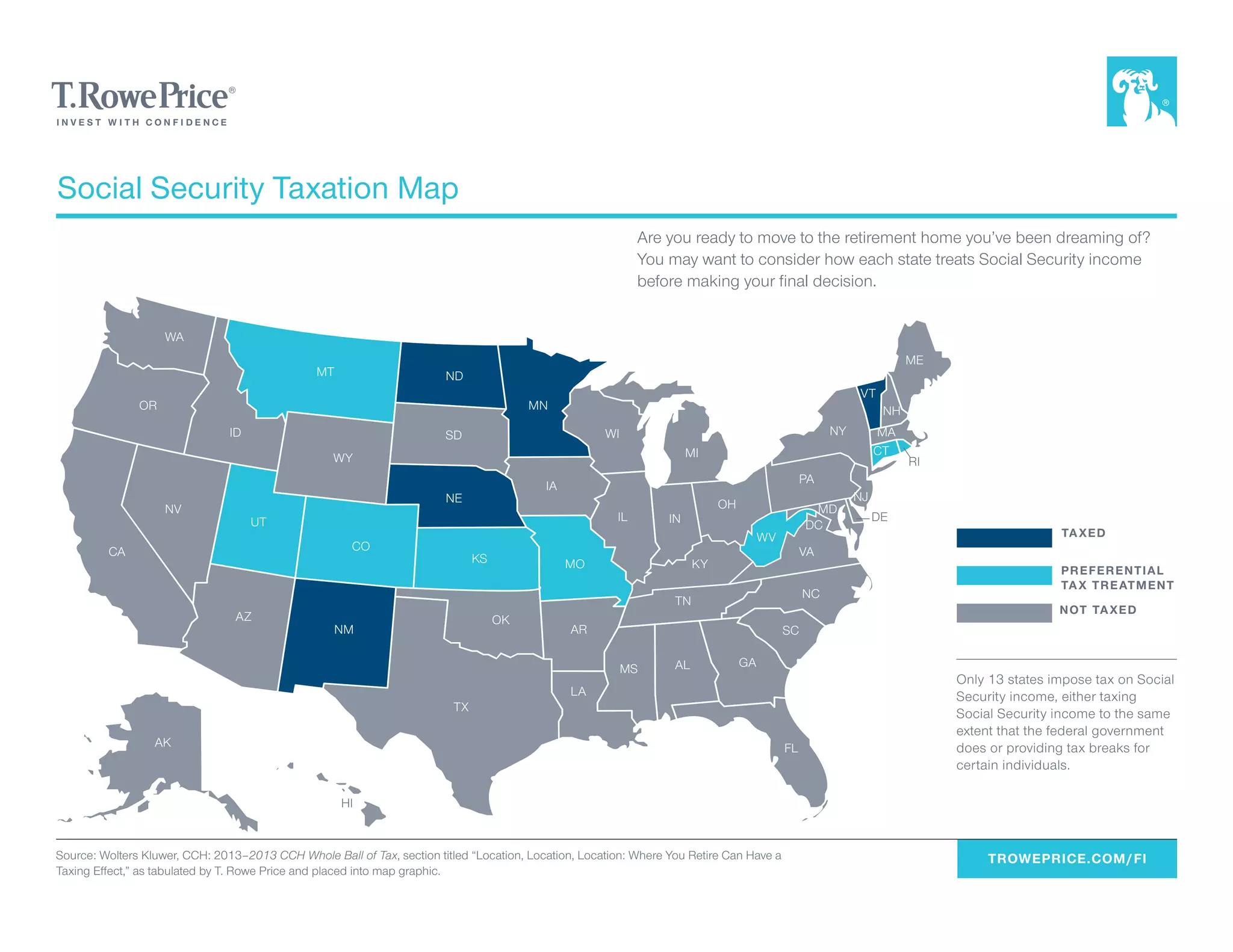

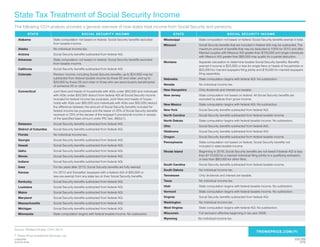

The document provides an overview of how different U.S. states tax social security income, indicating that only 13 states impose taxes on social security benefits, either at the same rate as federal taxes or with specific deductions for certain individuals. It details the taxation status state by state, noting that some states offer full exemptions or specific income thresholds that determine tax liability. The information is sourced from Wolters Kluwer and aims to assist individuals in making informed decisions about retirement relocation based on tax implications.