This document provides information about stretch IRAs, including:

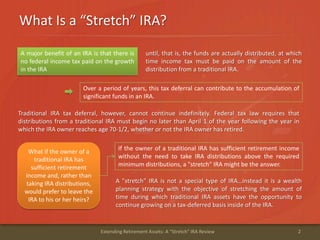

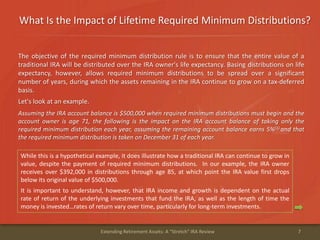

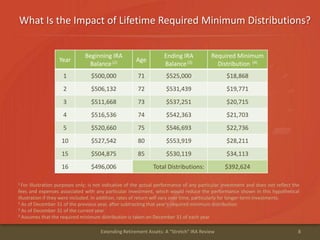

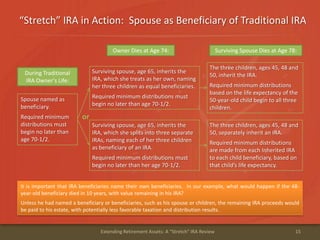

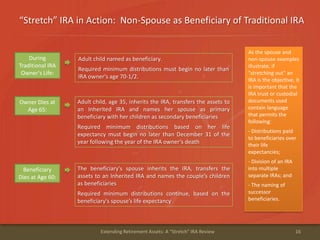

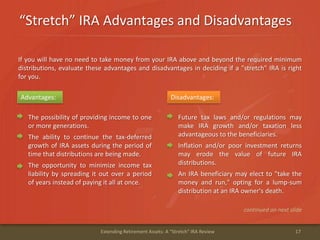

- A stretch IRA is a strategy to extend the tax-deferred growth of IRA assets by distributing them over a beneficiary's lifetime based on their life expectancy tables.

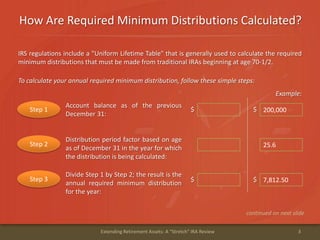

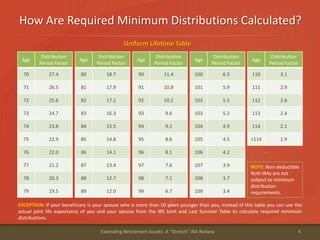

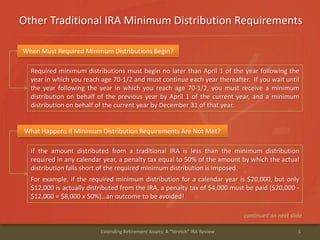

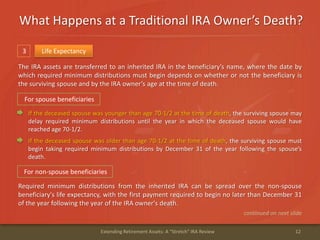

- Required minimum distributions must be taken from traditional IRAs starting at age 70 1/2, but these distributions can be spread out over many years, allowing the IRA to continue growing.

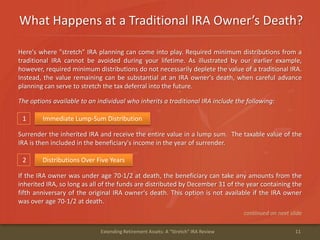

- The main options for beneficiaries of a traditional IRA are lump sums, 5-year distributions, or life expectancy distributions stretched over the beneficiary's lifetime.

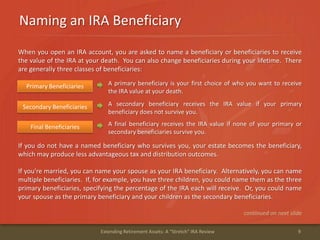

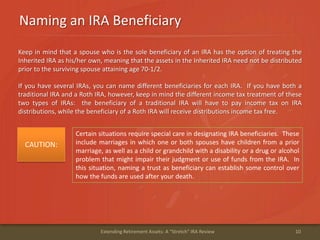

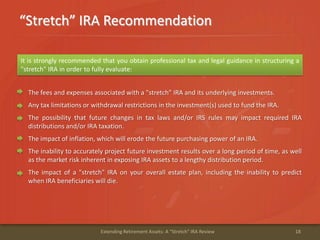

- Proper beneficiary designations are important for achieving stretch IRA goals and ensuring tax-efficient distributions over generations.