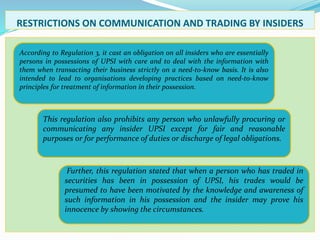

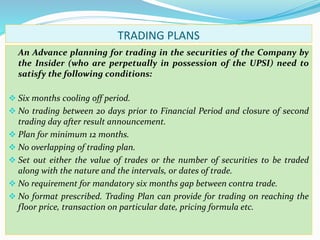

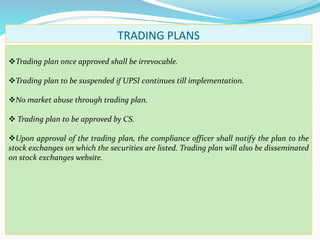

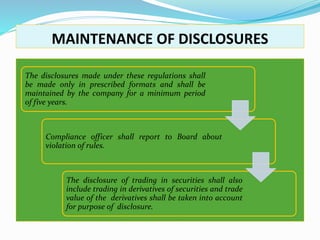

The document discusses the evolution of insider trading regulations in India. It summarizes the key events and reports that led to the notification of the SEBI (Prohibition of Insider Trading) Regulations, 2015, including the constitution of the Sodhi Committee in 2013, its report to SEBI, and SEBI's approval of new regulations in 2014. The regulations, effective from May 2015, define insider trading and key terms like "insider", "connected person", and "unpublished price sensitive information (UPSI)". The regulations place restrictions on communication and trading by insiders and require various disclosures and maintenance of registers by listed companies.

![Meaning of Insider Trading

Insider trading is trading or dealing in securities based on unpublished price

sensitive information(UPSI).

Insiders may have access to unpublished price sensitive information.

Trading includes subscribing, buying, selling, dealing or agreeing to do any of these

activities. [Section2(l) of new regulation].

Trading means transacting in securities whether by way of acquisition/ disposal.

[NK Sodhi Report].

Objective of these regulations is to prohibit an insider from profiting while he is in

the possession of unpublished price sensitive information.

To Ensure investor confidence in the market and the integrity of price discovery.](https://image.slidesharecdn.com/insidertrading-final-170709081410/85/Insider-trading-final-3-320.jpg)

![Format of Forms

FORM B

Securities and Exchange Board of India (Prohibition of Insider Trading) Regulations, 2015

[Regulation 7 (1) (b) read with Regulation 6 (2)]

Name of the Company: ABC Limited

ISIN of the Company: INE123D12345

Details of Securities held by Promoter, Key Managerial Personnel (KMP), Director and other such persons as mentioned in Regulation

6(2)

Name, PAN

No., CIN/ DIN &

address with

contact nos.

Category of

Person

(Promoters/

KMP/ Director

s/ immediate

relatives/

Others etc.)

Date of

appointment

of Director

/ KMP OR

Date of

becoming

Promoter

Securities held at the

time of becoming

Promoter/ appointment

of Director/ KMP

% of

Share

holding

Open Interest of the

Future contracts held

at the time of

becoming Promoter

/ appointment of

Director/ KMP

Open Interest of

the Option held at

the time of

becoming

Promoter/ appoint

ment of

Director/ KMP

Type of

sec urity (For

eg. – Shares,

Warrants,

Convertible

Debentures

etc .)

No. Number

of units

(c ontrac

ts * lot

size)

Notional

value in

Rupee

terms

Number

of units

(c ontrac

ts * lot

size)

Notion

al value

in

Rupee

terms

Note: “ Sec urities” shall have the meaning as defined under regulation 2(1)(i) of SEBI (Prohibition of Insider Trading) Regulations,

2015.

Date: Signature:

Plac e: Designation:](https://image.slidesharecdn.com/insidertrading-final-170709081410/85/Insider-trading-final-12-320.jpg)

![FORM C

Securities and Exchange Board of India (Prohibition of Insider Trading) Regulations, 2015

[Regulation 7 (2) read with Regulation 6 (2)]

Name of the Company: ABC Limited

ISIN of the Company: INE123D12345

Details of change in holding of Securities of Promoter, Employee or Director of a listed company and other such persons as mentioned

in Regulation 6(2).

Name,

PAN No.,

CIN/ DIN,

&

address

of

Promoter

/ Employ

ee /

Director

with

contact

nos.

Categor

y of

Person

(Promot

er / KMP

/

Director

s/

immedi

at e

relatives

/ others

etc.)

Securities held

prior to

acquisition/

disposal

Securities

acquired

/ Disposed

% of

shareholdin

g

Date of

allotment

advice/

acquisitio

n of

shares/

sale of

shares

specify

Date

of

intim

ation

to

comp

any

Trading in derivatives (Specify type

of contract, Futures or Options etc)Excha

nge on

which

the

trade

was

execut

ed

Buy Sell

Type of

security

(For eg.

Shares,

Warrant

Converti

ble

Debentur

e etc.)

No

Type of

security

(For eg.

Shares,

Warrants

, Converti

ble

Debentur

e, etc .)

No Pre

trans

act

ion

Post

tran

sa

ctio

n

From To

Val

ue

Number

of units

(contrac

ts * lot

size)

Val

ue

Numb

er of

units

(contr

acts *

lot

size)

Note: “ Securities” shall have the meaning as defined under regulation 2(1)(i) of SEBI (Prohibition of Insider Trading) Regulations, 2015.

Date: Signature:

Place: Designation:](https://image.slidesharecdn.com/insidertrading-final-170709081410/85/Insider-trading-final-13-320.jpg)

![FORM D

Securities and Exchange Board of India (Prohibition of Insider Trading) Regulations, 2015

[Regulation 7 (3) Transactions by other identified persons as identified by the Company]

Name of the Company: ABC Limited

ISIN of the Company: INE123D12345

Details of change in holding of Securities of Promoter, Employee or Director of a listed company and other such persons as mentioned

in Regulation 6(2).

Note: “ Sec urities” shall have the meaning as defined under regulation 2(1)(i) of SEBI (Prohibition of Insider Trading) Regulations, 2015.

Date: Signature:

Plac e: Designation:

Name,

PAN No.,

CIN/ DIN,

&

address

of the

connect

ed

persons

as

identifie

d by the

Compan

y with

contact

nos.

Conne

ction

with

the

Comp

any

Securities held

prior to

acquisition/

disposal

Securities

acquired

/ Disposed

% of

shareholdin

g

Date of

allotment

advice/

acquisitio

n of

shares/

sale of

shares

specify

Mode

of

acquis

ition

(mark

et

purch

ase/

Public

rights/

prefer

entia l

offer /

off

marke

t/

Inter-

se

transfe

r etc.

Date

of

intim

ation

to

comp

any

Trading in derivatives (Specify type

of contract, Futures or Options etc)Exchan

ge on

which

the

trade

was

execut

ed

Buy Sell

Type of

sec urity

(For eg.

Shares,

Warrant

Converti

ble

Debentur

e etc .)

N

o

Type of

sec urity

(For eg.

Shares,

Warrants ,

Converti

ble

Debentur

e, etc .)

N

o

Pre

trans

ac t

ion

Post

tran

sa

c tio

n

From To

Val

ue

Number

of units

(c ontrac

ts * lot

size)

Val

ue

Numb

er of

units

(c ontr

ac ts *

lot

size)](https://image.slidesharecdn.com/insidertrading-final-170709081410/85/Insider-trading-final-15-320.jpg)