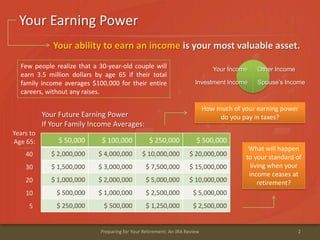

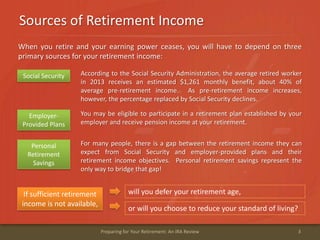

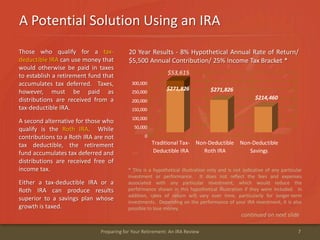

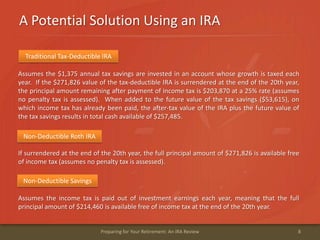

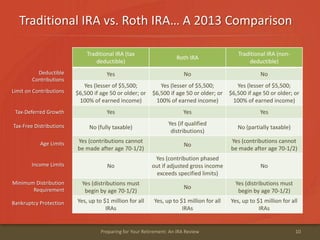

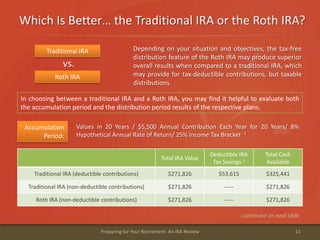

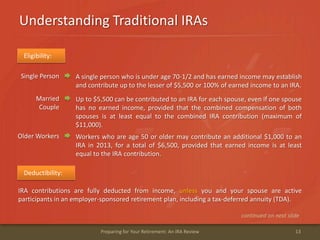

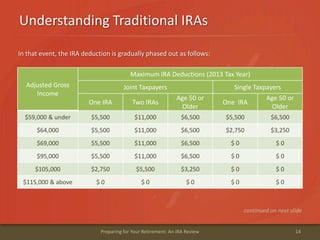

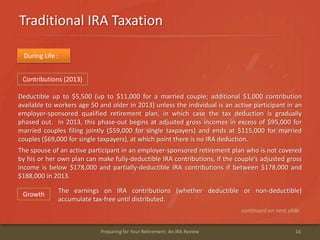

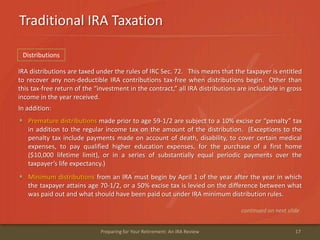

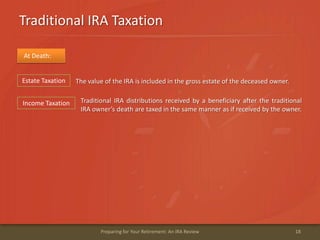

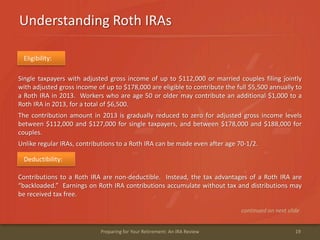

This document provides an overview and comparison of traditional IRAs and Roth IRAs. It discusses key factors to consider when choosing between the two options such as eligibility for tax-deductible contributions, contribution and income limits, tax treatment of distributions, required minimum distributions, and bankruptcy protections. Hypothetical examples are presented to illustrate how the different accounts may perform over long time horizons under varied rate of return and tax assumptions. The document emphasizes the importance of saving for retirement early and maximizing tax-advantaged retirement accounts.