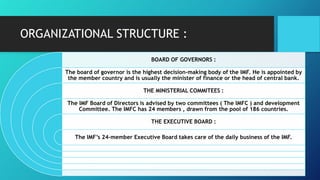

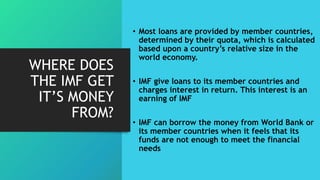

The International Monetary Fund (IMF) is an intergovernmental organization that oversees the global financial system, facilitating economic stability and growth among its 186 member countries. Comprised of a Board of Governors, ministerial committees, and an executive board, the IMF provides financial assistance to member nations and issues Special Drawing Rights (SDRs) as a reserve asset. As of 2019, Pakistan completed its quarterly review with the IMF as part of a $6 billion funding agreement and aims to generate $3 billion from global bonds.