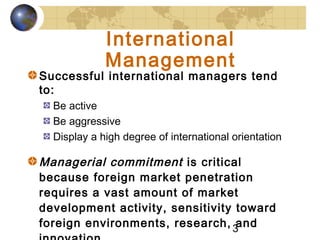

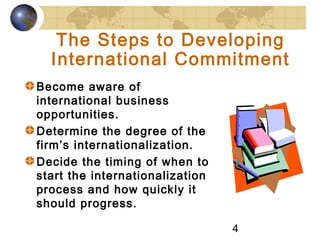

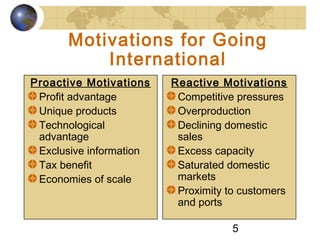

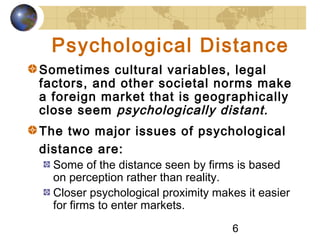

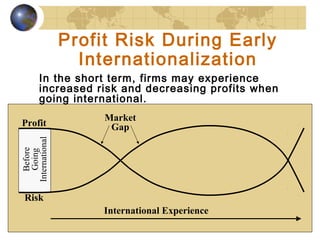

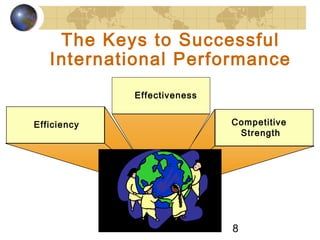

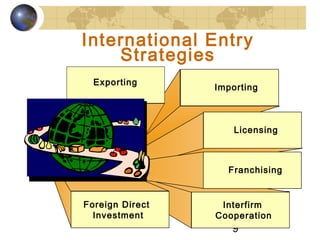

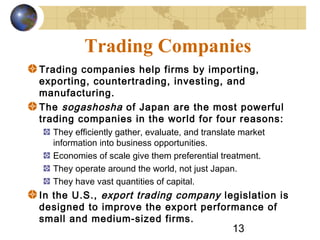

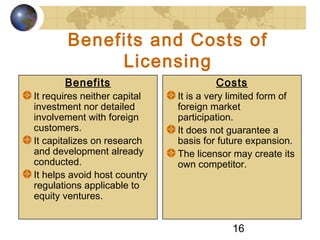

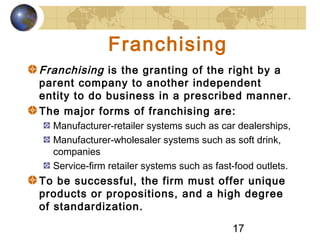

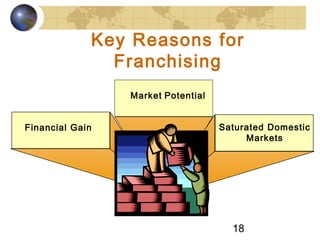

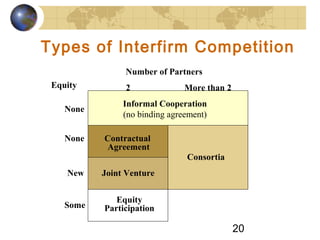

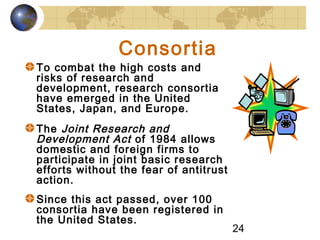

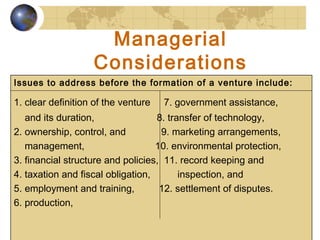

The document outlines the internationalization process for firms, detailing the motivations, strategies, and challenges involved in entering foreign markets. Key concepts include the role of intermediaries, licensing, franchising, and the importance of strategic alliances and joint ventures. It also highlights managerial considerations and the implications of psychological distance on market entry decisions.