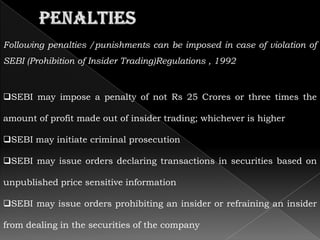

Insider trading involves trading in a company's securities using material, non-public information. It can include directors, employees or other connected persons trading based on confidential corporate info. The US was first to tackle insider trading through the Securities Exchange Act of 1984. In India, SEBI regulations from 1992 define "insiders" as connected persons who may have access to unpublished price sensitive info. The regulations prohibit insiders from trading using such info and require listed companies to implement codes of conduct regarding disclosure practices. Violations can result in heavy financial penalties or criminal prosecution.