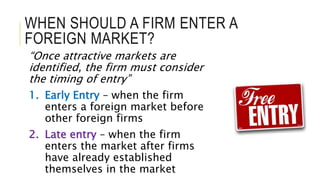

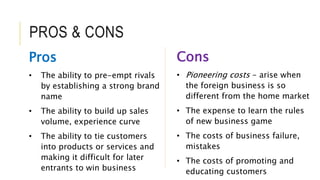

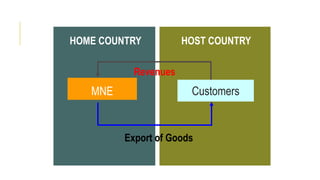

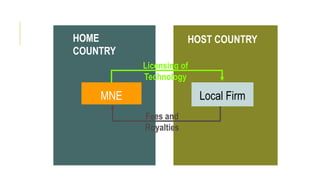

The document discusses various modes of entry for international firms looking to enter foreign markets, including the pros and cons of early vs late entry. It then outlines several specific modes of entry: exporting, licensing, franchising, turnkey projects, joint ventures, wholly owned subsidiaries, and strategic alliances. For each mode, it provides details on when a firm may choose to use that option versus not, and diagrams depicting the relationships between the home country firm and local partner or subsidiary.