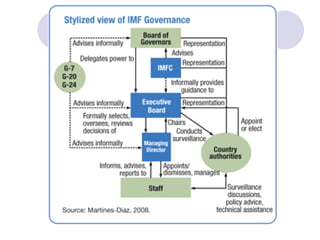

The document discusses several areas where restructuring of the IMF may be required in the current context of globalization. It suggests that the IMF should 1) make crisis prevention and resolution more integrated, 2) clarify its relationship and roles with the World Bank to avoid overlap, and 3) reduce extraneous roles like work on money laundering. It also recommends reforms to governance structures, surveillance and analysis procedures, lending programs, and financing sources.