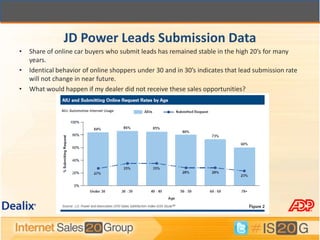

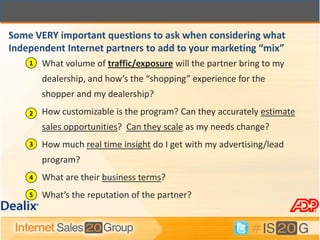

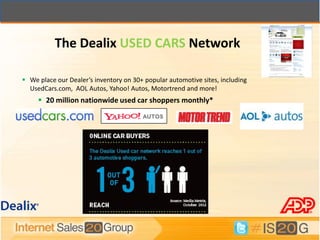

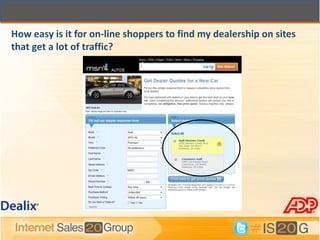

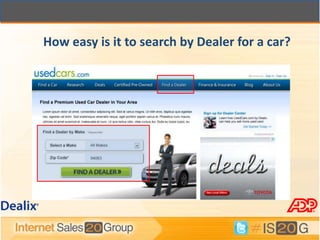

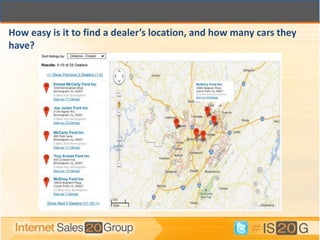

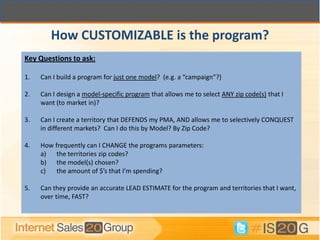

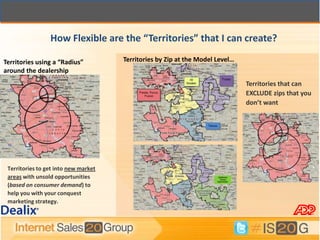

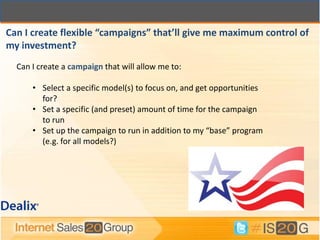

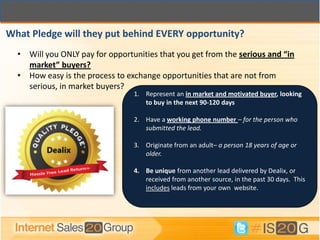

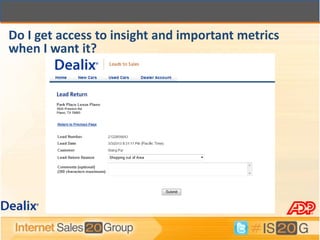

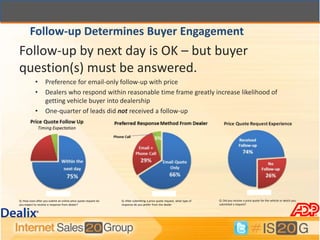

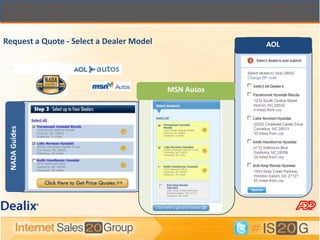

The document provides guidance on selecting and maximizing third party internet marketing partners. It discusses how independent internet sites play a leading role in the consumer vehicle purchase journey. When choosing partners, dealerships should consider the partner's traffic volume, customization options, ability to estimate sales opportunities, insight provided, and business terms. Key factors include reach and exposure, the shopping experience, consideration of the dealership, customization of programs, and real-time performance insights. Flexible territories and campaigns allow dealers to defend their area while conquering new markets.