1. Mudarabah is a partnership agreement where one party provides capital to another party for investment in a business venture. Any profits are shared according to a pre-agreed ratio, while losses are borne solely by the capital provider.

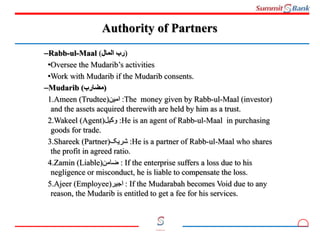

2. In mudarabah used by banks, depositors act as capital providers (rabb-ul-maal) and the bank acts as the manager (mudarib). Profits from the bank's investments using depositor funds are shared between depositors and the bank according to a pre-set ratio, while the bank is only responsible for losses due to negligence.

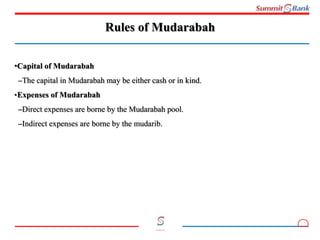

3. At banks, depositor funds are pooled and used to finance various ventures like murab