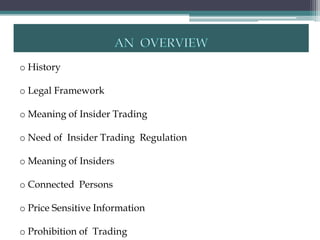

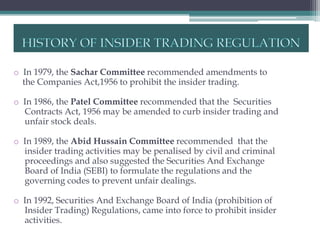

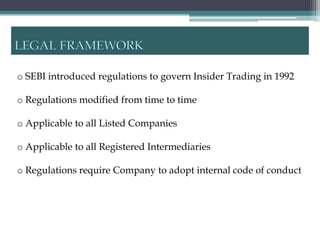

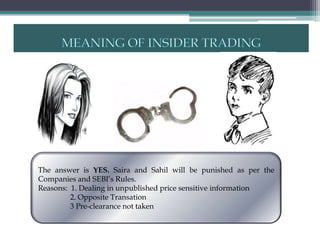

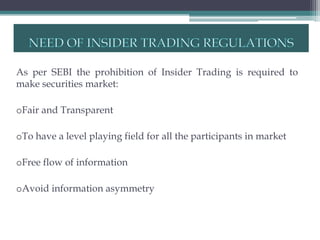

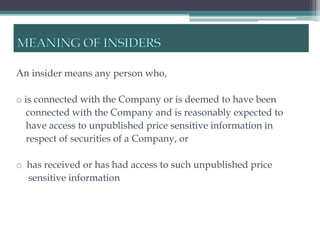

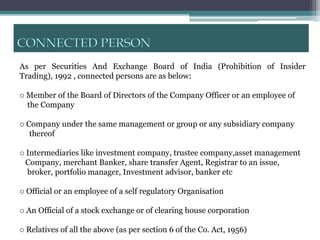

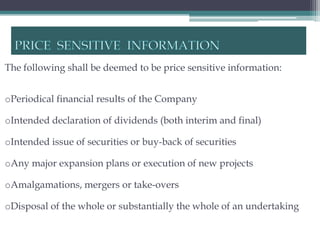

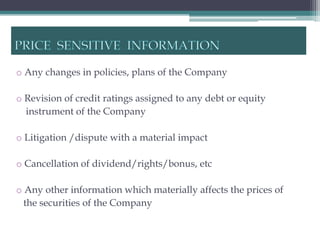

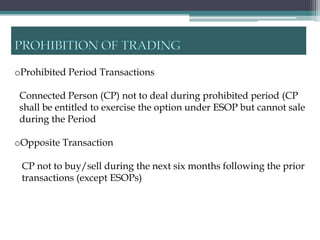

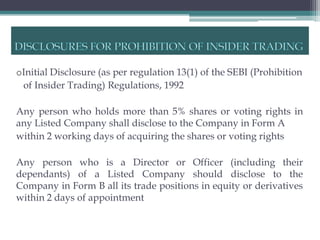

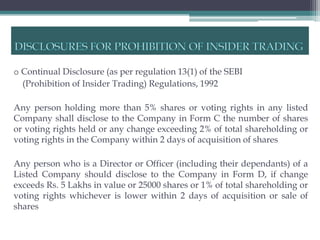

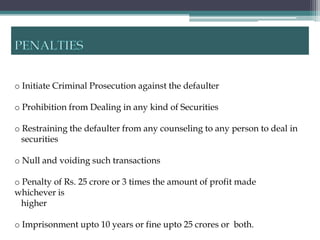

SEBI introduced regulations in 1992 to govern insider trading in India and prohibit the use of unpublished price sensitive information for securities trading. Insiders such as employees who have access to such information and connected persons such as family members cannot misuse this data for financial gain. Saira and her husband Sahil would be found guilty of insider trading as she shared non-public information about her company's acquisition plans with him, and he subsequently traded on this information for profit without following necessary pre-clearance procedures. SEBI regulations aim to promote fair securities markets and prevent information asymmetries through disclosure requirements and penalties for non-compliance, including heavy fines and imprisonment.