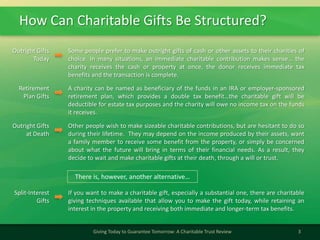

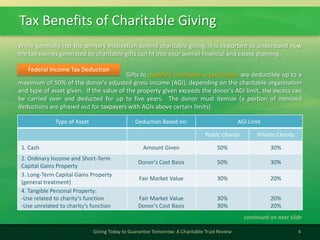

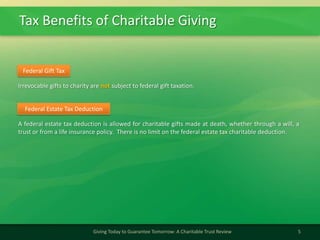

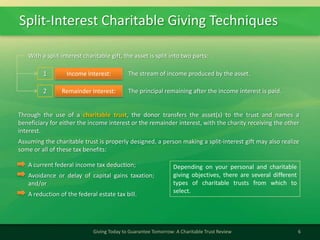

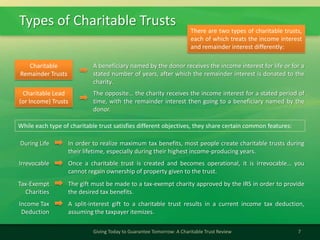

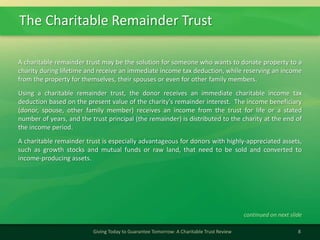

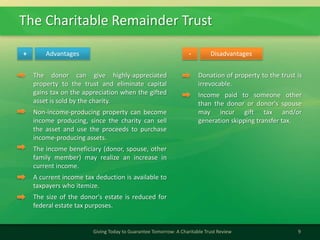

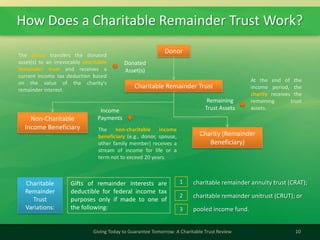

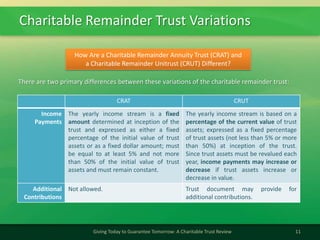

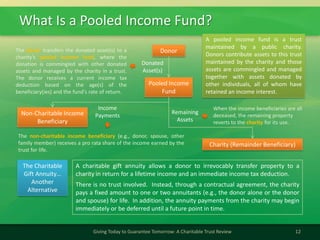

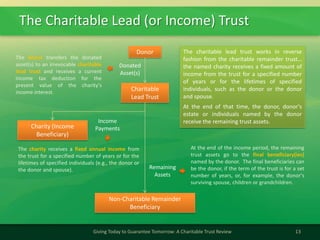

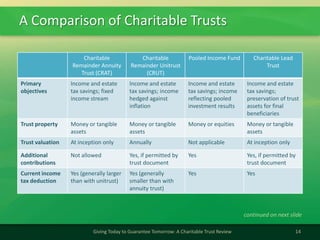

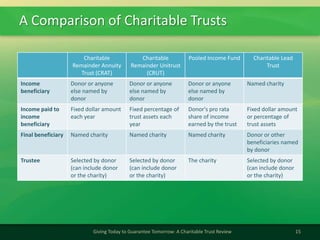

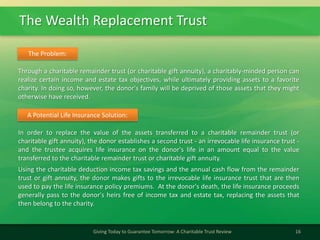

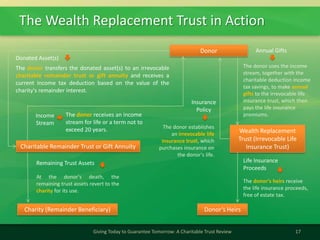

The document provides an overview of different ways to structure charitable gifts through trusts and other planned giving vehicles. It discusses outright gifts, retirement plan gifts, and bequests as simpler options, as well as split-interest gifts like charitable remainder trusts, charitable lead trusts, pooled income funds, and charitable gift annuities that provide tax benefits to donors while also benefiting charities. It compares the structures, tax treatment, advantages and disadvantages of these different planned giving techniques.