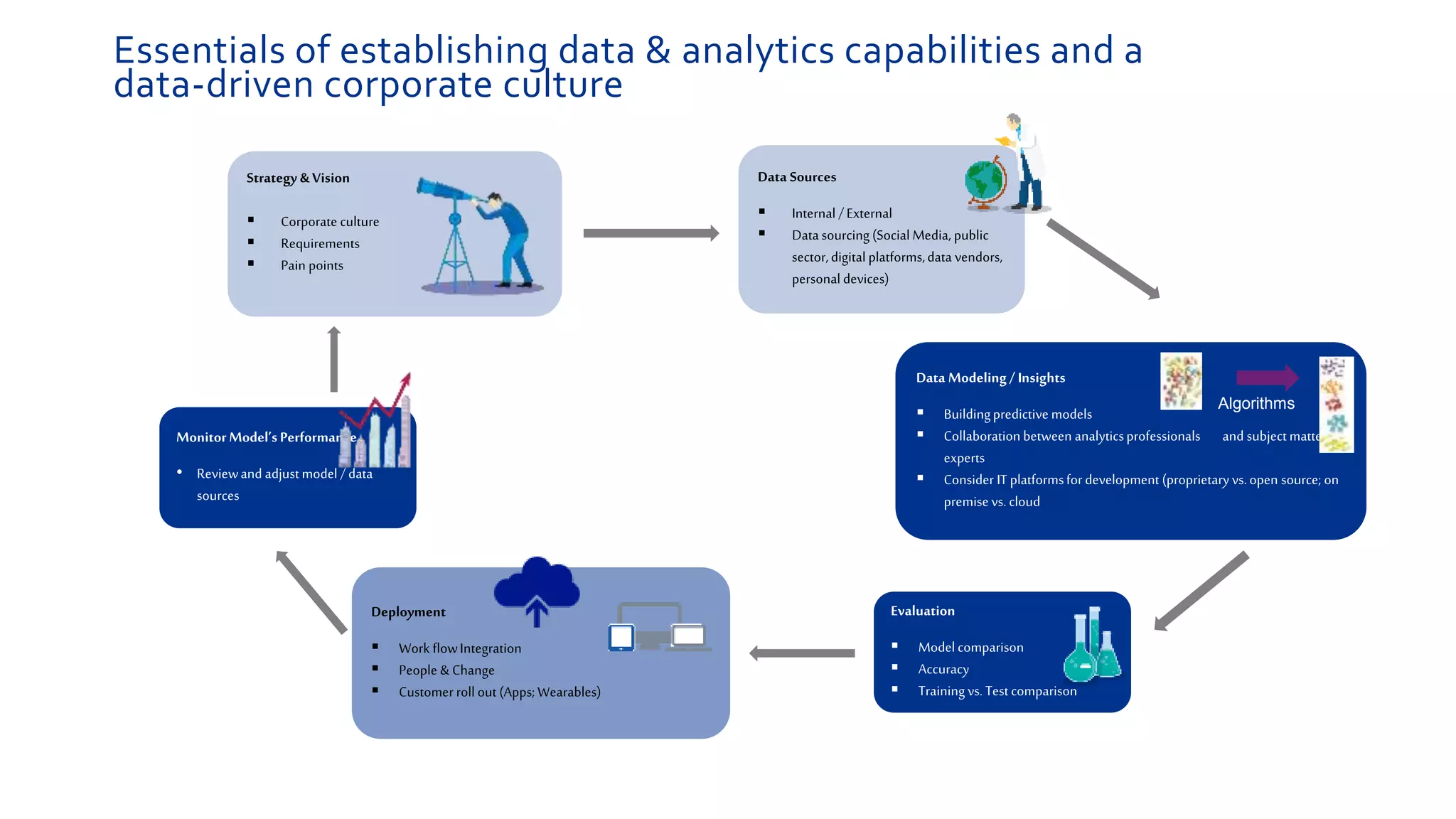

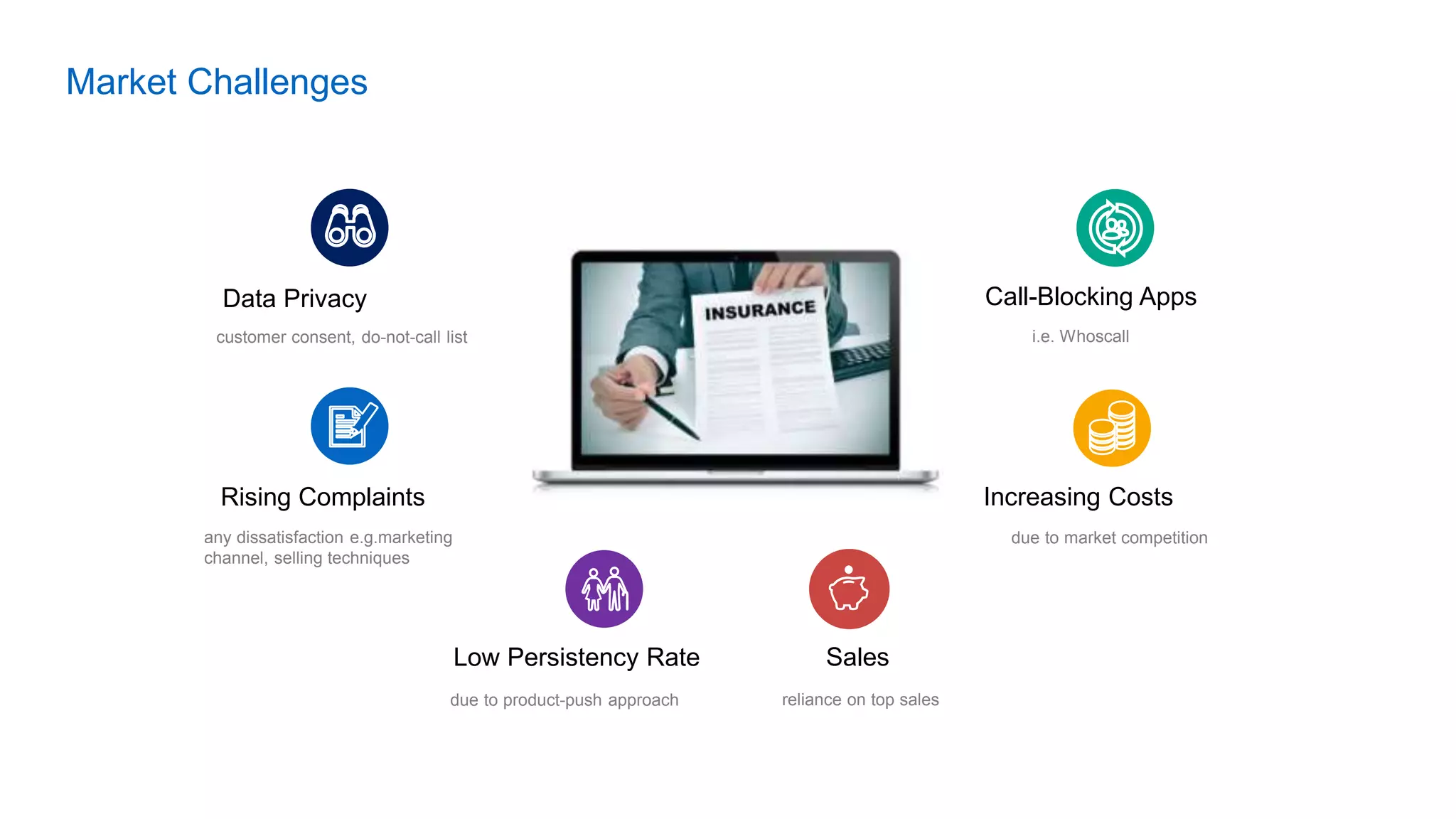

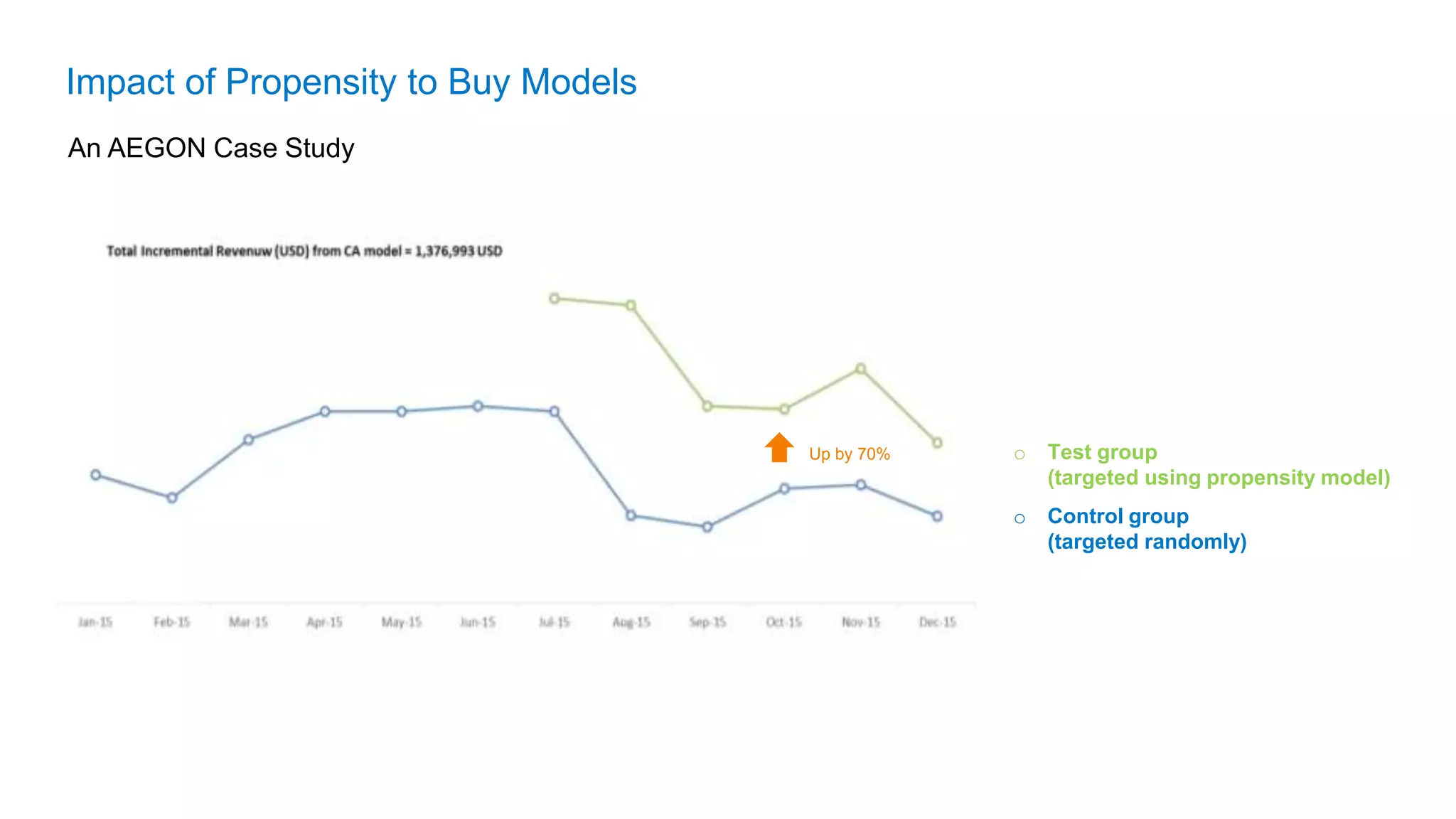

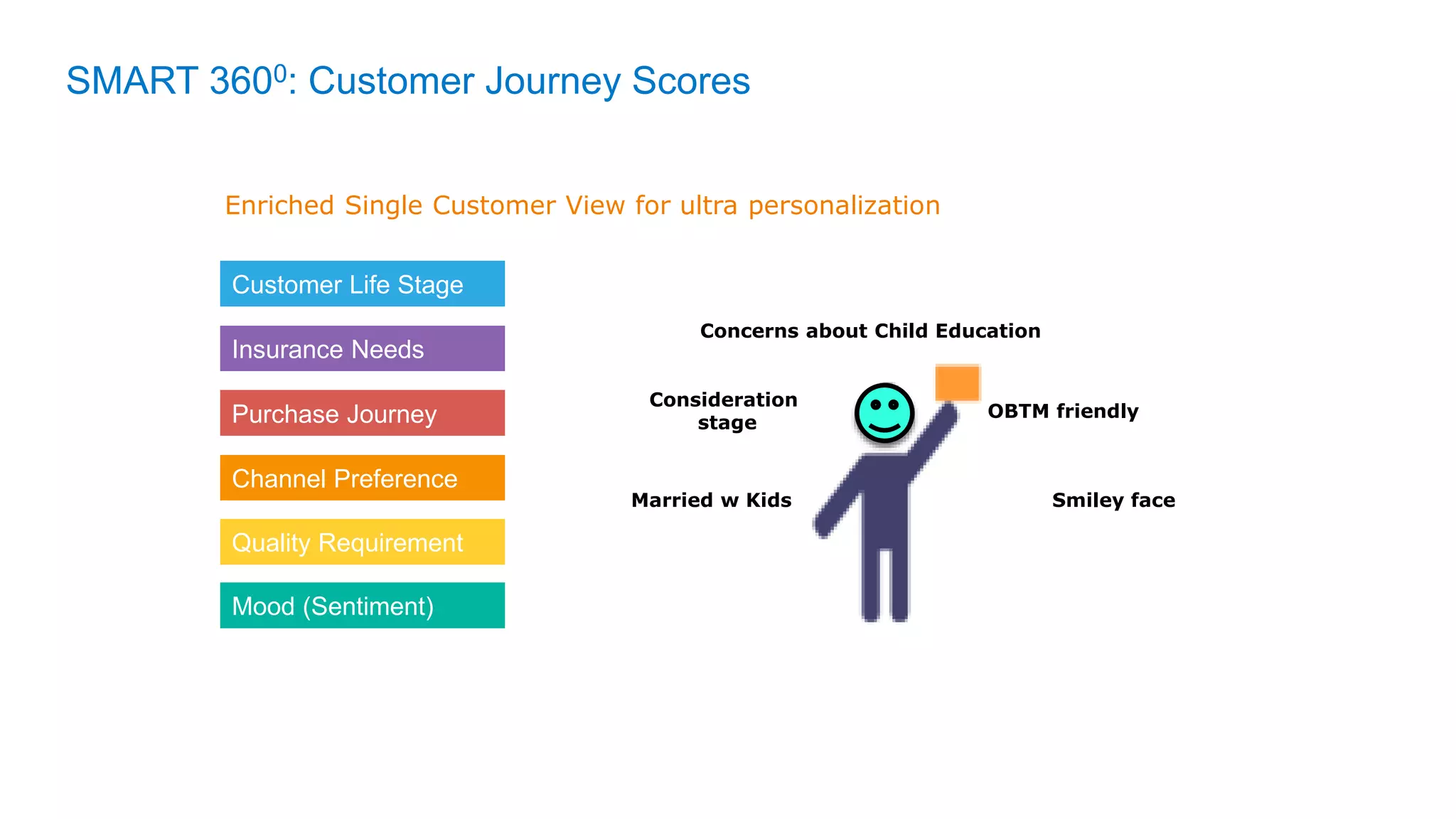

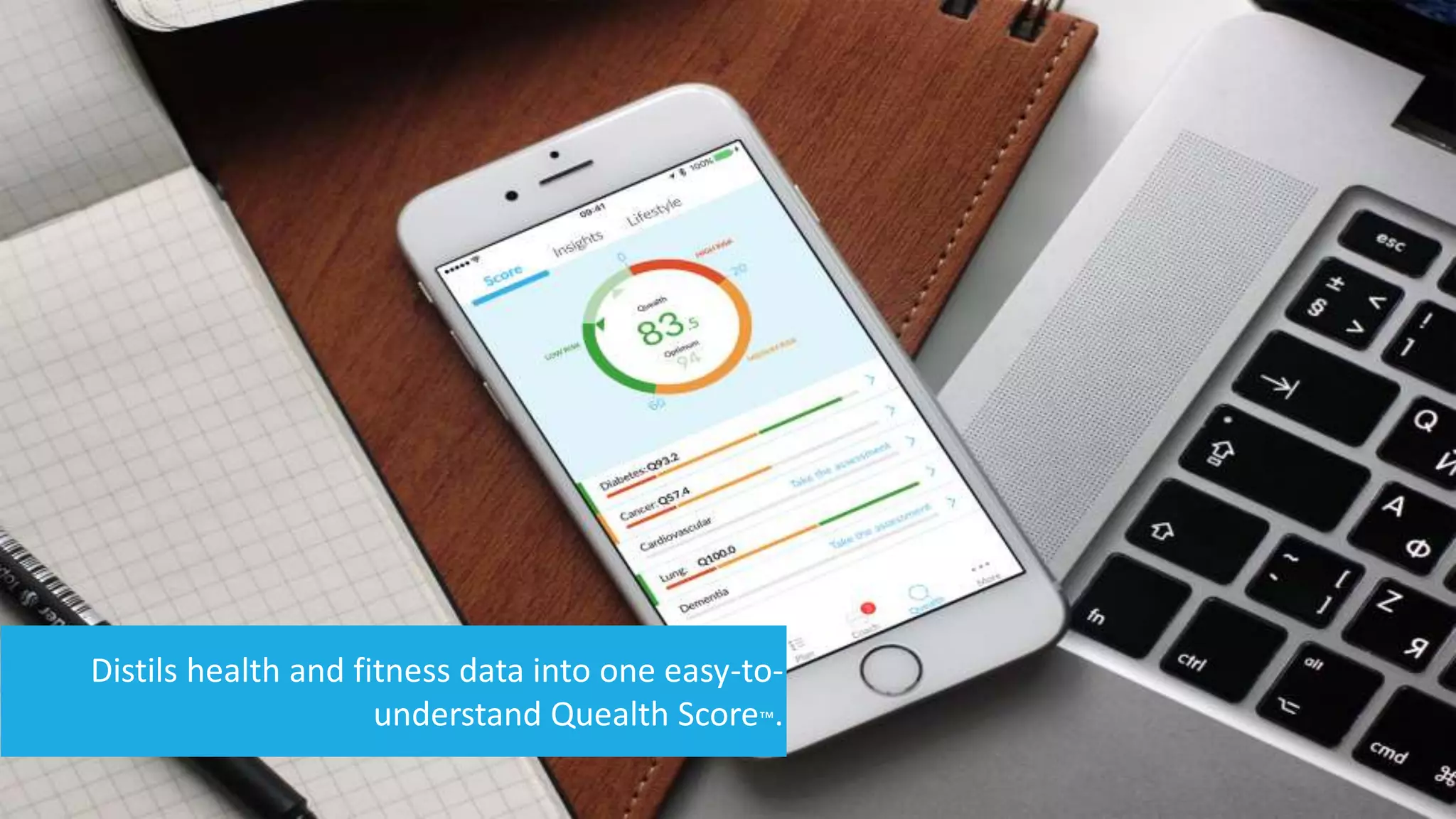

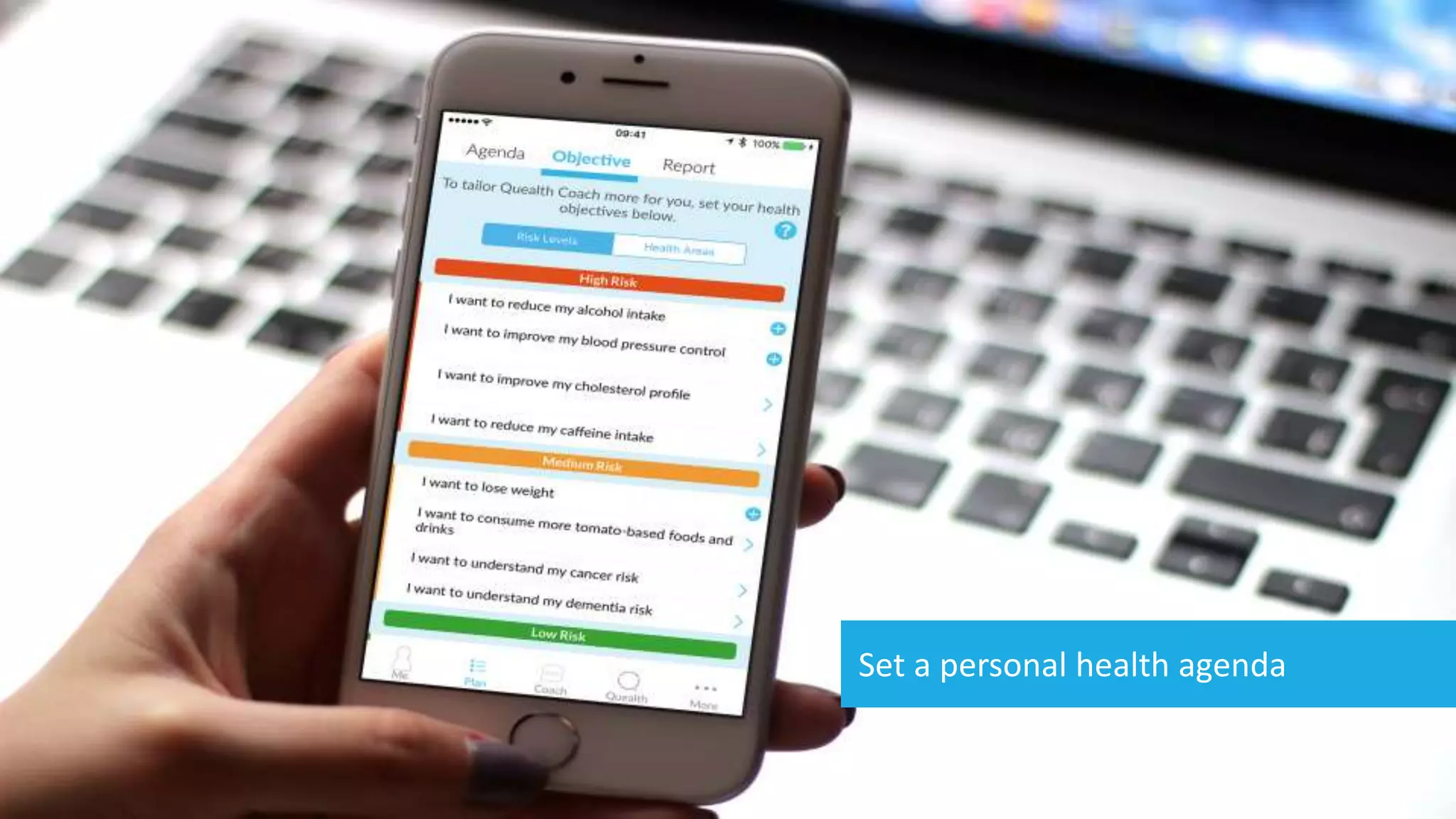

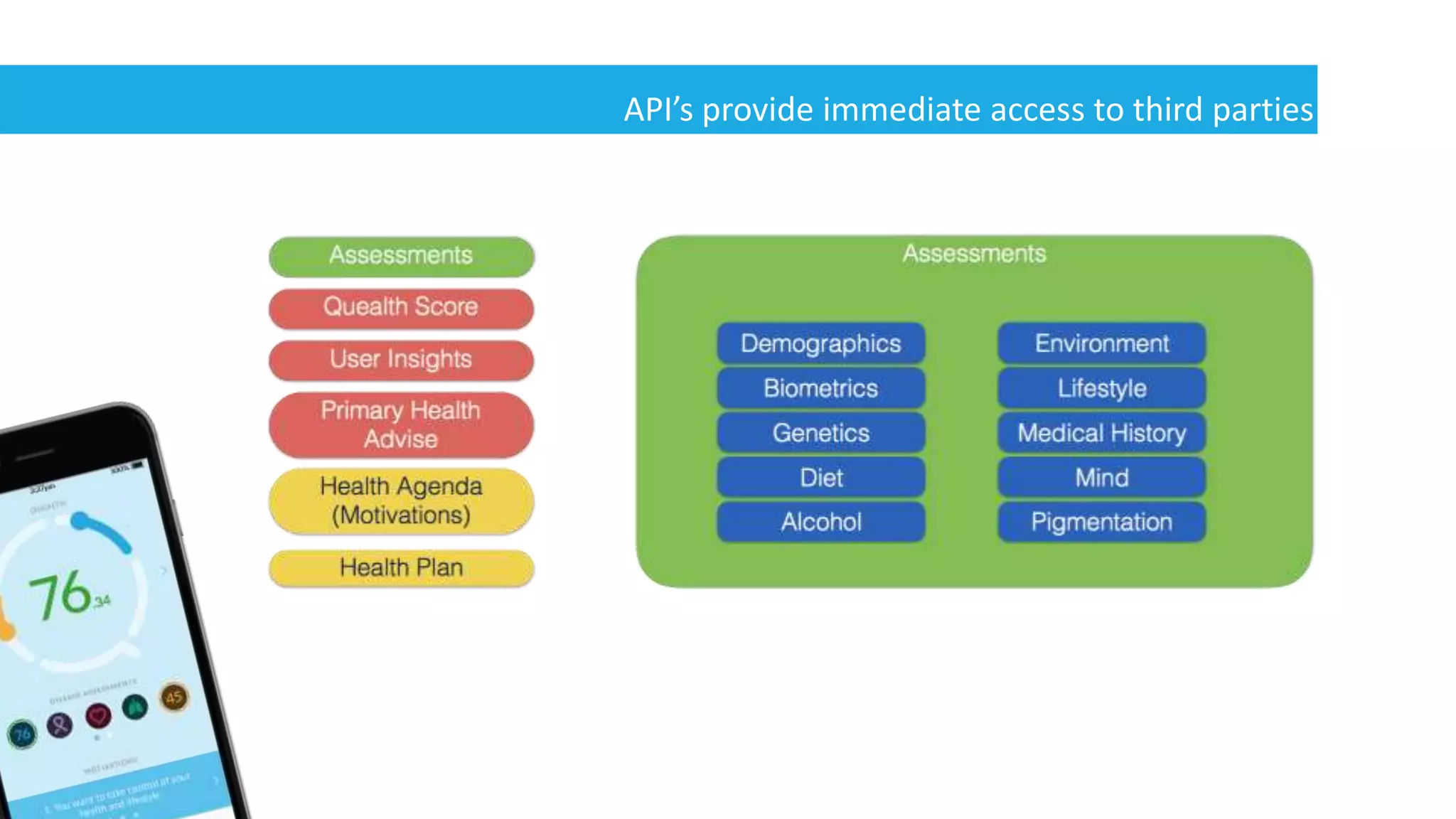

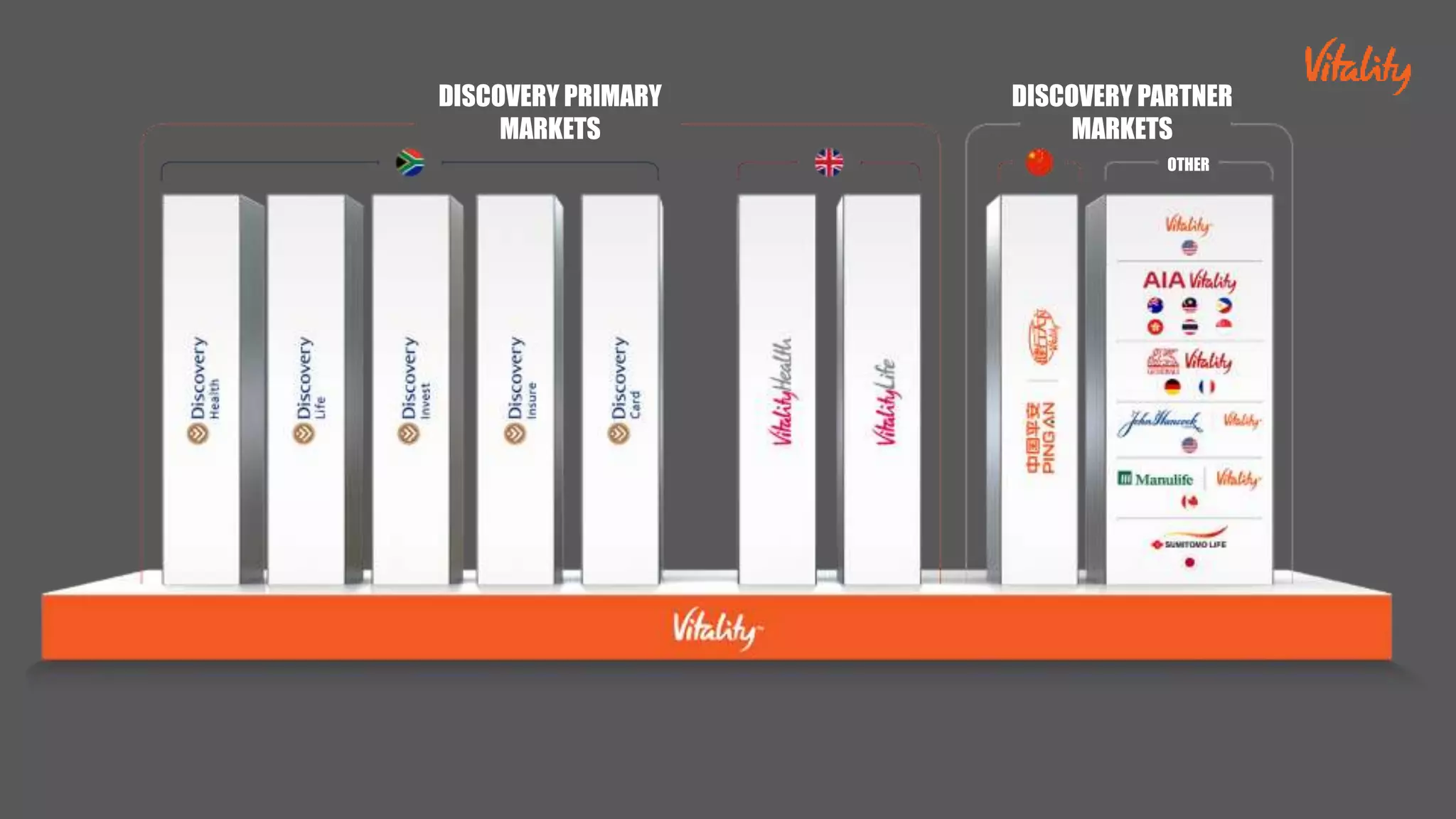

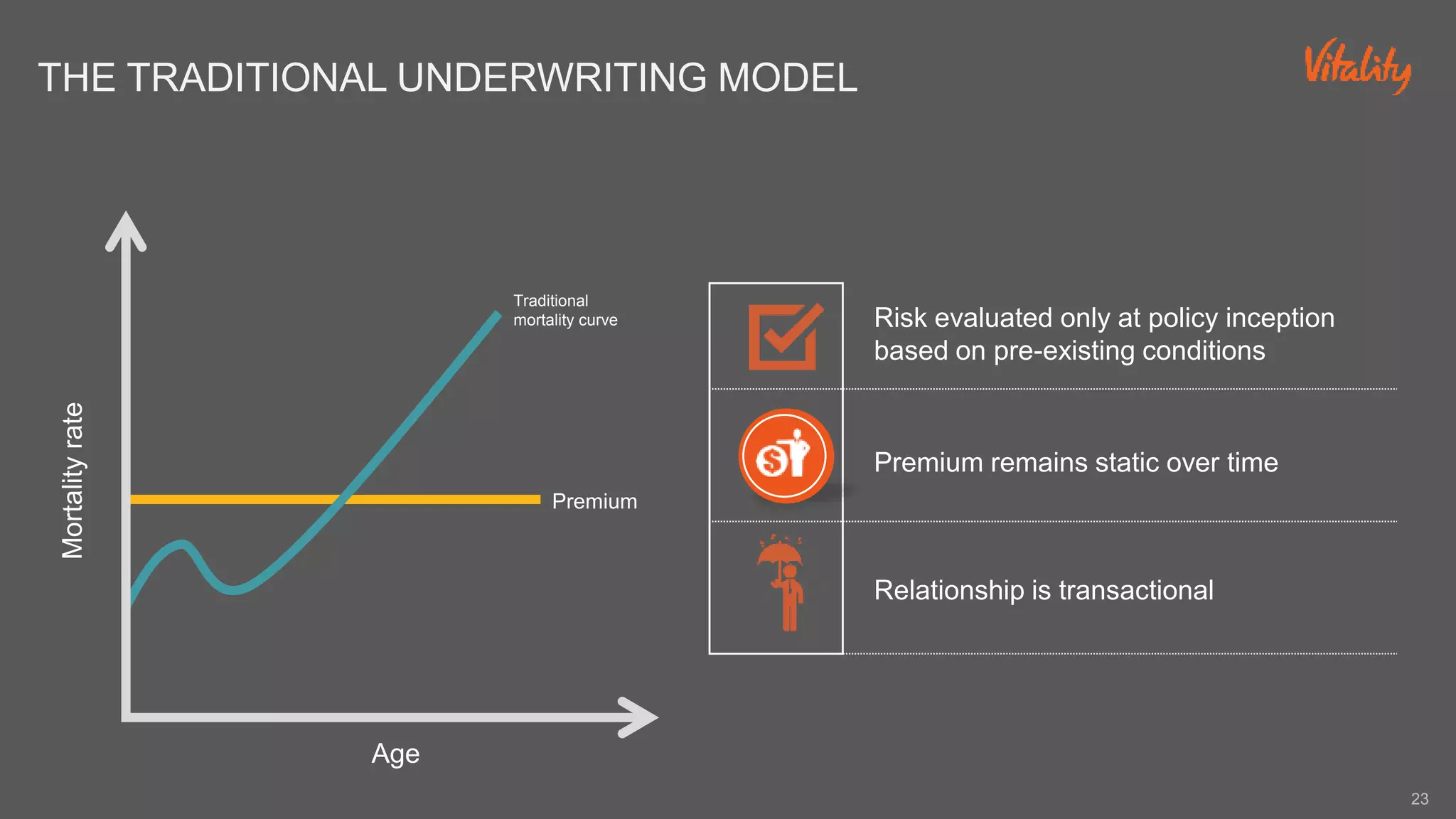

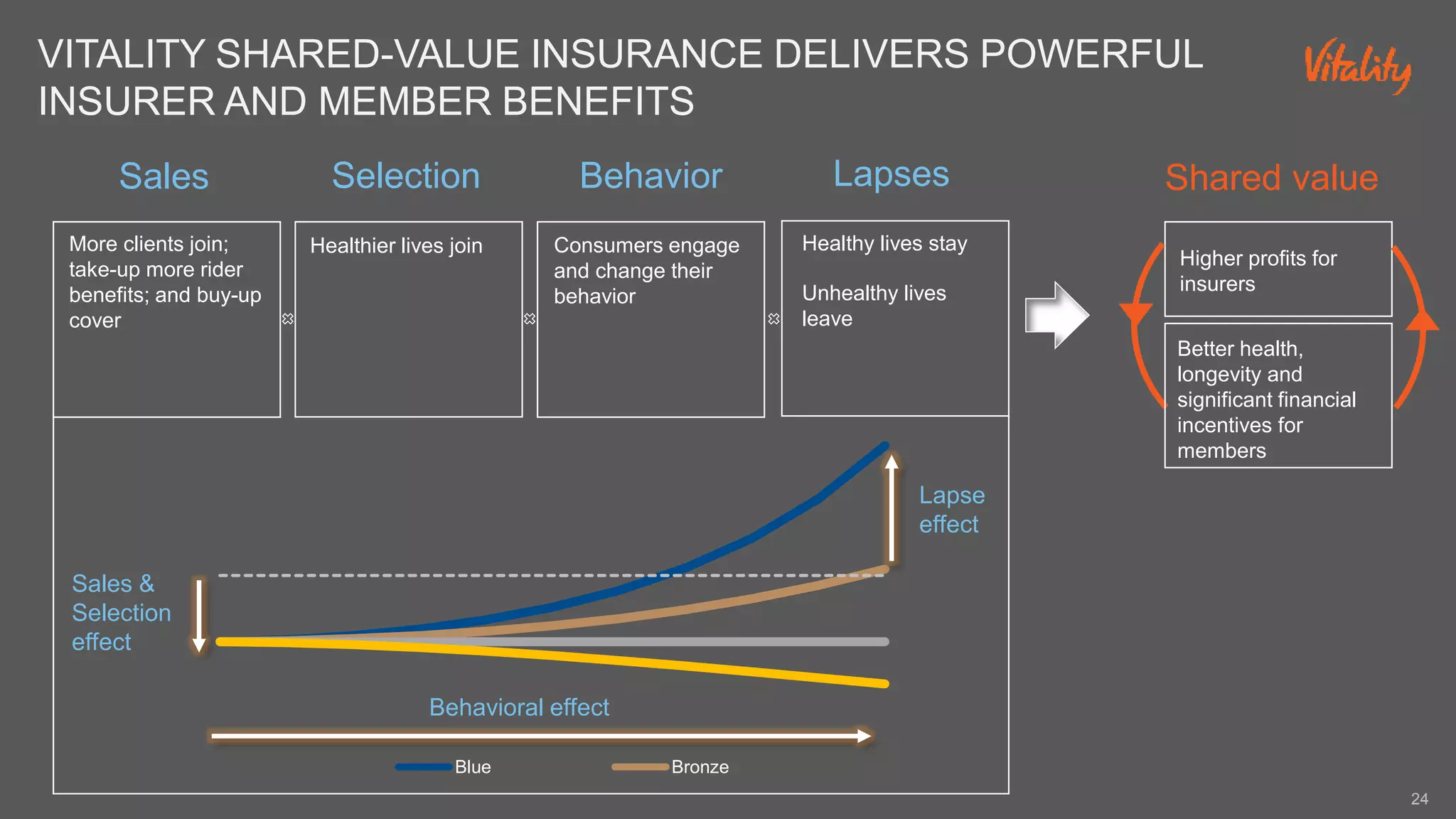

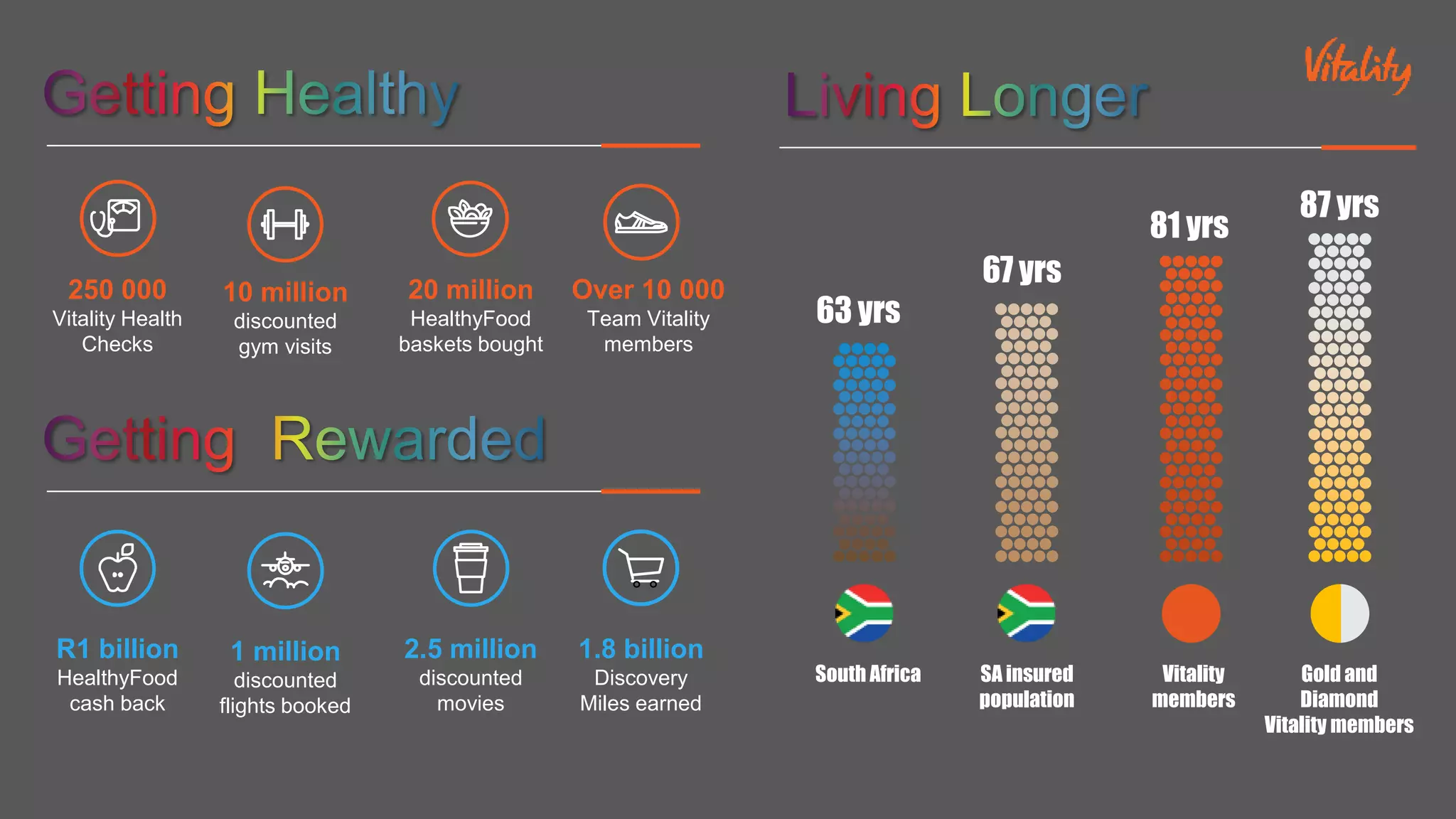

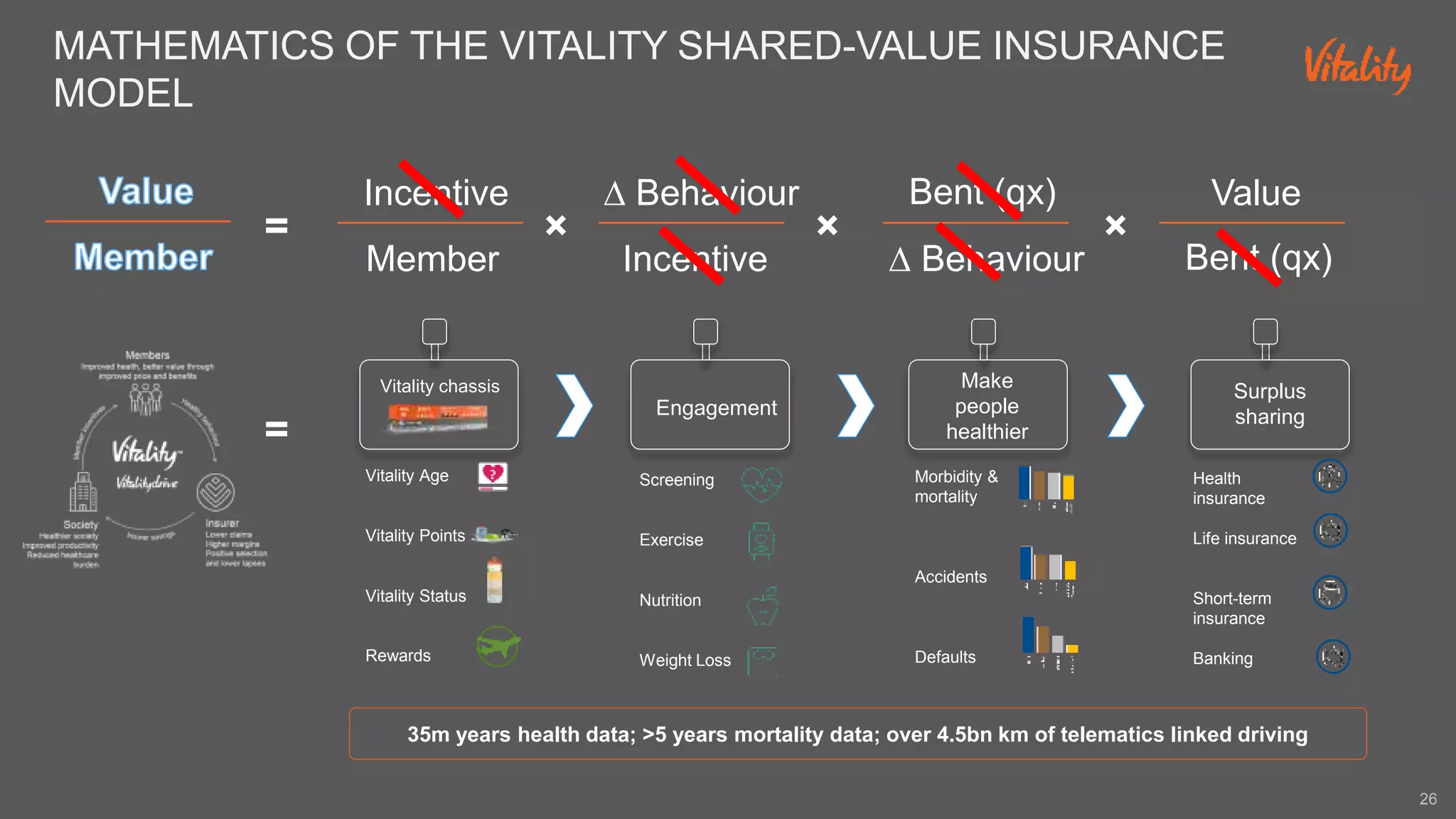

This document summarizes a webinar on data and analytics from an insurance perspective. It includes presentations from experts at KPMG, AEGON, Quealth, and Vitality Life on how insurers can build data and analytics capabilities. Vitality Life's presentation discusses how it uses data from customer health activities and biometrics to offer incentives, resulting in healthier customers and lower costs. The webinar concludes with a poll asking participants about their organization's current data and analytics programs.