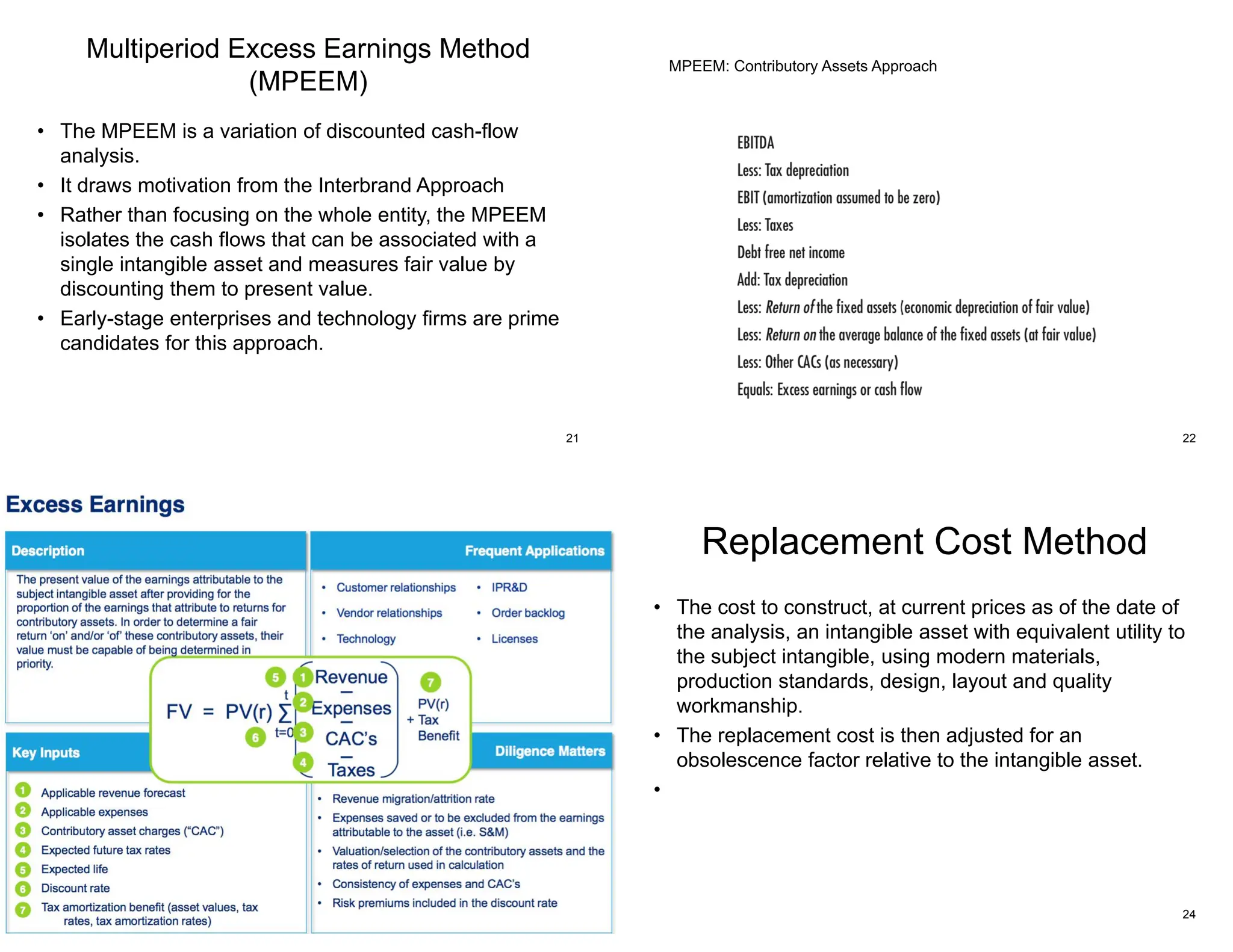

This document discusses various methods for valuing intangible assets, including the relief from royalty method, interbrand approach, multiperiod excess earnings method, and replacement cost method. It provides an overview of each method and key steps. It also discusses the increasing importance of intangible assets to company valuations given factors like data and the knowledge-based economy. Intangible assets are difficult to value but critical to accurately assess company performance and value.