The document presents information on an easy home financing product based on the Islamic financing structure of diminishing musharakah. Key points include:

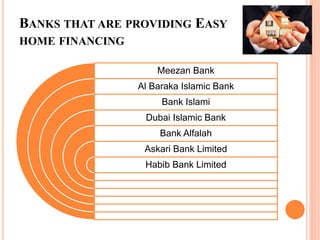

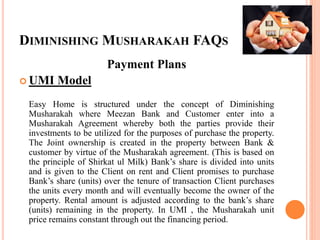

- Meezan Bank offers an easy home financing product that allows customers to purchase a home through monthly installments in a sharia-compliant manner without interest.

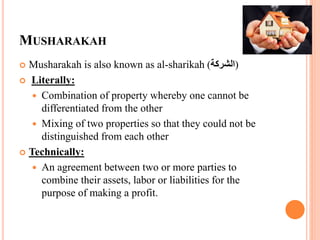

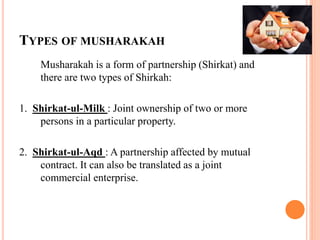

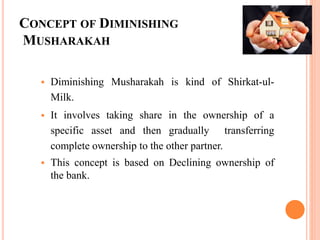

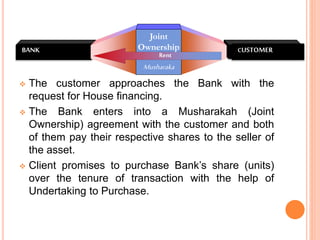

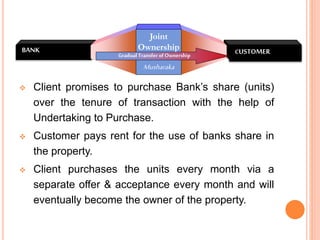

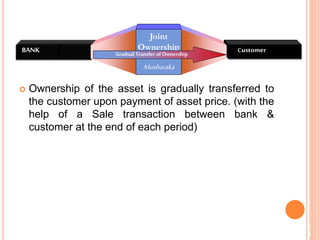

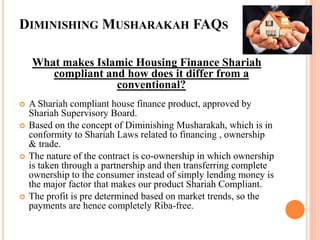

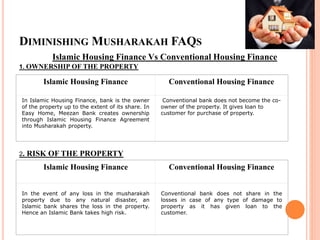

- The product is based on the concept of diminishing musharakah, where the bank and customer jointly own the property and the customer gradually purchases the bank's share over time.

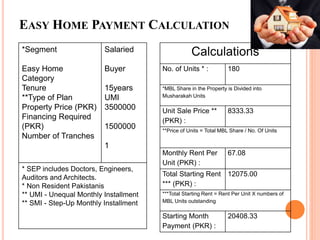

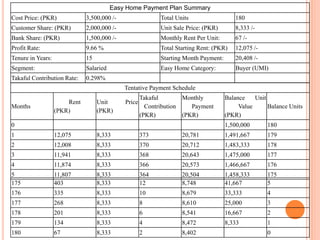

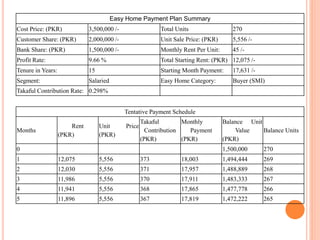

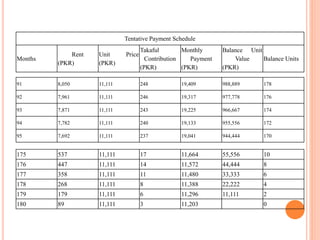

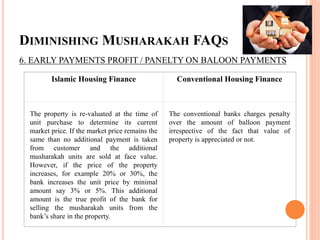

- The document provides details on payment plans, profit calculations, examples of payment schedules, and frequently asked questions about the diminishing musharakah structure and easy home financing product.