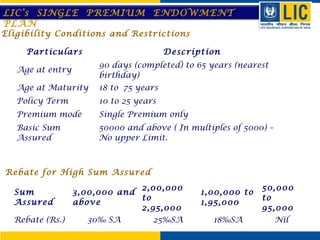

This document summarizes LIC's Single Premium Endowment Plan. The plan is a single premium endowment plan with profit that provides a death benefit equal to the sum assured plus bonuses. A maturity benefit equal to the sum assured plus bonuses is provided. Loans are available after one year up to a percentage of the surrender value. The plan has flexible options for ages, premium amounts, policy terms, and surrenders values. It is designed to provide protection, investment for children's education, and participation in profits.