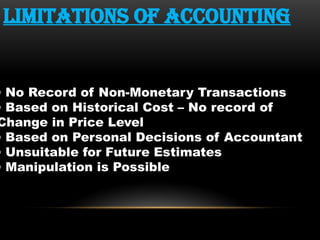

The document provides an overview of accounting, stating its importance as the 'language of business' and discussing its evolution from simple barter systems to complex global transactions. It differentiates between book-keeping, accounting, and accountancy, emphasizing the systematic recording and reporting of financial information. Additionally, it outlines the objectives, qualitative characteristics, advantages, and limitations of accounting.