The document provides information about the Indian textile industry. Some key points:

- The Indian textile industry is one of the largest in the world and contributes 5% to India's GDP. Textile exports were $39.2 billion in FY2018 and are projected to reach $82 billion by 2021.

- The industry has grown due to factors like rising incomes, availability of raw materials, policy support, and investments. However, it faces threats from competition and potential substitutes.

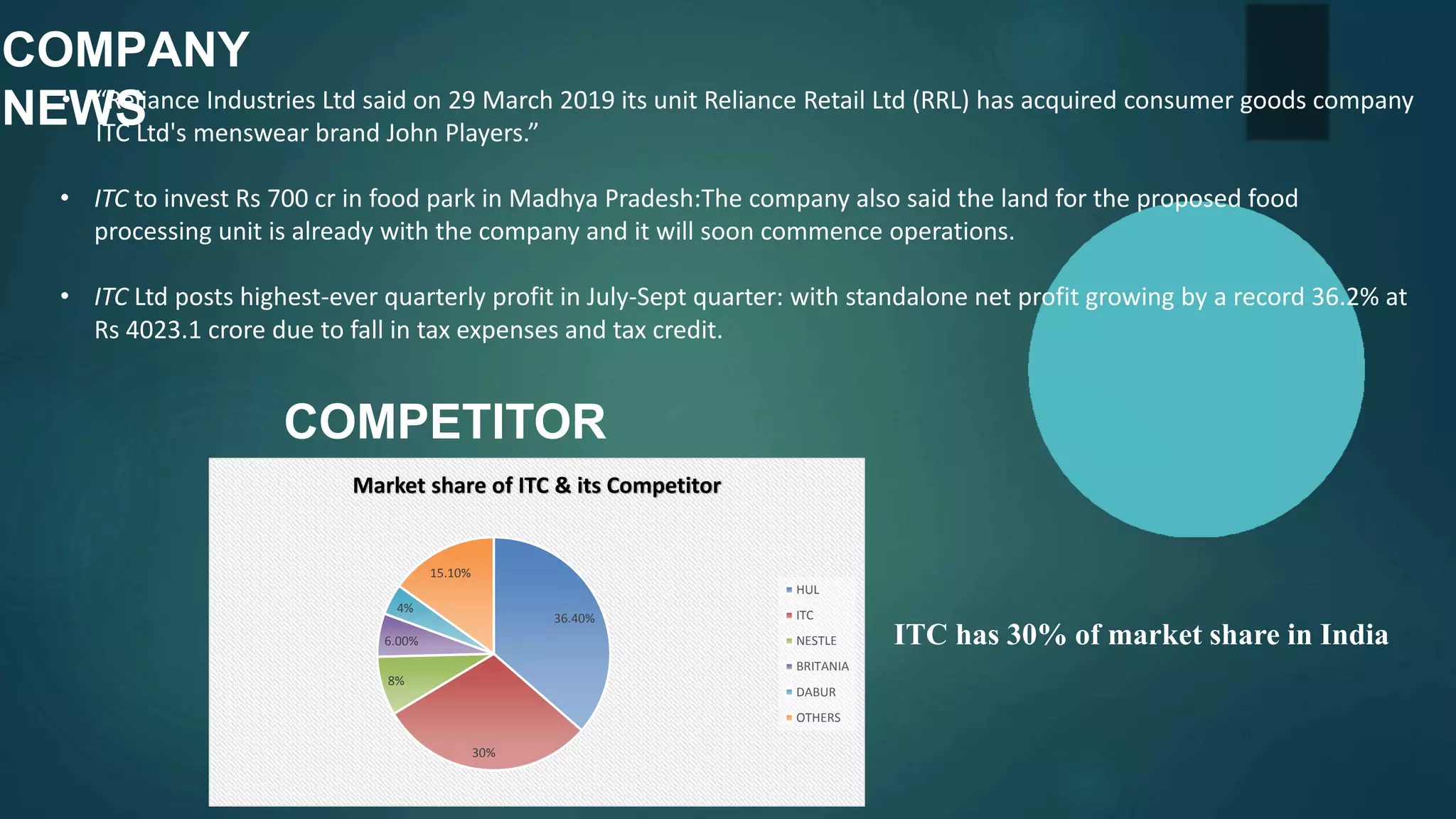

- ITC Ltd is a major player in the industry, with a 30% market share. It acquired the John Players menswear brand and plans to invest in expanding its market.