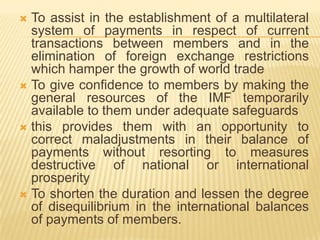

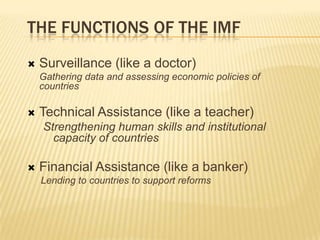

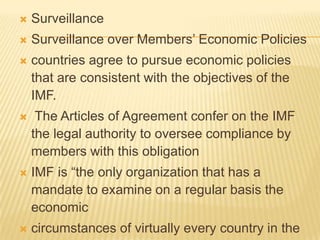

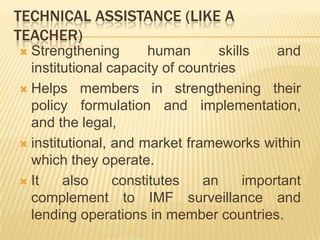

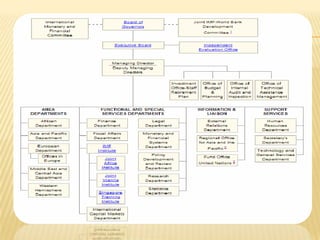

The IMF was created in 1944 at the Bretton Woods conference to promote global monetary cooperation and stability after the economic issues of the early 20th century. It is governed by 185 member countries and provides surveillance, technical assistance, and financing to its members. The IMF aims to foster international trade, employment, economic growth, exchange stability, and development.