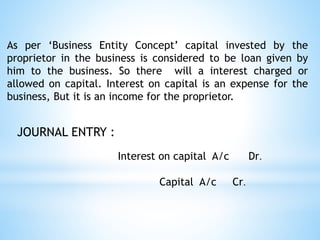

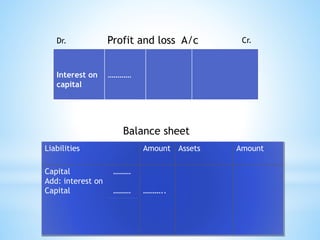

The document discusses how interest is treated for capital invested in a business, drawings from the business, and loans to/from the business. Interest charged on capital and drawings is treated as income for the business and interest expense for the proprietor, while interest paid on loans is treated as an expense for the business and interest received is treated as income. Journal entries are provided to record these interest transactions and reflect the impact on the balance sheet and profit and loss account.