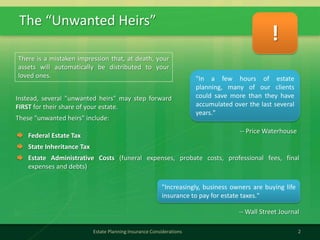

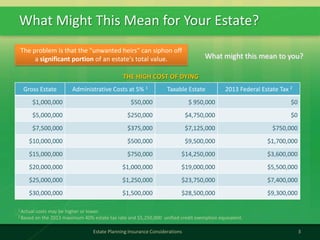

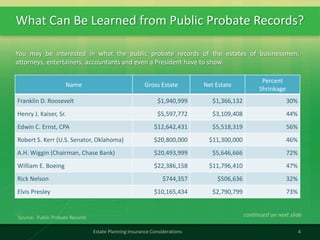

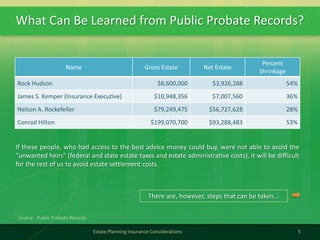

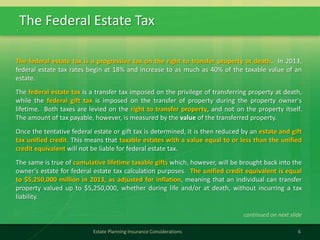

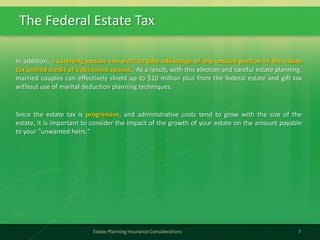

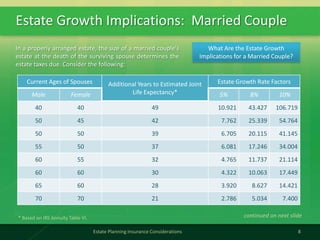

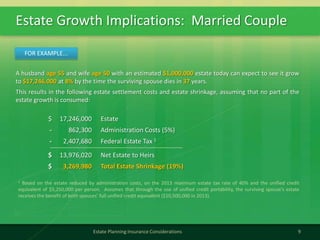

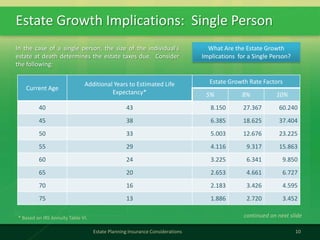

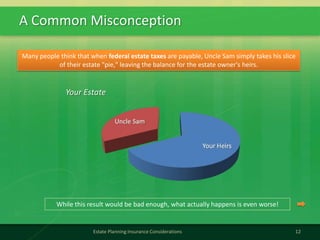

The document discusses estate planning considerations related to unwanted heirs and the federal estate tax. It notes that upon death, assets may not automatically pass to loved ones, as unwanted heirs like taxes may claim a portion. Life insurance can be used to pay estate taxes and costs, protecting more from passing to these heirs. Several case studies and tables show how estates of different sizes may face taxes and shrinkage without proper planning.