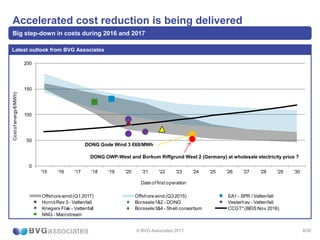

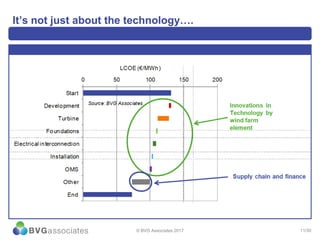

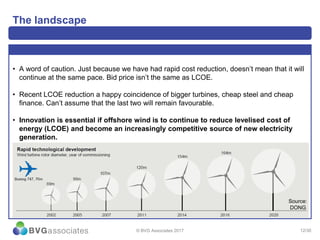

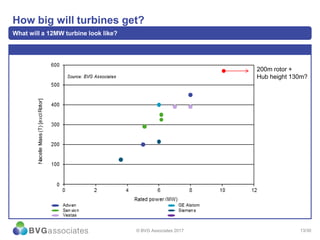

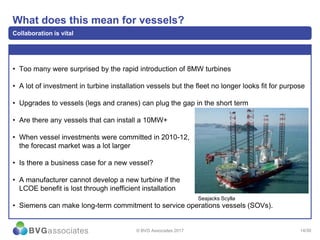

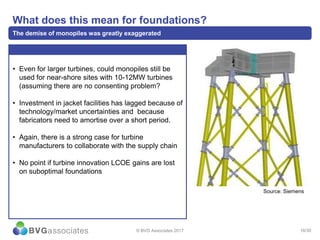

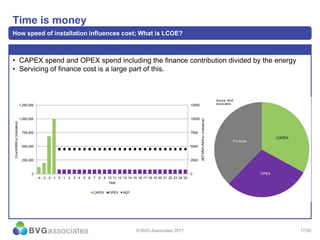

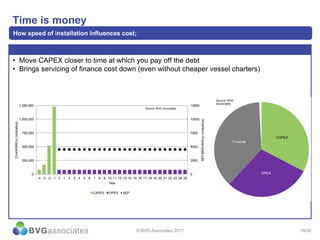

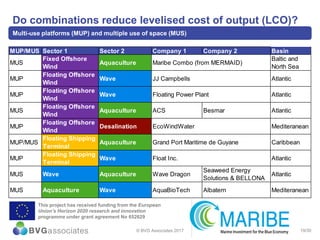

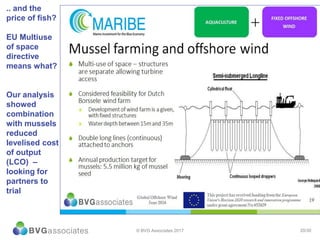

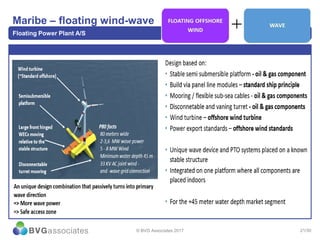

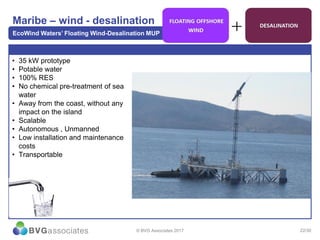

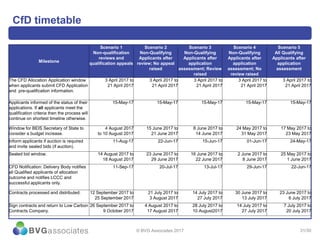

The document covers the offshore wind innovation landscape discussed during an event led by Mike Blanch of BVG Associates, focusing on various technologies and their implications for cost reduction in offshore wind energy. Key topics included the integration of offshore wind and wave power, economic modeling of energy costs, and the necessity for innovative approaches to maintain competitive pricing in the market. The presentation outlines ongoing projects, demonstration initiatives, and future challenges in turbine installation and foundation technologies.