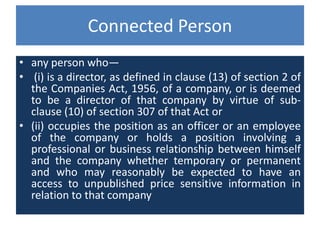

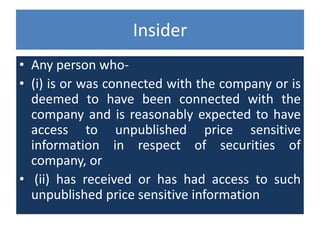

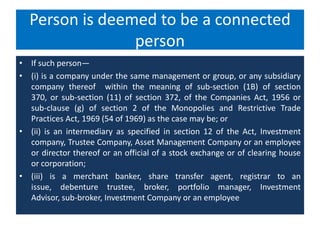

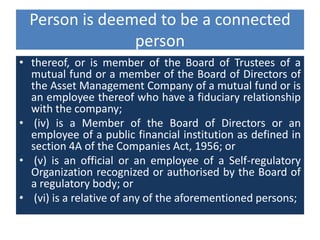

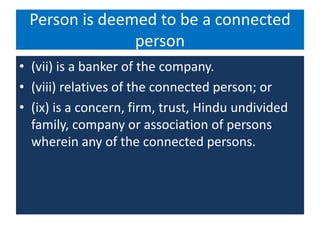

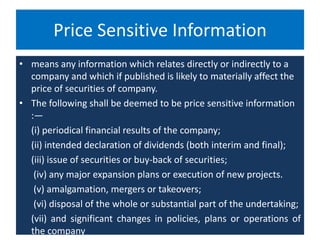

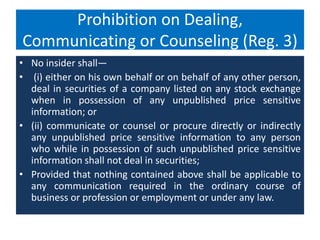

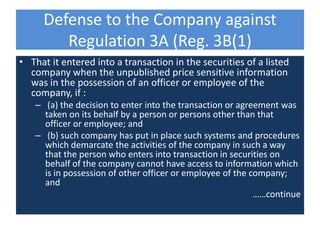

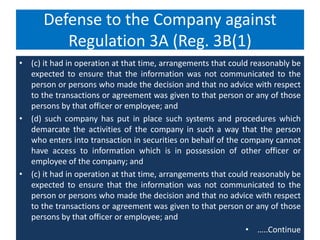

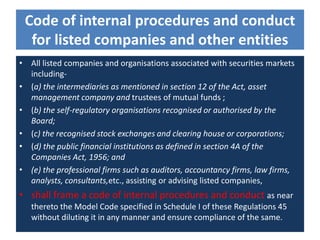

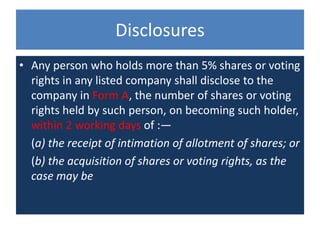

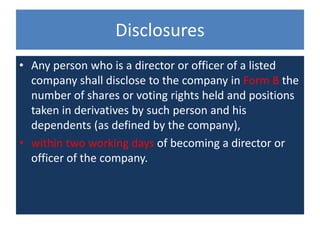

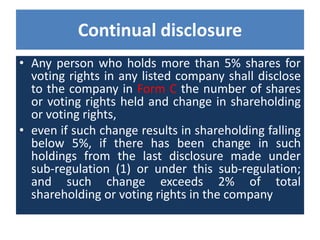

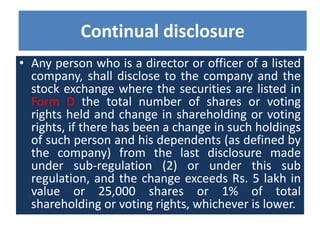

The document outlines regulations regarding insider trading in India. It defines key terms like connected person, insider, and price sensitive information. It prohibits insiders from dealing in securities based on unpublished price sensitive information. It requires initial and continual disclosure of shareholding by substantial shareholders, directors, and officers. Companies must have internal code and procedures to prevent insider trading and disclose information received about share transactions of insiders and substantial shareholders to stock exchanges.