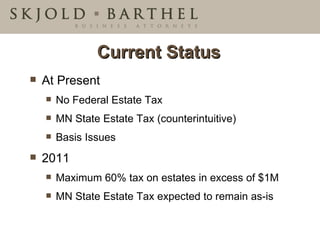

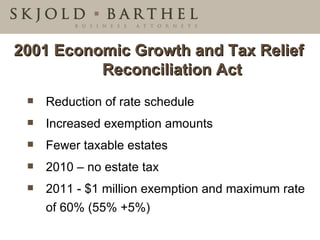

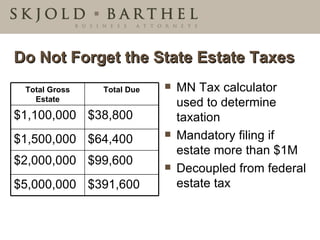

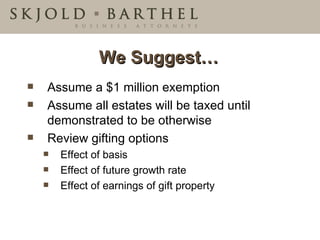

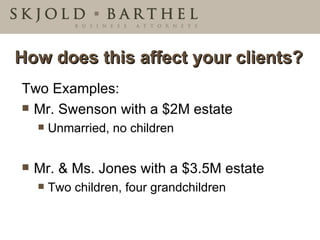

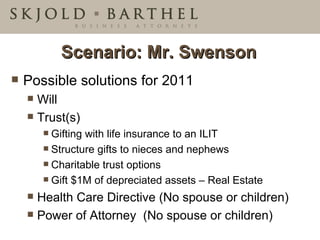

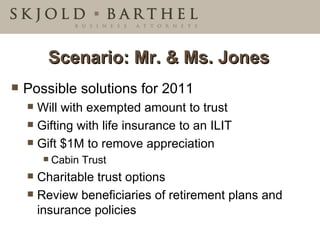

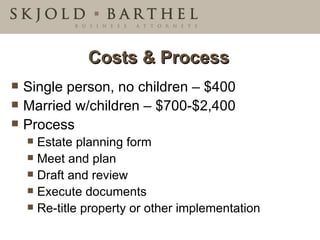

The document summarizes estate planning strategies in light of changing estate tax laws. It notes that current estate tax exemptions are set to expire after 2010. For clients with estates over $1 million, it recommends reviewing gifting options, life insurance trusts, and other strategies to minimize estate taxes and coordinate plans with beneficiary designations. Costs for basic estate planning range from $400 for individuals to $700-2,400 for married couples with children.

![Thank You! For further information, please contact: Ben Skjold Litigation & Business Attorney Licensed in MN and IL [email_address] Paul Christensen Estate and Tax Attorney Licensed in MN and TX [email_address] [p] 612.746.2560 ■ [f] 612.746.2561 www.skjold-barthel.com](https://image.slidesharecdn.com/estatetaxwebinar-12853436872534-phpapp01/85/Estate-Tax-Webinar-19-320.jpg)