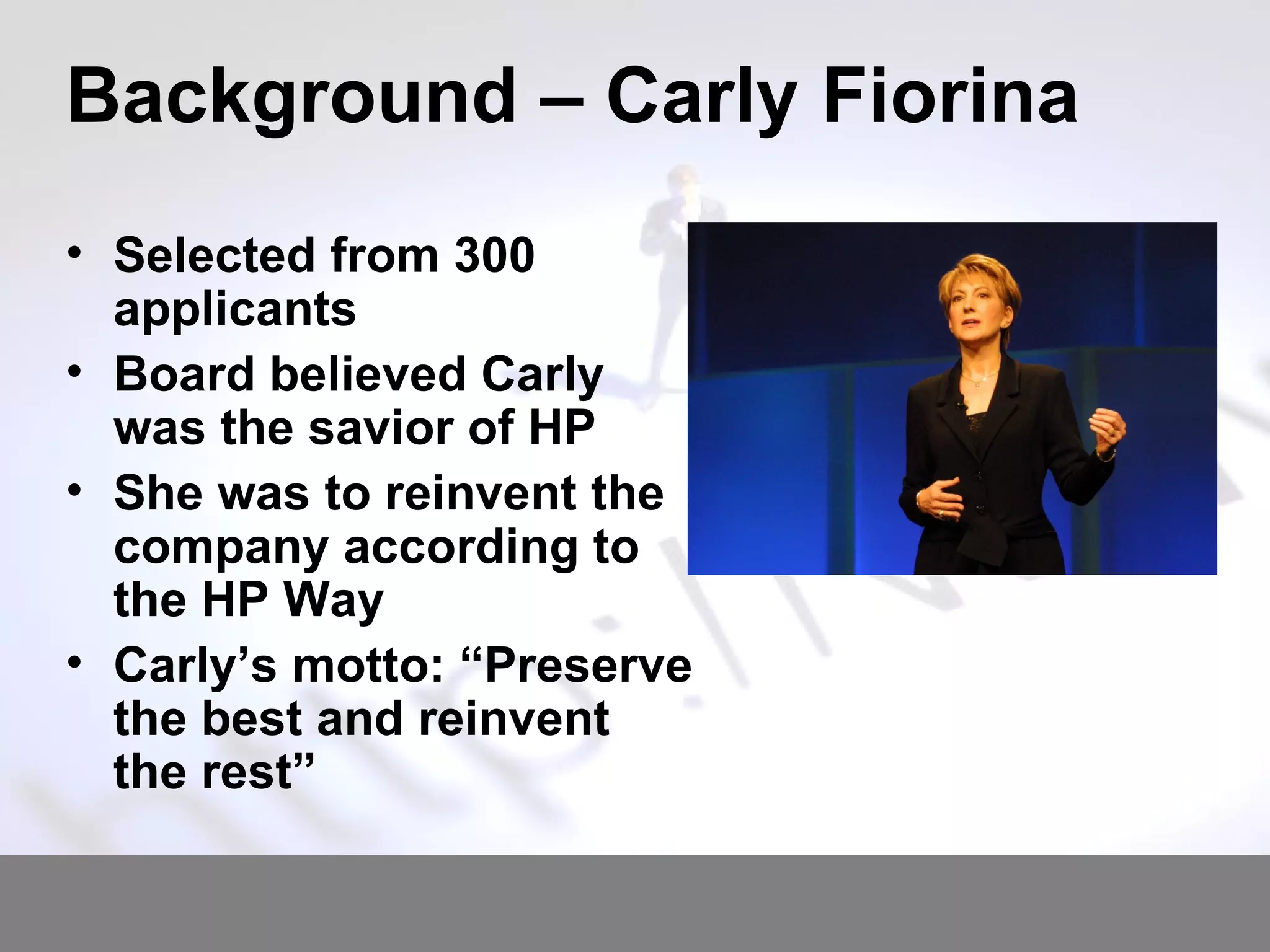

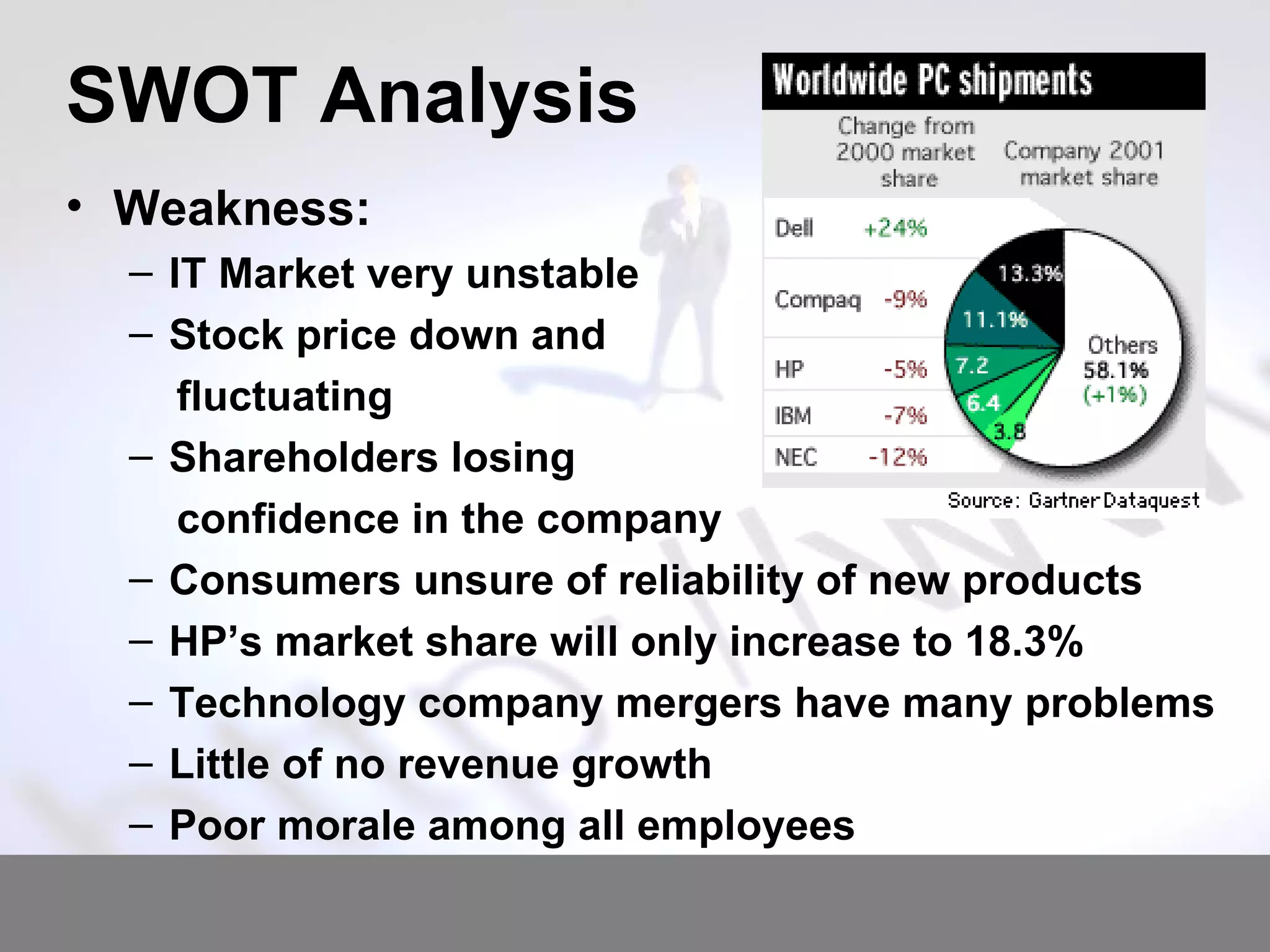

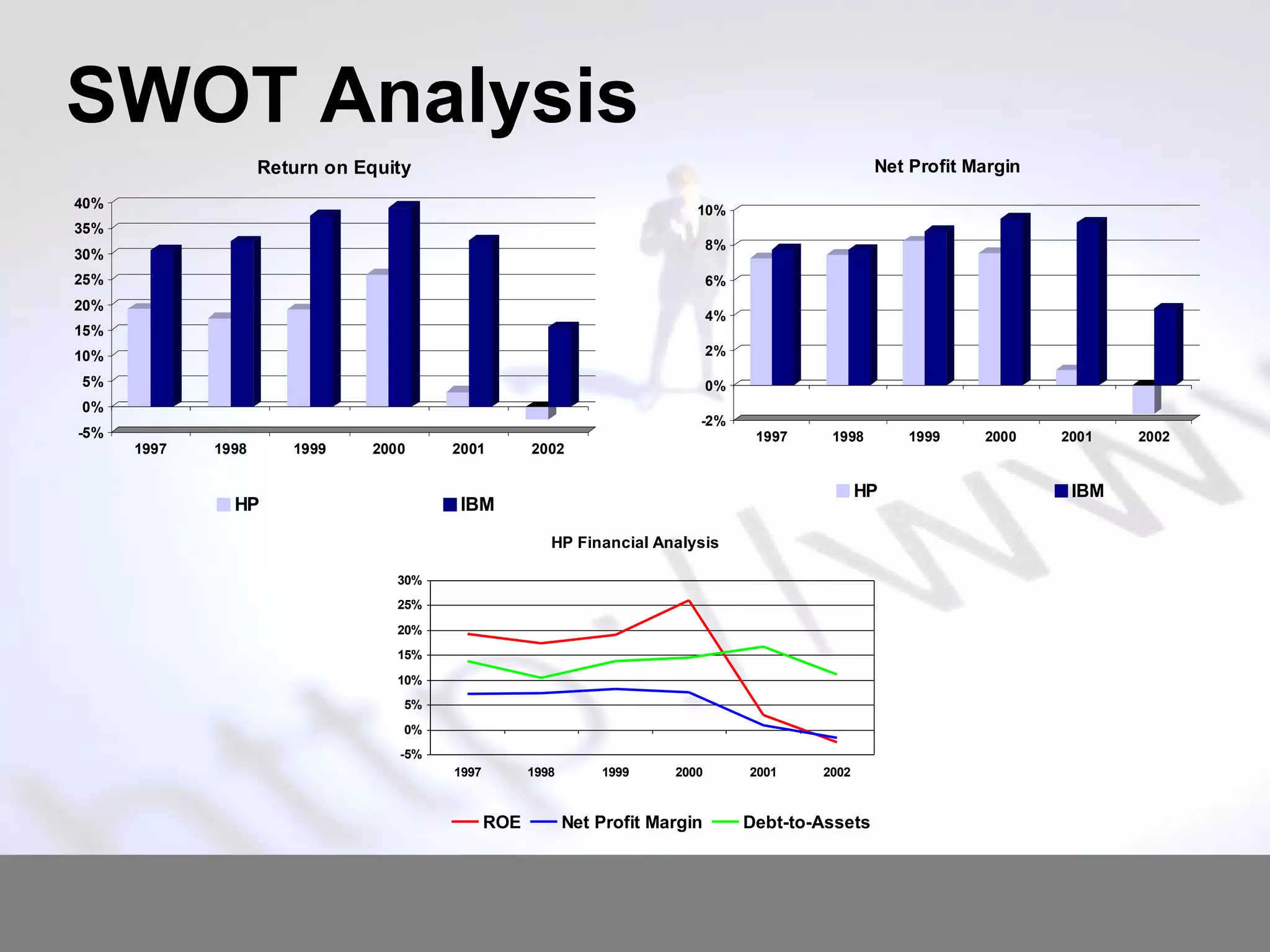

The document discusses the merger between HP and Compaq and the challenges that arose. It notes that Carly Fiorina held too many leadership roles at HP, which caused governance issues. Integrating the two company cultures and technologies was also challenging. Restoring stakeholders' trust in HP after the merger was an important issue to address. Recommendations included improving communication, restructuring governance, properly integrating the companies, and creating value to regain stakeholders' confidence.