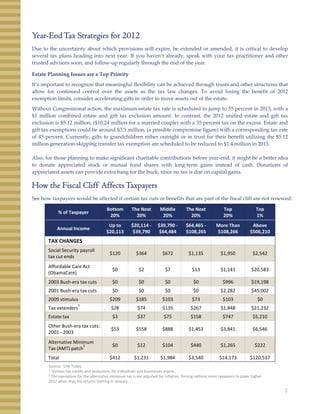

- If lawmakers cannot agree on a deal by the end of the year to avoid the "fiscal cliff", $560 billion in tax increases and $136 billion in spending cuts will automatically go into effect in 2013, resulting in a 3.6% decline in GDP and average household tax bills rising by $3,500.

- With many popular tax deductions and credits set to expire, tax planning strategies are more important than ever given the uncertainty around which provisions will be extended or changed.

- Estate and gift tax exemptions could be reduced substantially if Congress does not act, so accelerating gifts may help move assets out of estates before year-end.