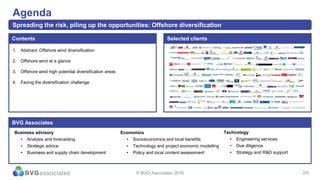

The document outlines strategies for diversification in the offshore wind sector, emphasizing the benefits of capitalizing on skills from the oil and gas industry to mitigate risks and drive innovation. It identifies key areas of potential investment and collaboration within the supply chain, showcasing the overlap in engineering and project management capabilities. The content highlights the importance of adapting to changing market dynamics while maintaining a focus on cost efficiency and local engagements.