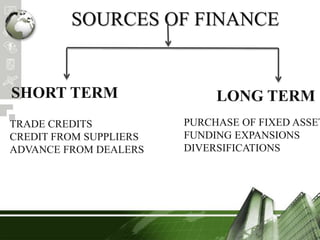

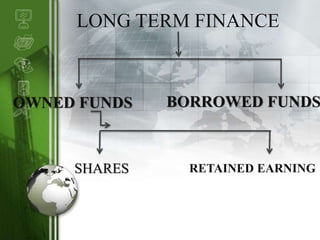

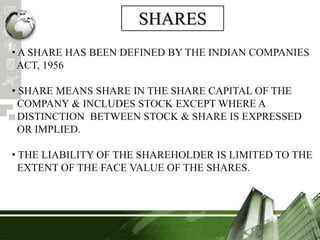

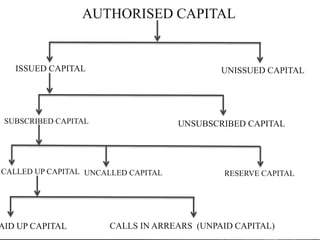

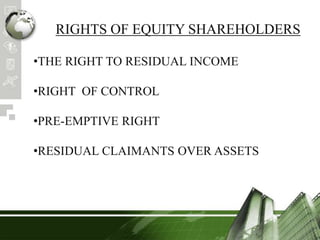

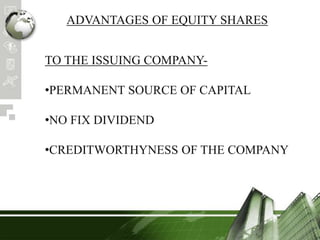

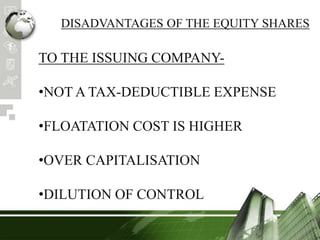

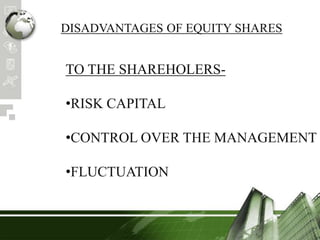

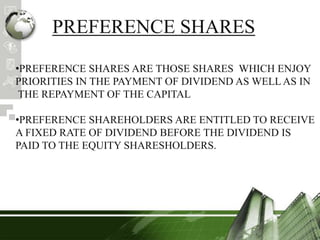

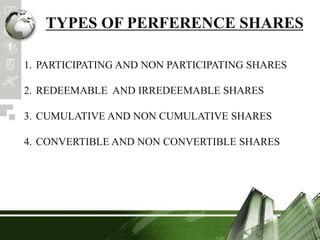

This document discusses various sources of finance for companies including short term sources like trade credits and long term sources like shares. It describes the different types of shares like equity shares and preference shares. Equity shares are the risk bearing capital of a company, while preference shares enjoy priority in dividend payments and capital repayment. Retained earnings are an important source of internal financing for companies as they help in capital accumulation, investments and meeting working capital needs. Internal financing provides advantages to both companies and shareholders.