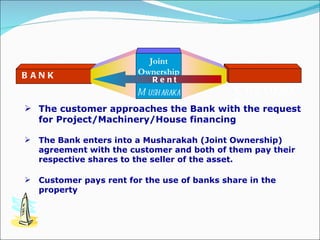

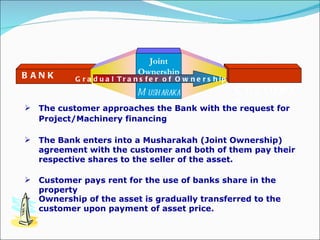

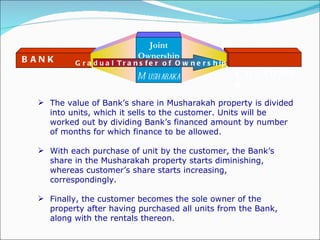

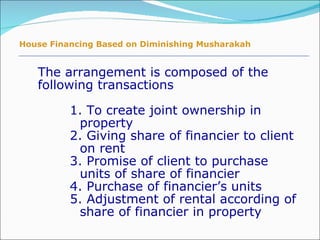

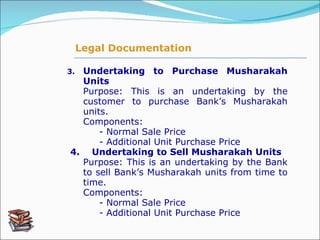

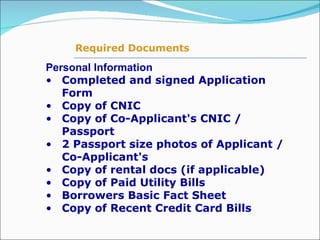

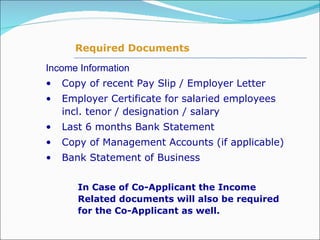

The document provides an overview of Diminishing Musharakah, a Shari'ah-compliant financing structure used for the acquisition of fixed assets like homes and machinery through joint ownership between the bank and customer. It outlines the transaction process, Shari'ah principles supporting this arrangement, and necessary documentation required from the customer. The customer gradually purchases the bank's share in the property while making rental payments, eventually achieving sole ownership.

![Ph: 021-9212509, Fax: 021-9212472 Email: [email_address] http://www.sbp.org.pk/departments/ibd.htm](https://image.slidesharecdn.com/diminishingmusharakahpresentation02-06-08-110105051240-phpapp01/85/Diminishing-musharakah-presentation_02-06-08-35-320.jpg)