This document provides an introduction to book keeping and accounting. It discusses the meaning and objectives of accounting, and distinguishes between book-keeping and accounting. It also outlines the key users of accounting information, including external users like investors, creditors, and government agencies, as well as internal users like owners and management. The document serves to introduce foundational accounting concepts.

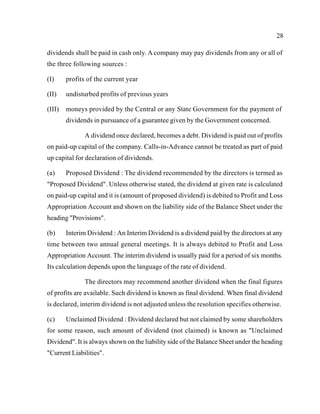

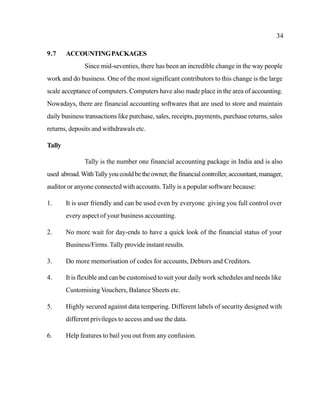

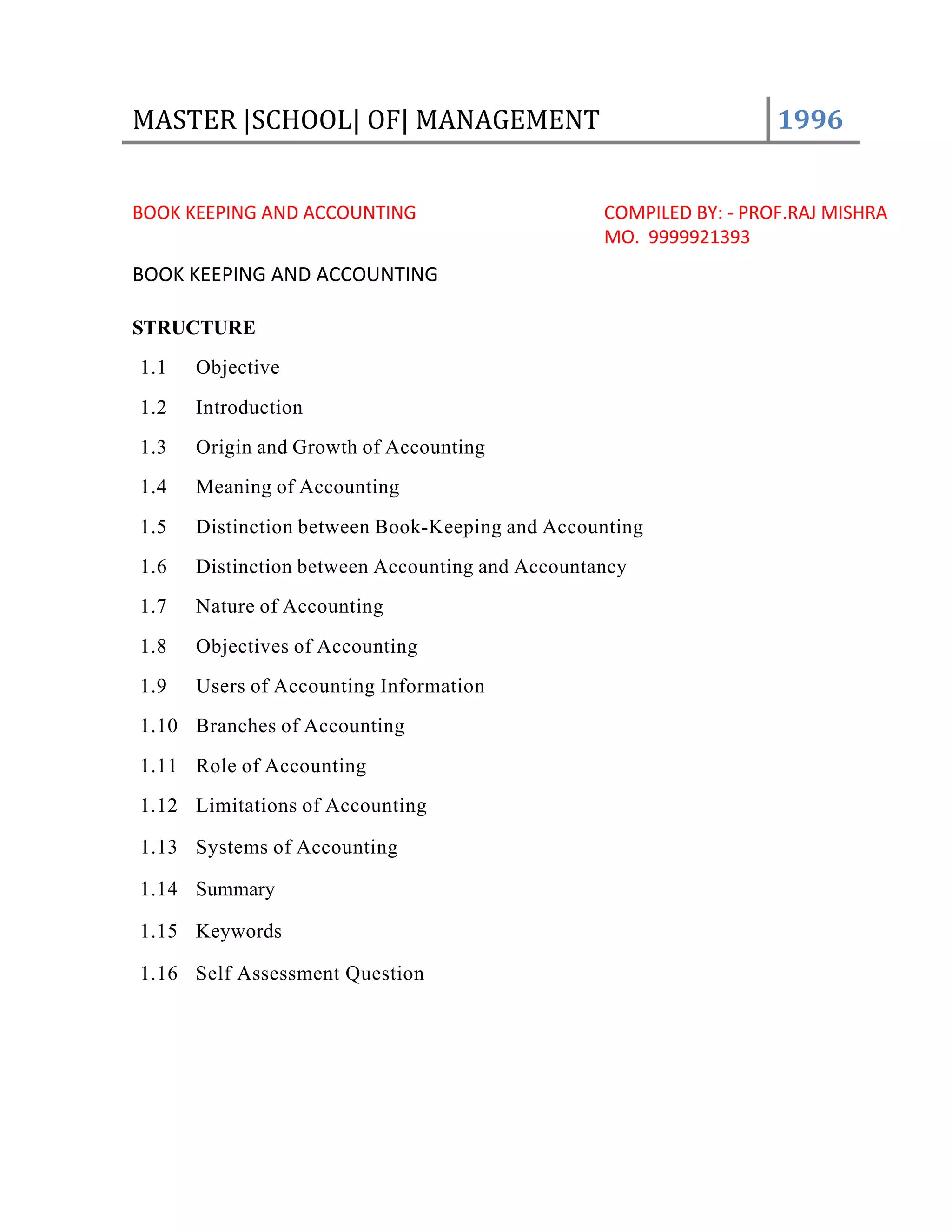

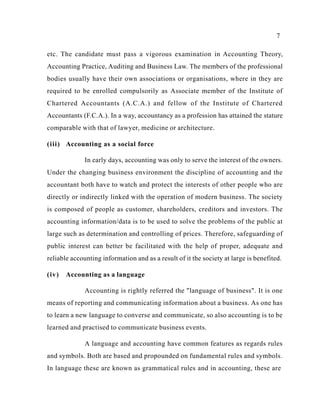

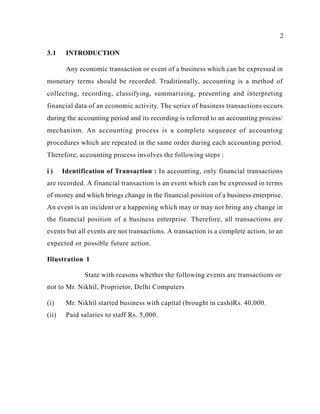

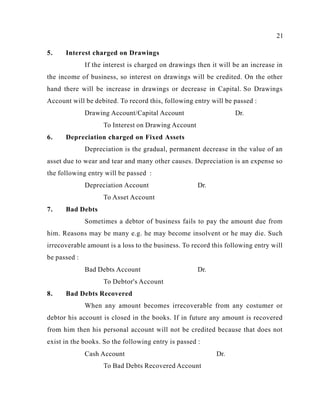

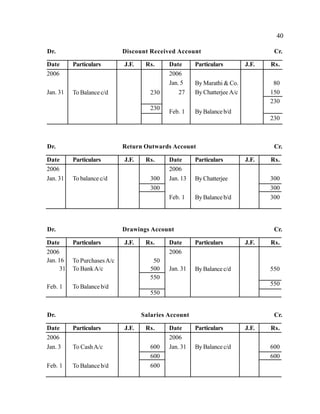

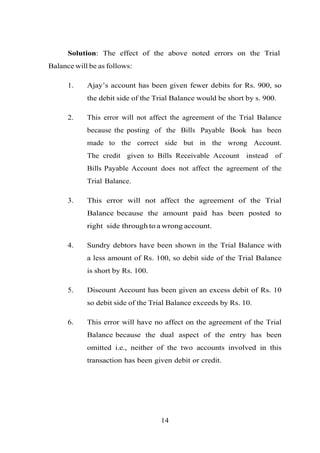

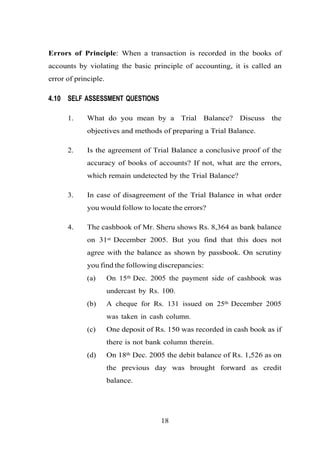

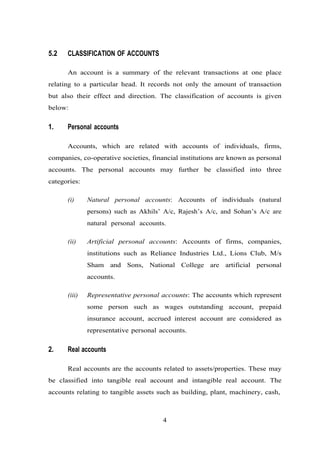

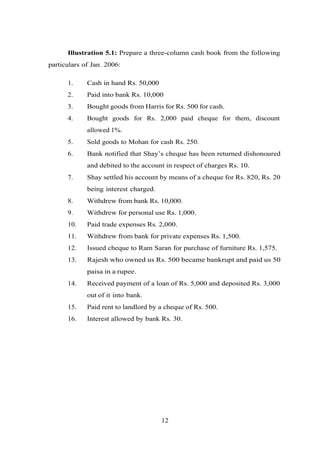

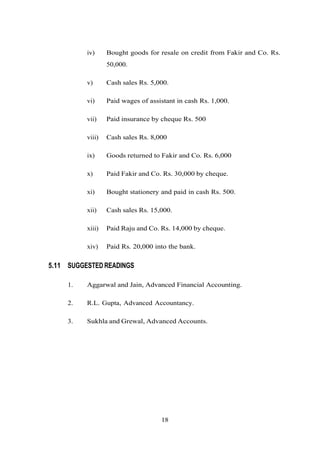

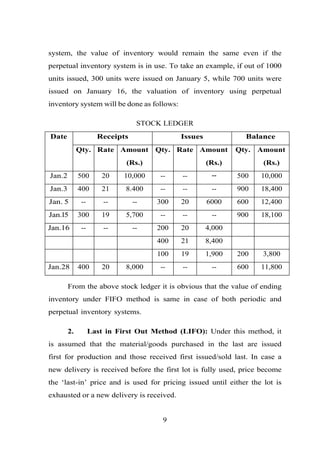

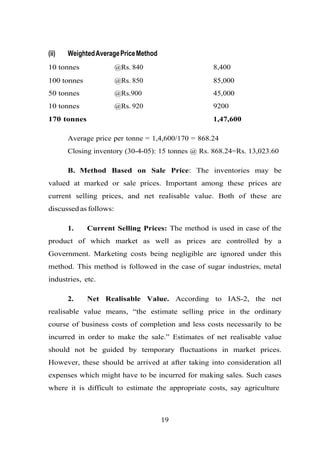

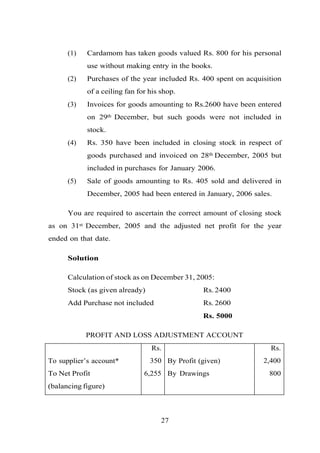

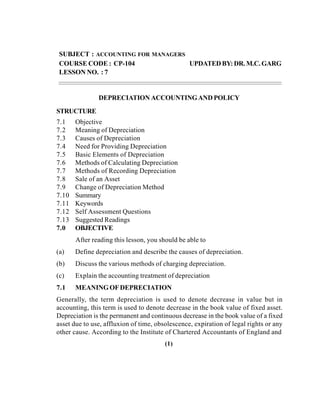

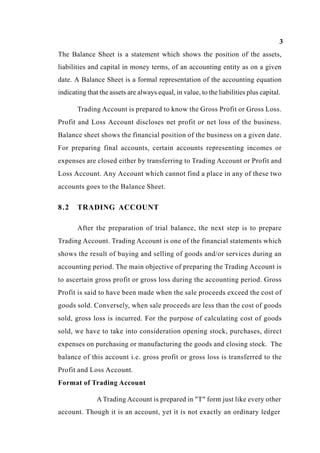

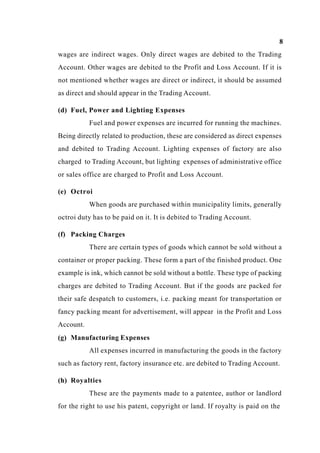

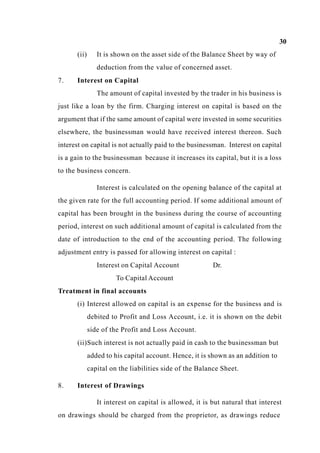

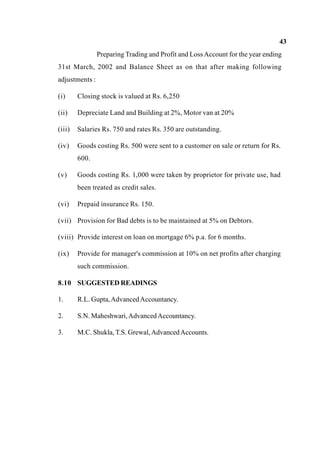

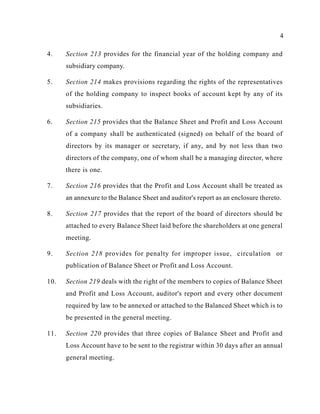

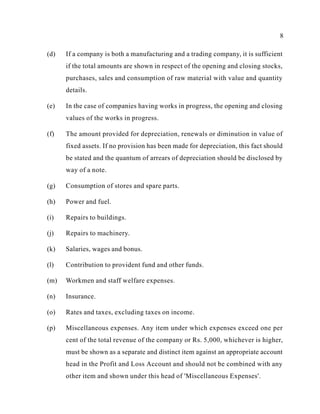

![Example: Suppose that following information is available from

records:

Opening inventory of material as on Jan. 1 , 2000 at Rs.20 = 200

units.

Purchases of materials as on Jan. 16, 2000 at Rs. 24 = 100 units.

Purchases of materials as on Jan.26, 2000 at Rs.30 = 150 units

Total units available for sale = 450 units

Units sold during January = 260 units

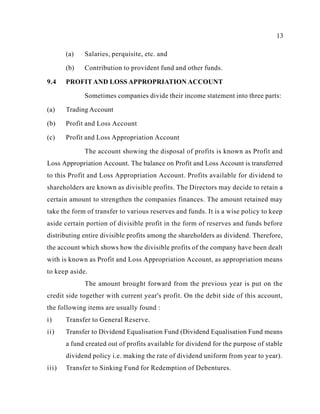

Inventory of materials at January end = 190 units

Now, if it assumed that the firm selected 200 items of materials

that had a unit cost of Rs. 20 and 60 units of items that had a unit cost

Rs. 24, the cost of goods sold for the firm would be as follow:

Cost of 200 items = 200 × 20 = Rs. 4000

Cost of 60 items = 60 × 24 = Rs. 1440

Rs. 5440

Whereas, if 260 items having highest cost are selected, then the

cost of goods sold would be Rs. 7100 [(l50×30) + (l00×24) + (10×20)].

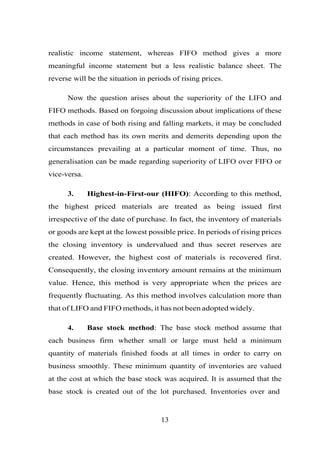

5. Simple average Price (SAP): This is the average of prices

of different lots of purchase. Under this method no consideration is

given to the quantity of purchases in various lots. For example the

purchases of 500 units of materials at Rs. 10 per unit are made as on

5th January, 1995 and 800 units of materials at Rs. 14 per unit on 10th

January. If at the end 200 units remains unissued/unsold, these will be

valued at Rs. 12 = [(10 + 14)/2]per unit and hence, the closing inventory

will be shown at Rs. 2400 (200 × 12 = 2400). Infact, this method

operated on the principle that when items of materials are purchased in

15](https://image.slidesharecdn.com/bba101-161023202742/85/COMPLETE-NOTES-ONACCOUNTING-130-320.jpg)

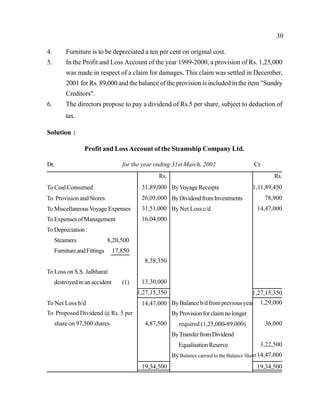

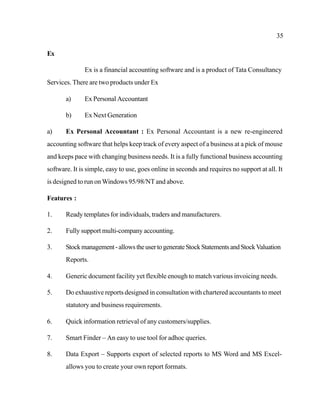

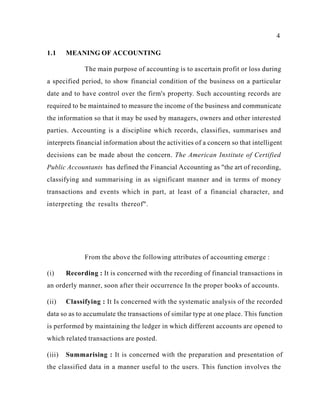

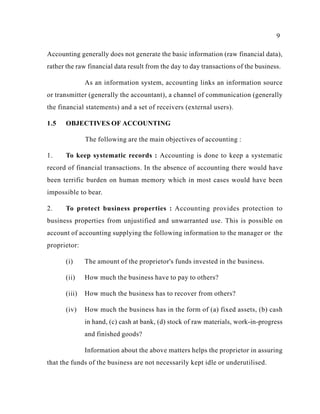

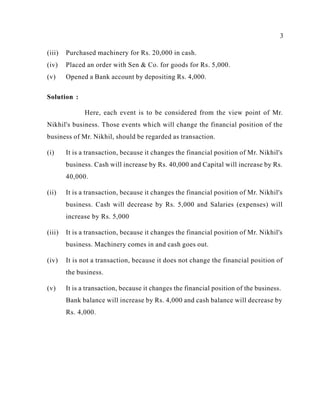

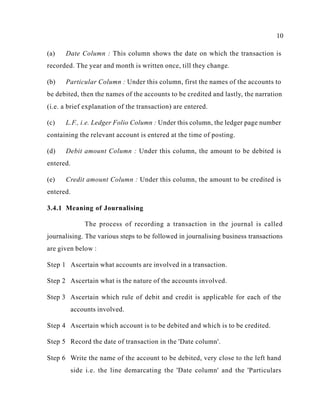

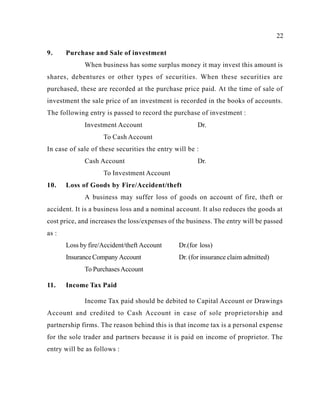

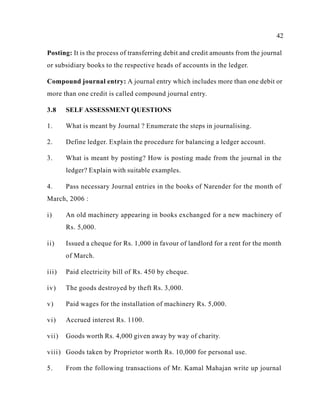

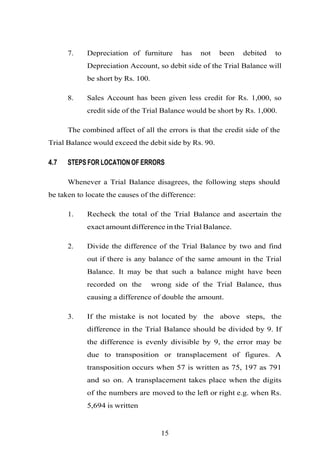

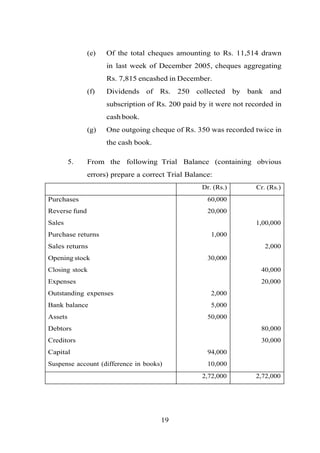

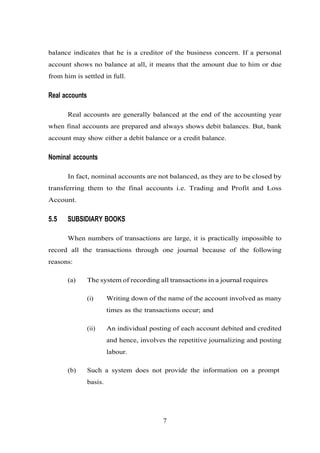

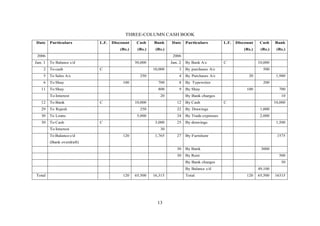

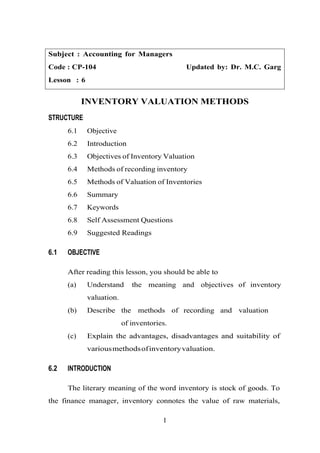

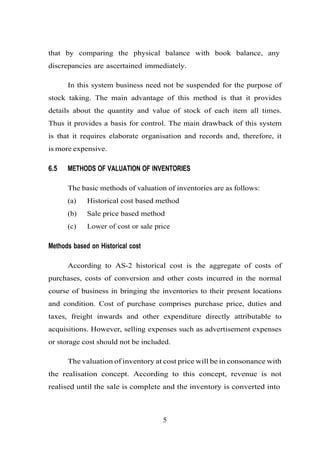

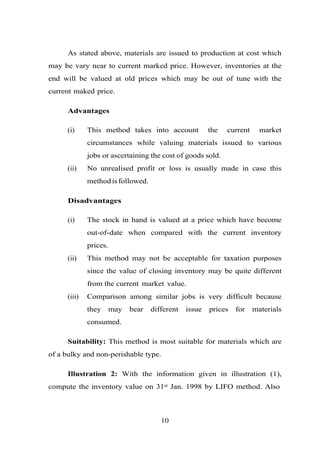

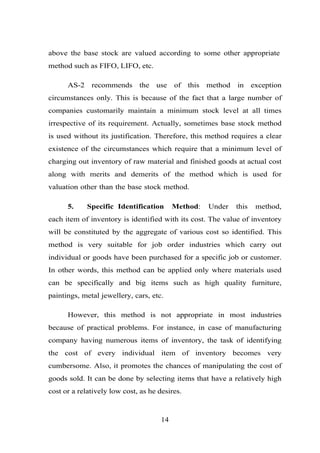

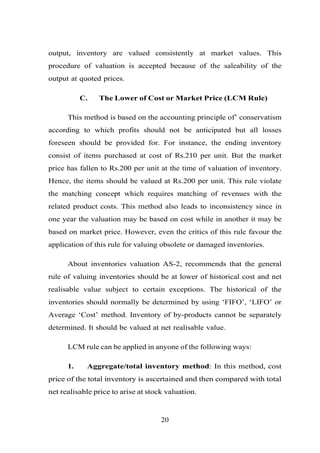

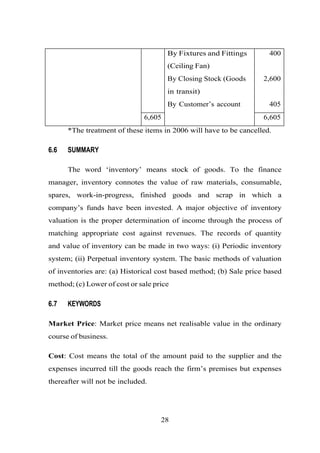

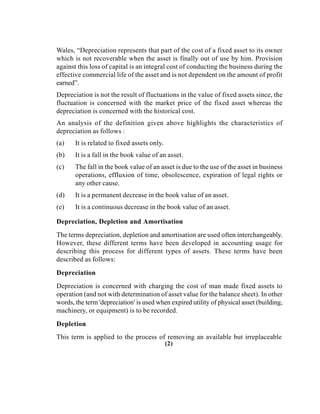

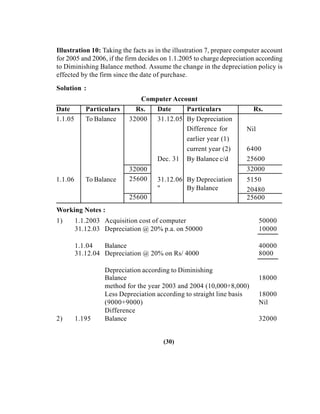

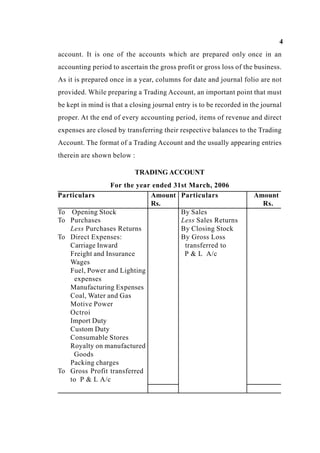

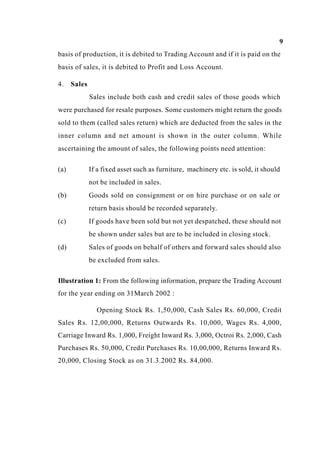

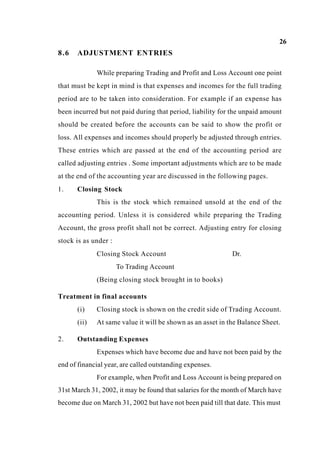

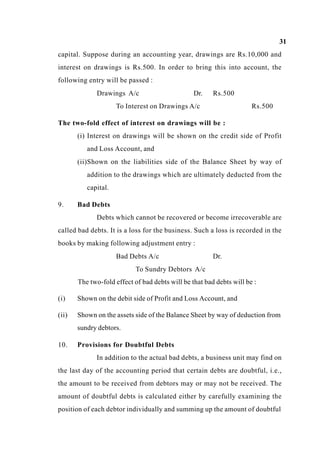

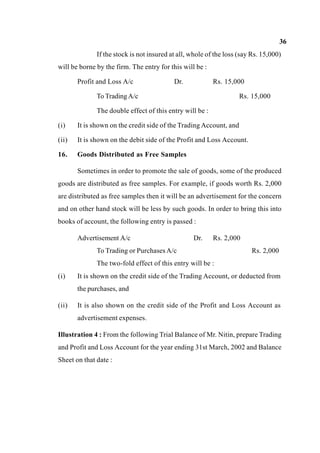

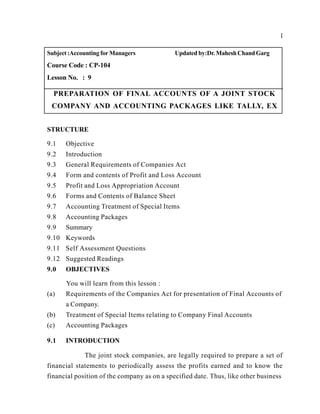

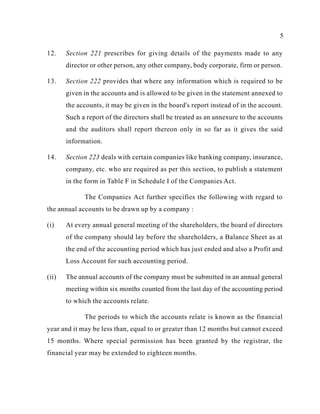

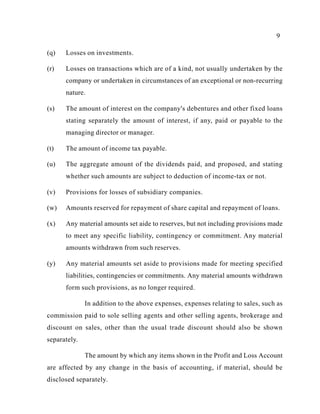

![2. Purchases returns between 30th June and 7th July are Rs.

200.

3. Sales between 30th June and 7th July are Rs. 4000.

4. Sales returns between 30th June and 7th July are Rs. 100.

5. The firm makes a gross profit at 25% on cost.

Calculate the value of stock on 30th June, 2006.

Solution

MR RATAN LAL & CO.

VALUATION OF CLOSING STOCK

Stock as on July 7 Rs. 20,000

Less: Purchases between June 30 and July 7 2,000

18,000

Add: Purchases returns between June 30 and July 7 200

18,200

Add: Sales (at cost price) between June 30 and July 7

[4000-onefifthof4,000]

3,200

21,400

Less: Sales returns (at cost price) between June 30 and

July 7 [Rs.100-20]

80

Stock on June 30, 2006 21,320

Illustration 8: The Profit and Loss Account of Cardamom for the

year ended 31st December, 2005 showed a net profit of Rs. 2,400 after

taking into account the closing stock of Rs. 2,400. On a scrutiny of the

books the following information could be obtained:

26](https://image.slidesharecdn.com/bba101-161023202742/85/COMPLETE-NOTES-ONACCOUNTING-141-320.jpg)

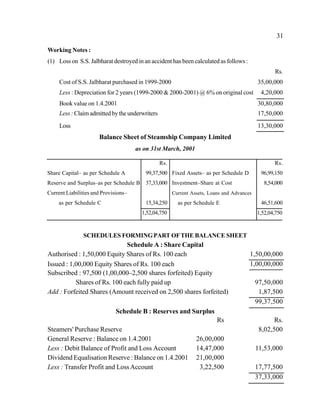

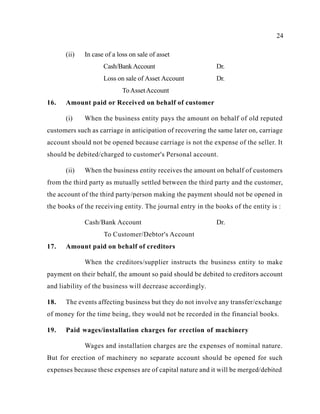

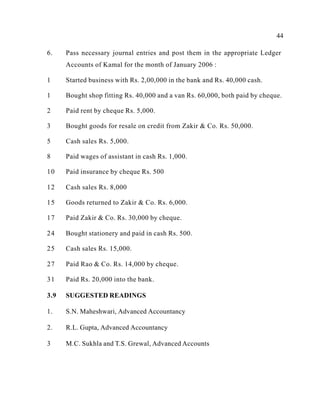

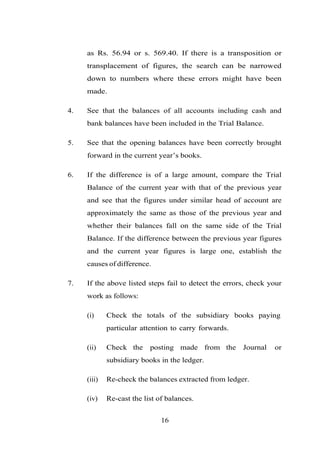

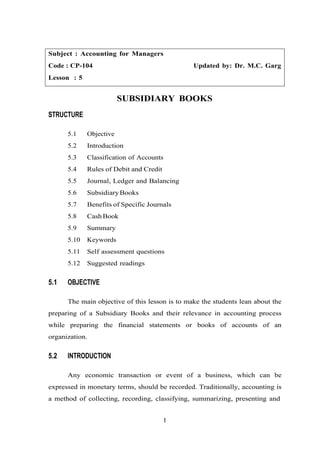

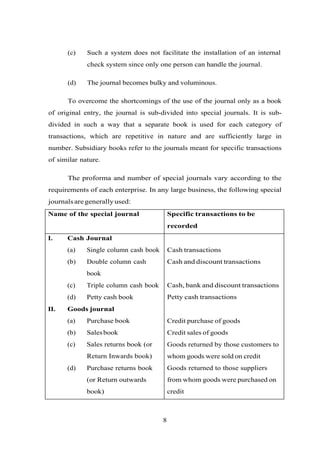

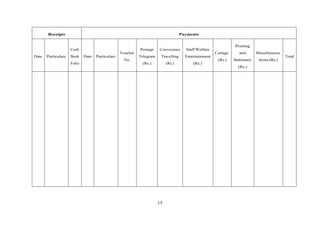

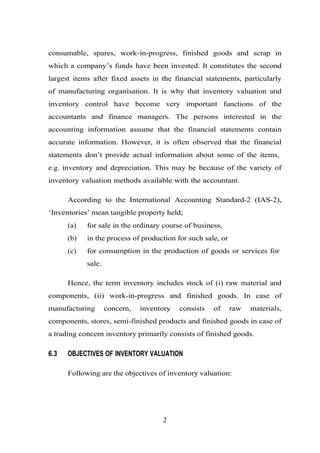

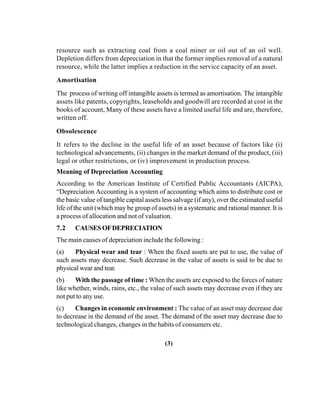

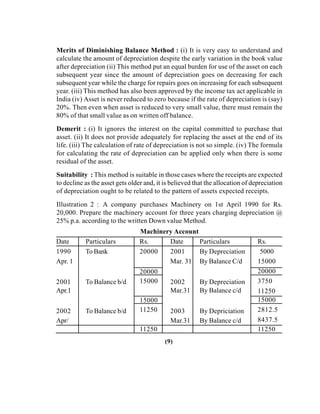

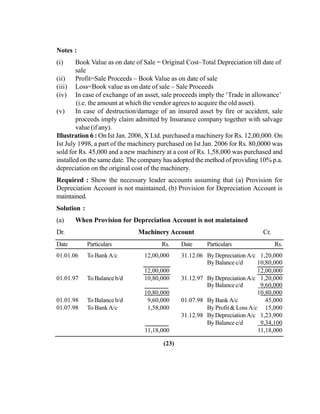

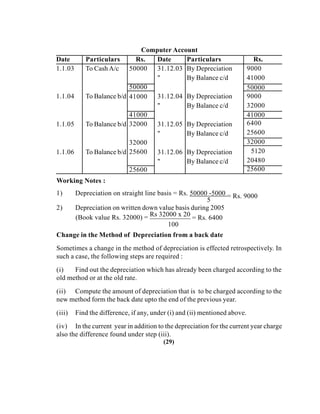

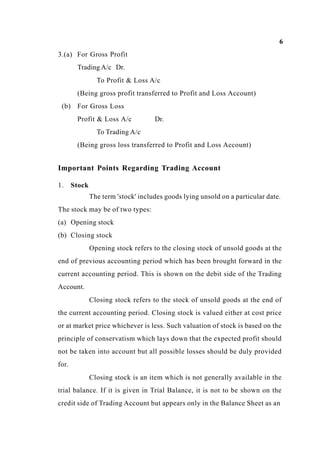

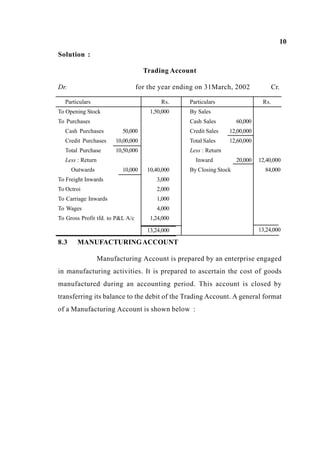

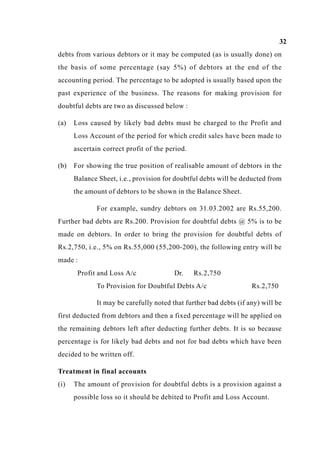

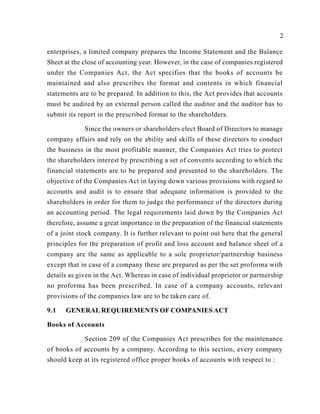

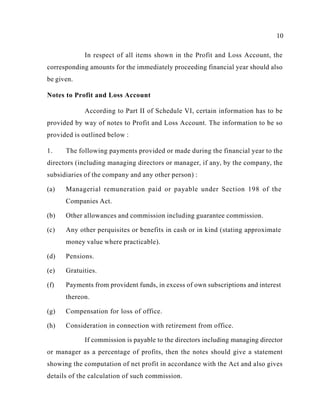

![(d) Expiration of legal rights : When the use of an asset (e.g., patents, leases) is

governed by the time bound arrangement, the value of such assets may decrease with

the passage of time.

7.3 NEEDFORPROVIDINGDEPRECIATION

The need for providing depreciation in accounting records arises due to any one or

more of the following objectives to be achieved :

(a) To ascertain true results of operations : For proper matching of costs with

revenues, it is necessary to charge the depreciation (cost) against income (revenue) in

each accounting period. Unless the depreciation is charged against income, the result

of operations would stand overstated. As a result the Income Statement would fail to

present a true and fair view of the result of operations of an accounting entity.

(b) To present true and fair view of the financial position : For presenting a

true and fair view of the financial position, it is necessary to charge the depreciation. If

the depreciation is not charged, the unexpired cost of the asset concerned would be

overstated. As a result, the Position Statement (i.e. the Balance Sheet) would not present

a true and fair view of the financial position of an accounting entity.

(c) To ascertain the true cost of production : For ascertaining the cost of

production, it is necessary to charge depreciation as an item of cost of production. If

the depreciation on fixed assets is not charged, the cost records, would not present a

true and fair view of the cost of production.

(d) To comply with legal requirements: In case of companies, it is compulsory

to charge depreciation on fixed assets before it declares dividend [Sec. 205(1) of the

Companies Act, 1956].

(e) To accumulate funds for replacement of assets : A portion of profits is set

aside in the form of depreciation and accumulated each year to provide a definite amount

at a certain future date for the specific purpose of replacement of the asset at the end

of its useful life.

7.4 BASIC ELEMENTS OFDEPRECIATION

In order to assess depreciation amount to be charged in respect of an asset in an

accounting period the following three important factors should be considered :

(4)](https://image.slidesharecdn.com/bba101-161023202742/85/COMPLETE-NOTES-ONACCOUNTING-151-320.jpg)

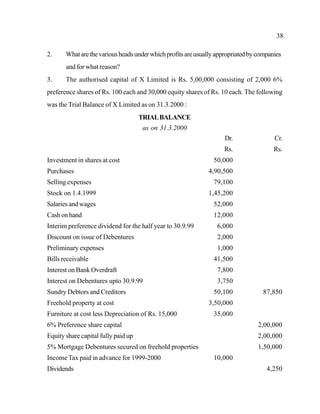

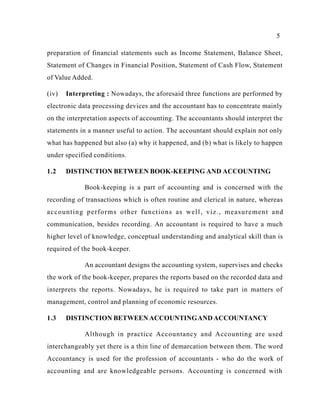

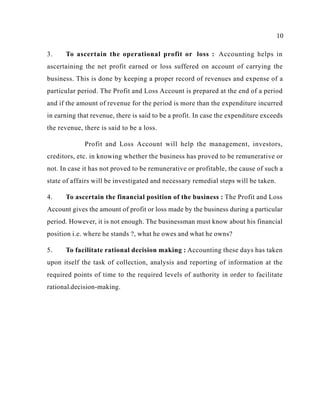

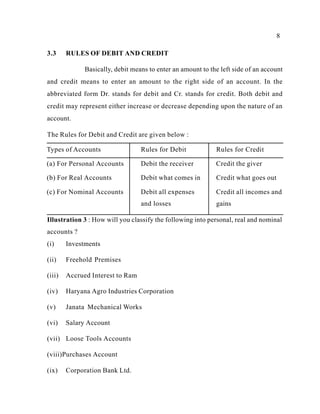

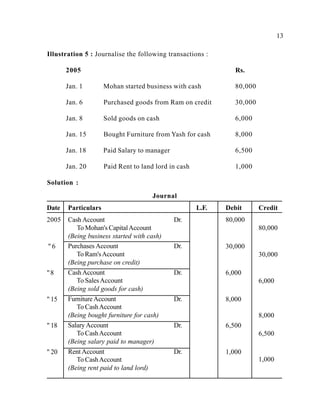

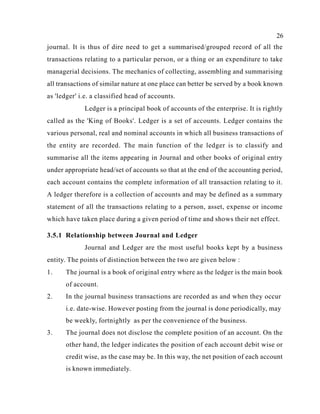

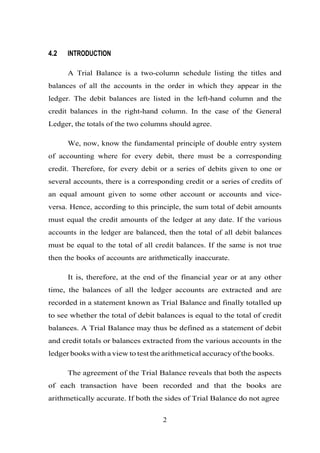

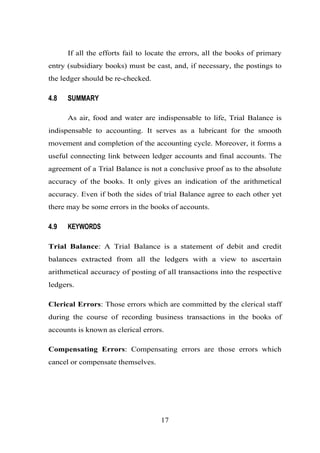

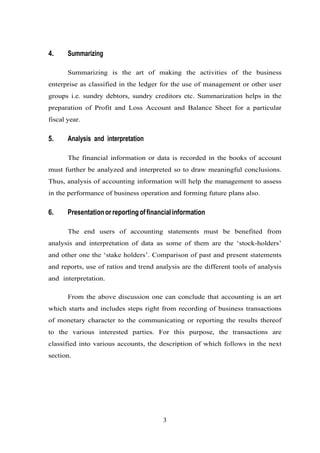

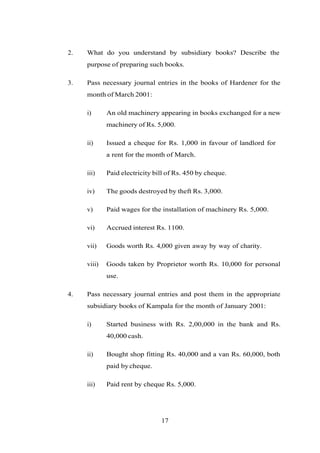

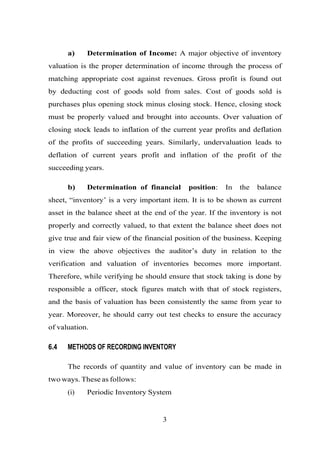

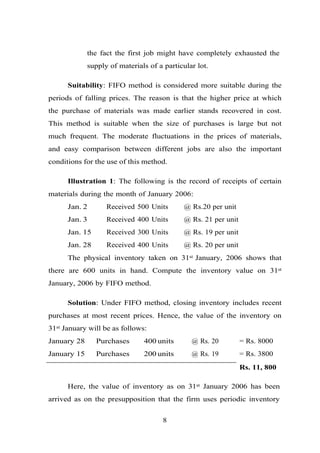

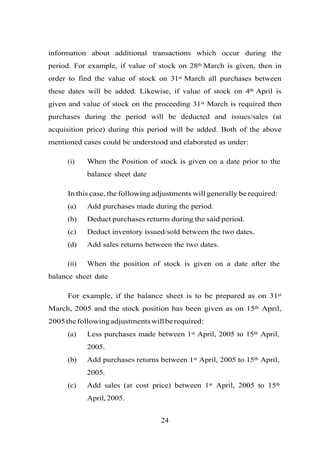

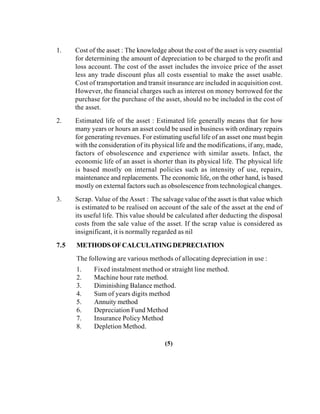

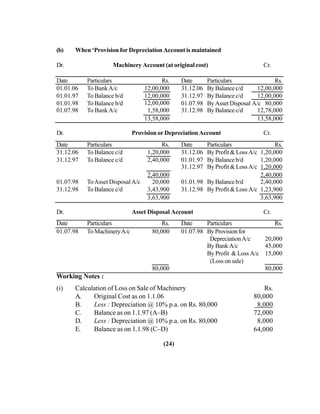

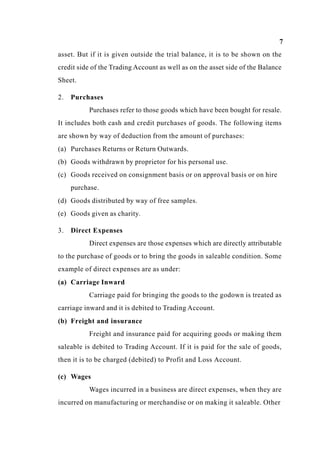

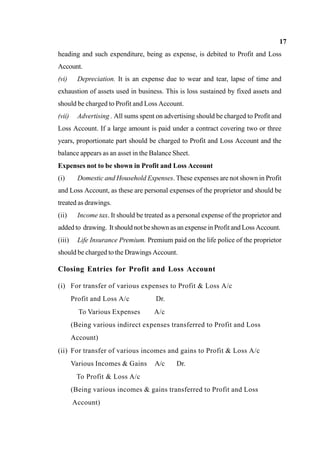

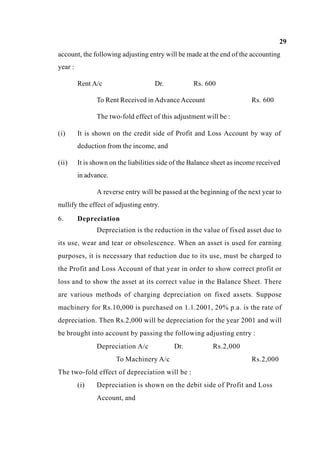

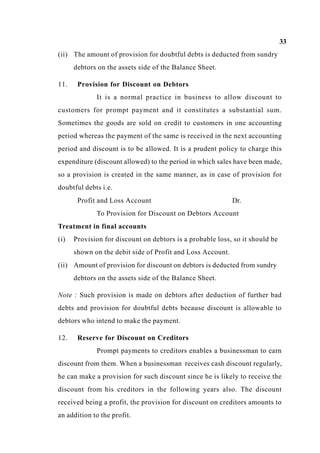

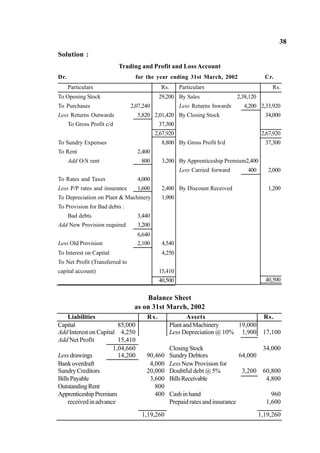

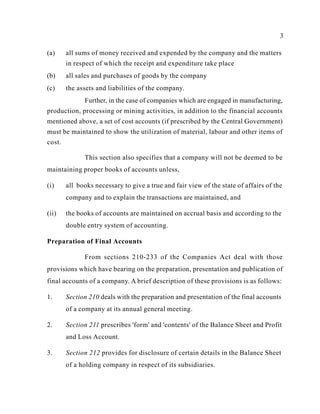

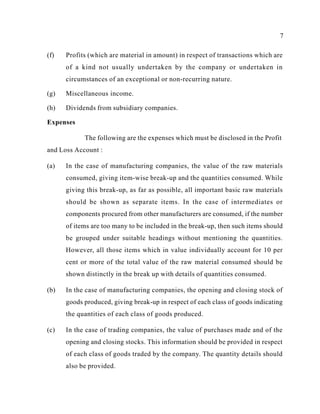

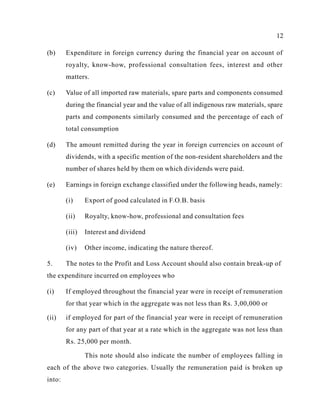

![F. Less : Depreciation @ 10% p.a. on Rs. 80,000 for 6 months 4,000

G. Balance as on 1.7.98 (E–F) 60,000

H. Less: Sale proceeds 45,000

I. Loss on Sale (G–H) 15,000

(ii) Calculation of Depreciation for 1998

(a) On Rs. 11,20,000 for 1 year 1,12,000

(b) On Rs. 60,000 for 1/2 year 4,000

(c) On Rs. 1,58,000 for 1/2 year 7,900

1,23,900

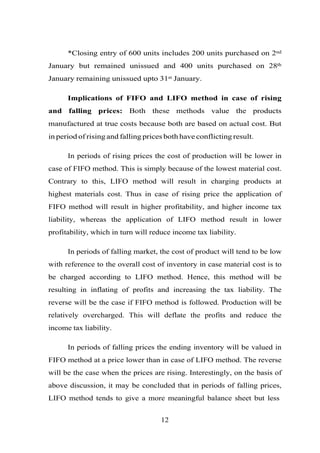

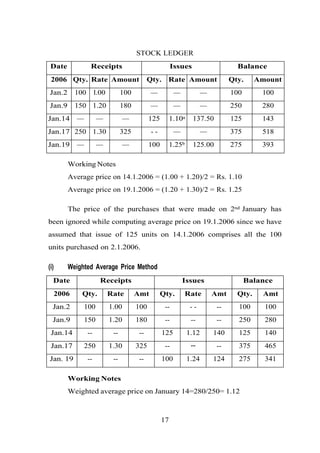

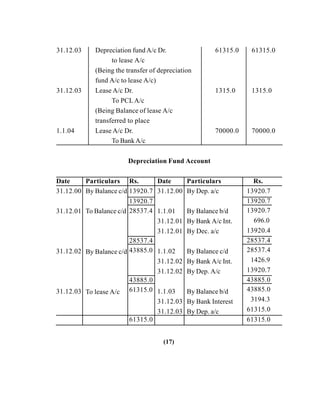

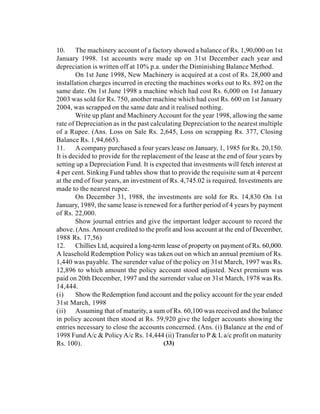

Illustration 7 : Rahul Ltd. which depreciates the machines @ 25% p.a. on the reducing

balance method, provides you the following particulars :

Cost on 31.12.95 Rs. 2,46,000. Provision for Depreciation (on

31.12.95) Rs. 1,24,000. No amounts being charged in the year of sale but full charge is

being made for the years during which addition is made. On 1.7.97, one new machine

was purchased for Rs. 24,000 and old machinery purchased on 1.7.1994 for Rs. 20,000

was discarded but could not be sold immediately. However, it was expected to realise

Rs. 5,000 for same. Prepare (a) machinery Account, (b) Provision for Depreciation

Account, and (c) Machinery Disposal Account for the years 1996 and 1997.

Solution

Dr. Machinery Account Cr.

Date Particulars Rs. Date Particulars Rs.

01.01.96 To Balance b/d 2,46,000 31.12.96 ByBalance c/d 2,46,000

01.01.97 To Balance b/d 2,46,000 01.07.97 ByMachinery

01.07.97 To BankA/c 24,000 DisposalA/c 20,000

31.12.97 ByBalance c/d 2,50,000

2,70,000 2,70,000

Dr. Provision for Depreciation Account Cr.

Date Particulars Rs. Date Particulars Rs.

31.12.96 To Balance c/d 1,54,500 01.01.96 ByBalance b/d 1,24,000

31.12.96 ByDepreciationA/c

[25% of (Rs. 2,46,000)

- Rs. 1,24,000] 30,500

1,54,500 1,54,500

(25)](https://image.slidesharecdn.com/bba101-161023202742/85/COMPLETE-NOTES-ONACCOUNTING-172-320.jpg)

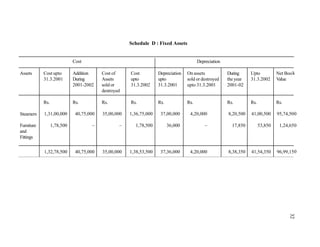

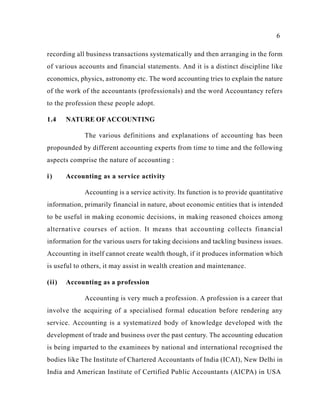

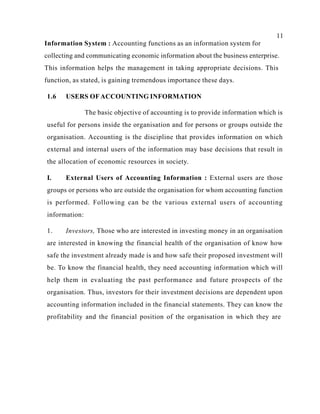

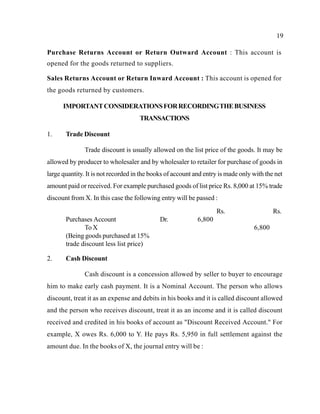

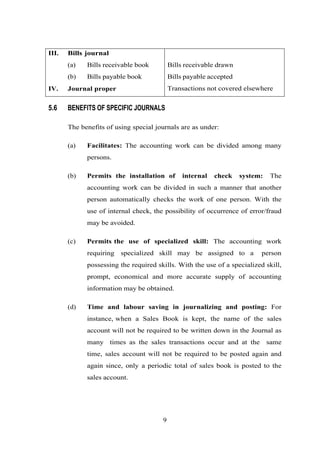

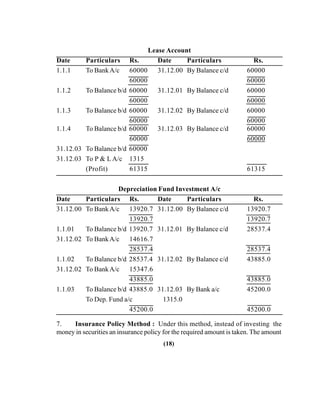

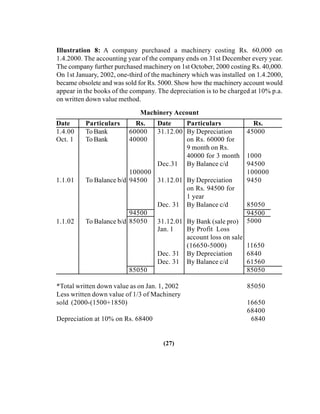

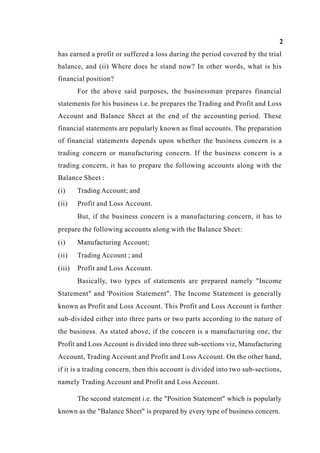

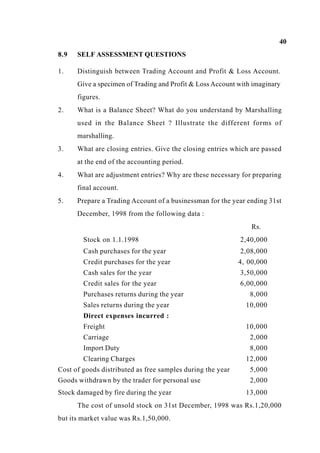

![01.07.97 ToMachinery 11,563 01.01.97 ByBalance b/d 1,54,500

Disposala/c 31.12.97 ByDepreciation

31.12.97 ByBalance c/d 1,69,703 [25% of (Rs. 2,50,000-

Rs. 1,54,500+Rs.11,563] 26,766

1,81,266 1,81,266

Dr. Machinery Disposal Account Cr.

Date Particulars Rs. Date Particulars Rs.

01.07.97 ToMachinery 20,000 01.07.97 ByProvisionfor

DepreciationA/c 11,563

By P&L A/c (Loss)

(Purchase concept) 3,437

ByBalance c/d 5,000

20,000 20,000

Working Note : Calculation of Depreciation provided on Machine discarded

A. OriginalCost

Book

Value

Rs.

20,000

Accumulated

Depreciation

Rs.

–

B. Less : Depreciation for 1994 5,000 5,000

C. Book value on 1.1.1995 15,000

D. Less : Depreciation for 1995 3,750 3,750

E. Book Value on 1.1.1996 11,250

F. Less : Depreciation for 1996 2,813 2,813

8,437 11,563

7.7 SALE OF AN ASSET

An enterprise may sell an asset either because of obsolescence or inadequacy or

even for other reasons. In case an asset is sold during the course of the year, the

amount realised should be credited to the Asset Account. The amount of

depreciation for the period of which the asset has been used should be written off

in the usual manner. Any balance in the Asset Account will represent profit or loss

on disposal of the asset. This balance in the Asset Account should be transferred to

the profit and loss account.

(26)](https://image.slidesharecdn.com/bba101-161023202742/85/COMPLETE-NOTES-ONACCOUNTING-173-320.jpg)

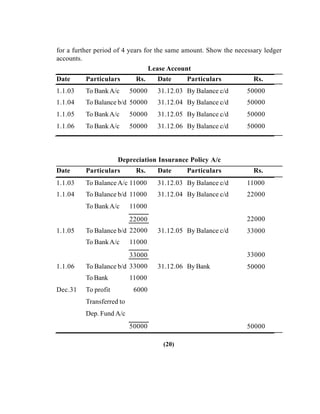

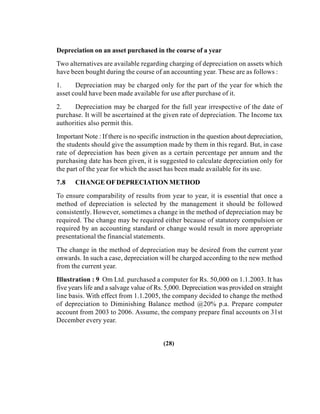

![7.11 SELF ASSESSMENT QUESTIONS

1. Why is it necessary to calculate depreciation ? Discuss various factors which

are considered for calculating depreciation

2. How do the matching principle and going concern concept apply to

depreciation.

3. Distinguish between the following :

(a) Straight line method and diminishing balance method.

(b) Annuity method and depreciation Fund method.

(c) Depreciation and depletion

4. Explain the circumstances under which different methods of depreciation

can be employed.

5. Discuss the advantages and disadvantage of Insurance Policy Method and

Straight Line Methods.

6. What is 'sum of the year-digits method' to depreciation ? In what way does it

differ from sinking fund method of depreciation

7. A firm purchases a plant for a sum of Rs. 10,000 on 1st January 2000.

Installation charges are Rs. 2,000. Plant is estimated to have a scrap value of Rs.

1,000 at the end of its useful life of five years. You are required to prepare the

plant account for five years charging depreciation according to Straight Line Method

8. A transport company purchases 5 trucks at Rs. 2,00,000 each on April 1, 2006.

The company writes off depreciation @ 20% per annum on original cost and observes

calendar year as its accounting year. On October 1, 1998 one of the trucks is involved

in an accident and is completely destroyed. Insurance company pays Rs. 90,000 in full

settlement of claim. On the same day, the company purchases a used truck for Rs.

1,00,000 and spends Rs. 20,000 on its overhauling. Prepare Truck Account for the

three years ending on 31st December 2005.

[Loss on one truck Rs. 10,000, BookValue–Old trucks Rs. 3,60,000, NewTruck Rs. 1,14,000].

9. A plant is purchased for Rs. 20,000. It is depreciated at 5% per annum on

reducing balance for five years when it becomes obsolete due to new method of

production and is scrapped. The scrap produces Rs. 5,385. Show the plant account

in the ledger.

(An Loss on sale Rs. 10,091; Depreciation 1st year Rs. 1,000; 2nd years Rs. 950;

3rd year Rs. 902; 4th year RS. 857; 5th year Rs. 815.)

(32)](https://image.slidesharecdn.com/bba101-161023202742/85/COMPLETE-NOTES-ONACCOUNTING-179-320.jpg)

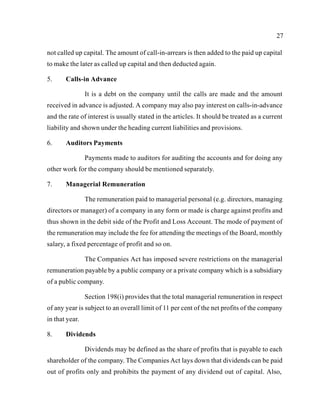

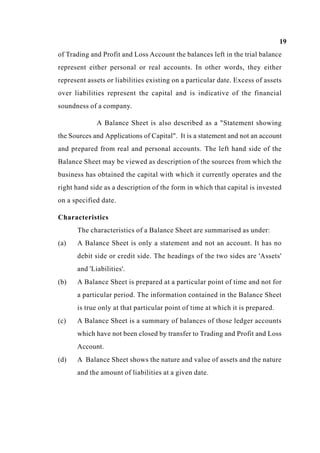

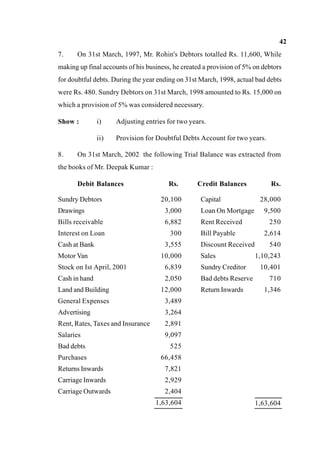

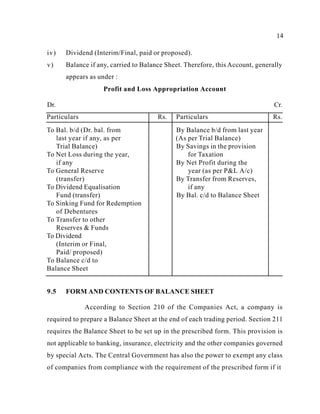

![18

(1) (2) (3) (4) (5) (6)

3. Shares Premium Account (Showing details of

its utilisation in the manner provided in Section

78intheyearofutilisation).

4. Other reserves specifying the nature of each

Reserve andthe amount inrespect thereof.

Less : Debit balance in Profit and Loss

Account(ifany)

(The debit balance in the Profit and Loss Account

shallbeshownasadeductionfromtheuncommitted

reserves,ifany)

5. Surplus,i.e.balanceinProfitandLossAccount

after providing for proposed allocations namely;

Dividend,BonusorReserves

6. Proposed additions to Reserves.

7. SinkingFunds.

(Additions and deductions since last balance sheet

tobe shownundereachofthe specifiedheads.The

word"funds"inrelationtoany"Reserve"shouldbe

used only where such Reserve is specifically

represented byearmarked investments).

Secured Loans :

1. Debentures.

2. Loans and Advances fromBanks

3. LoansandAdvancesfromSubsidiaries.

4. Other Loans and Advances.

(Loans from directors and/or manager should be

shown separately). Interest accrued and due on

Secured Loans should be included under the

appropriate sub-heads under the head "Secured

Loans".

(Showingseparatelysharesfullypaidupandpartly

paidupandalsodistinguishingthe different classes

of shares and showing also in similar details

investment in shares, debentures or bonds of

subsidiarycompanies).

3. Immovableproperties

4. Investmentsinthecapitalofpartnershipfirms

(Aggregate amount of company's quoted

investments and also the market value thereof shall

be shown).

(Aggregate amount of company's unquoted

investmentshallalsobeshown).

Current Assets, Loans and Advances :

(A) Current Assets :

1. InterestAccruedonInvestments.

2. Stores and Spare Parts.

3. LooseTools

4. Stock-in-Trade

5. Work-in-Progress

[In respect of (2) and (4), mode of valuation of

stock shall be stated and the amount in respect of

raw materials shall also be stated separately where

practicable. Mode of valuation of work-in-progress

shall be stated].

6. SundryDebtors

(a) ebts Outstanding for a period exceeding six

months.

(b) Other Debts

Less : Provision

(The amounts to be shown under Sundry Debtors

shall include the amounts due in respect of goods](https://image.slidesharecdn.com/bba101-161023202742/85/COMPLETE-NOTES-ONACCOUNTING-241-320.jpg)

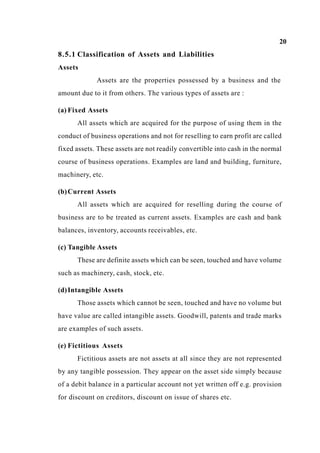

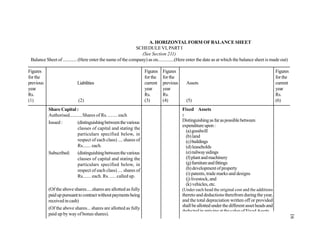

![20

(1) (2) (3) (4) (5) (6)

5. UnclaimedDividends.

6. OtherLiabilities(ifany).

7. Interest accrued but not due on loans.

B. Provisions

8. ProvisionforTaxation.

9. ProposedDividends.

10.ForContingencies.

11. For Provident FundScheme.

12. For Insurance, pension and similar staff benefit

schemes.

13. Otherprovisions.

A foot-note to the balance sheet may be added to show

separately:

1. Claims against the company not acknowledged as

debts.

2. Uncalledliabilityonsharespartlypaid.

3. Arrearsoffixedcumulativedividends.

(The period for which the dividends are in arrears or if

there is more than one class of shares, the dividends on

each such class that are in arrears shall be started. The

amount shall be stated before deduction of income-tax,

except that in the case of tax-free dividends the amount

shall be shown free of income-tax and the fact that it is so

shownshall be stated).

4. Estimated amount of contracts remaining to be

executed oncapital account and not provided for.

5. Othermoneysforwhichthecompanyiscontingently

liable.

The amount of any guarantees given by the company on

behalf of directors or other officers of the company shall

be stated and where practicable, the general nature and

amount ofeachsuchcontingentliability,ifmaterialshall

alsobe specified.

(c) the natureofthe interest, ifany, ofanydirector or

his relative in each of the bankers (other than

Scheduled Banks referred to in (b) above)).

(B) Loans and Advances :

8. (a) Advances and loanstosubsidiaries.

(b) Advances and loans to partnership firm in

whichthe company or any of its subsidiaries

is a partner.

9. BillsofExchange.

10.Advances recoverable in cash or in kind or for

valuetobereceived,e.g.,Rates,Taxes,Insurance,

etc.

11.Balances with Customs, Port Trust, etc. (where

payable on demand).

[TheinstructionsregardingSundryDebtorsapply

to "Loans and Advances" also. The amounts due

fromothercompaniesunderthesamemanagement

withinthemeaningofsub-section(IB)ofSection

370 should also be given with the names of

companies;themaximumamountduefromevery

one of these at any time during the year must be

sown].

Miscellaneous Expenditure

(to the extent not written off or adjusted).

1. Preliminaryexpenses.

2. Expenses including commission or brokerage or

under-writing or subscription of shares or

debentures.

3. Discountallowedontheissueofsharesordebentures.

4. Interestpaidoutofcapitalduringconstruction(also

statingtherateofinterest).

5. Developmentexpenditurenotadjusted.

6. Otherssums(specifyingnature).

Profit and Loss Account

(Show here the debit balance of Profit and Loss

Account carried forward after deduction of the

uncommittedreserves,ifany).](https://image.slidesharecdn.com/bba101-161023202742/85/COMPLETE-NOTES-ONACCOUNTING-243-320.jpg)