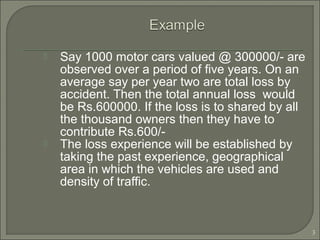

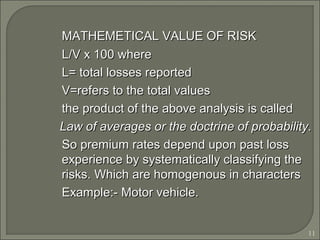

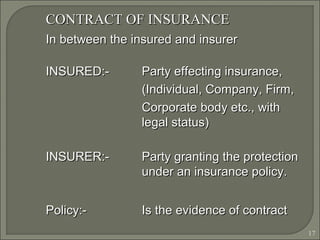

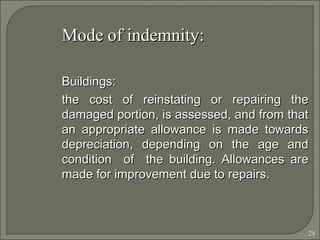

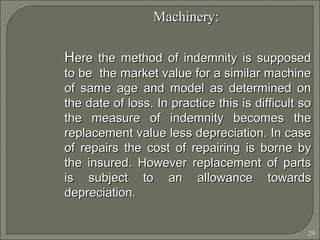

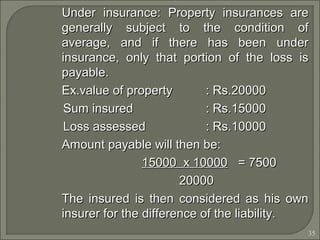

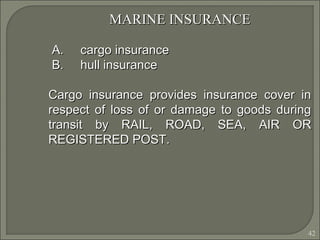

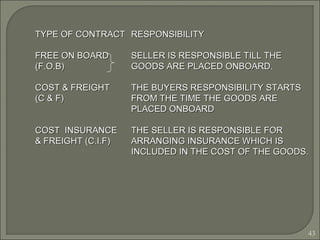

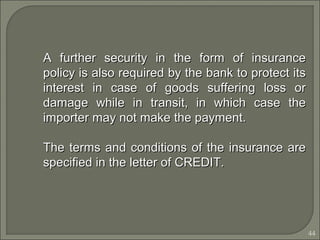

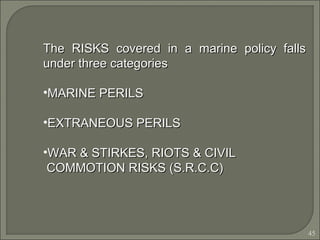

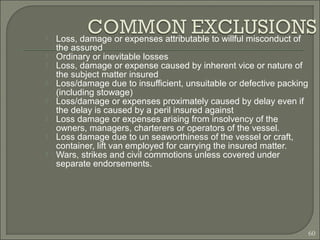

The document provides an overview of insurance principles, elucidating concepts such as risk, insurable interest, and the various types of insurance including fire, marine, and miscellaneous policies. It explains the contract elements required for insurance validity, the importance of utmost good faith, and the methods of indemnification. Additionally, it covers topics like underinsurance, excess, salvage, contribution, and proximate cause in the context of insurance claims.