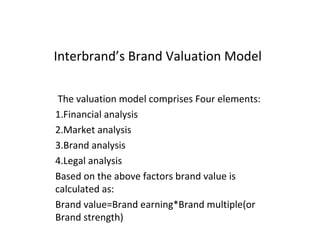

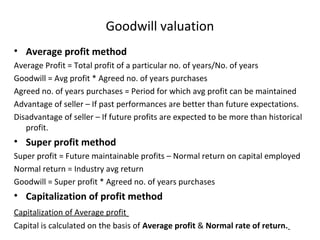

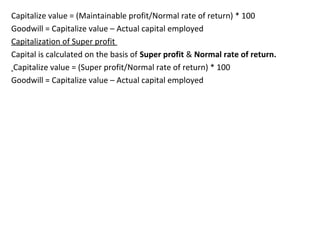

This document discusses valuation of intangible assets, which play an important role in mergers and acquisitions. It defines intangible assets and lists some common types, such as patents, customer lists, and brands. The value of companies used to be driven mainly by tangible assets, but now intangibles like brands are key value drivers. The document also discusses methods for valuing specific intangibles like brands, goodwill, and the role they play in corporate valuation, especially for M&A deals.