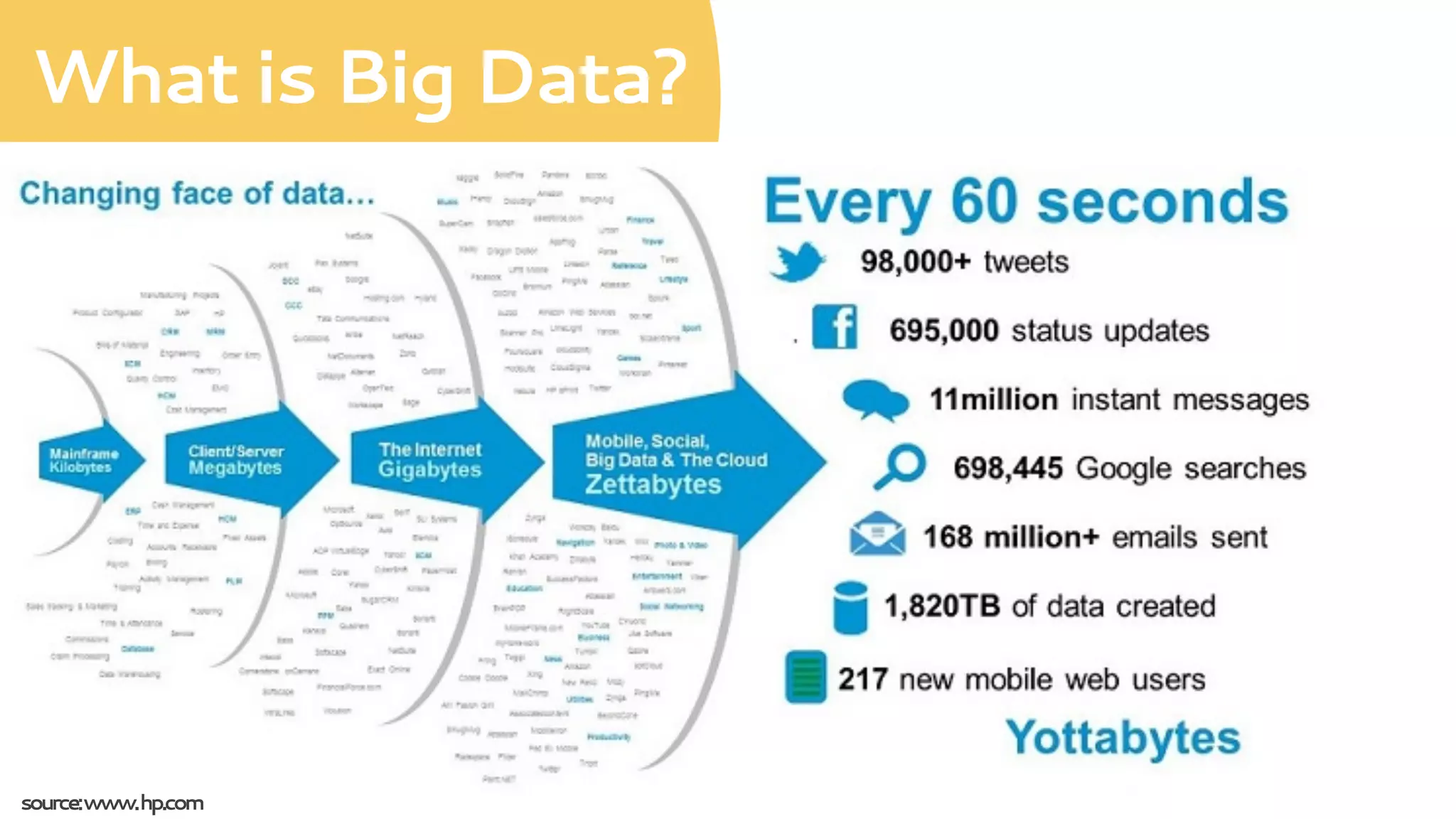

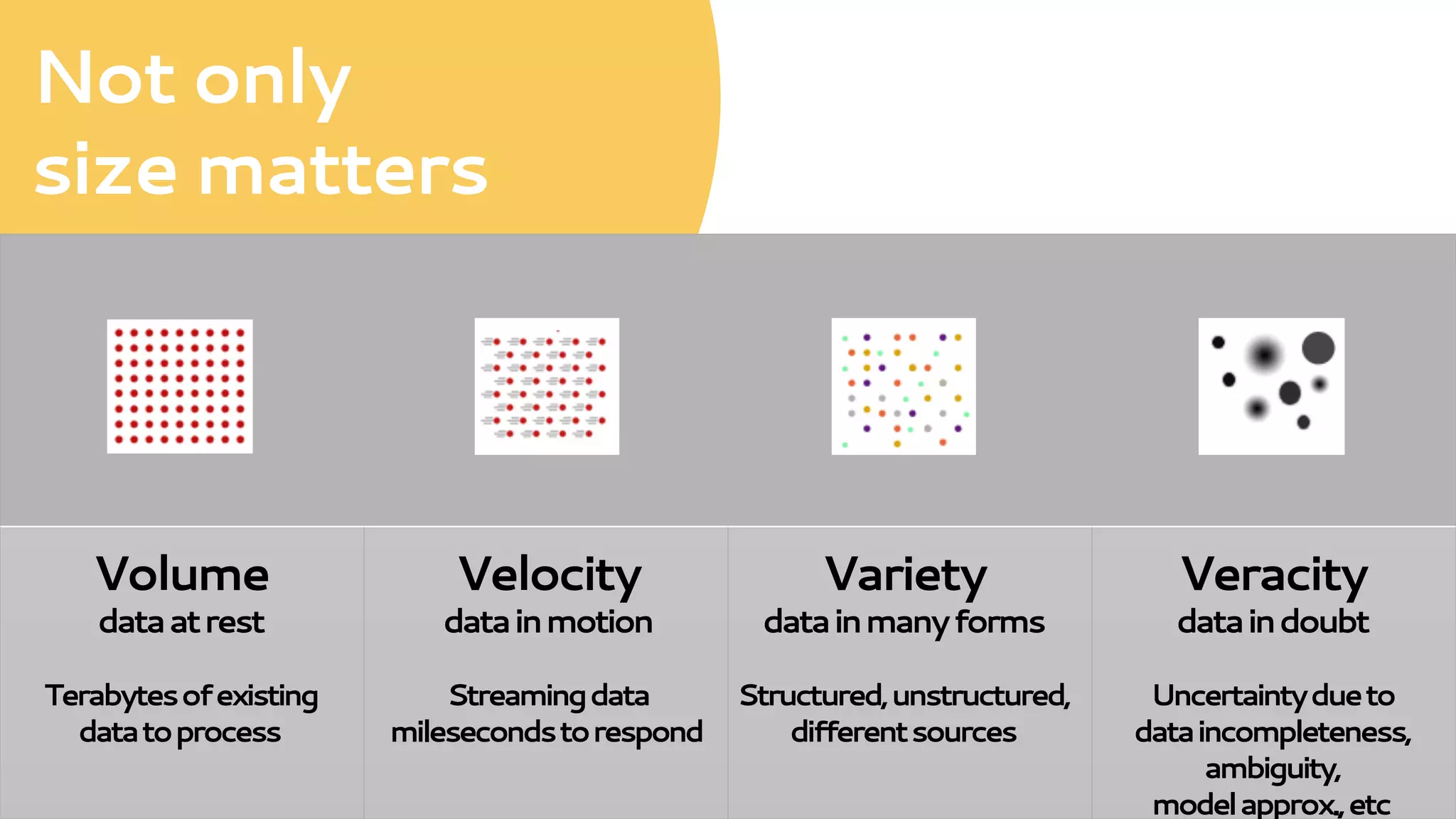

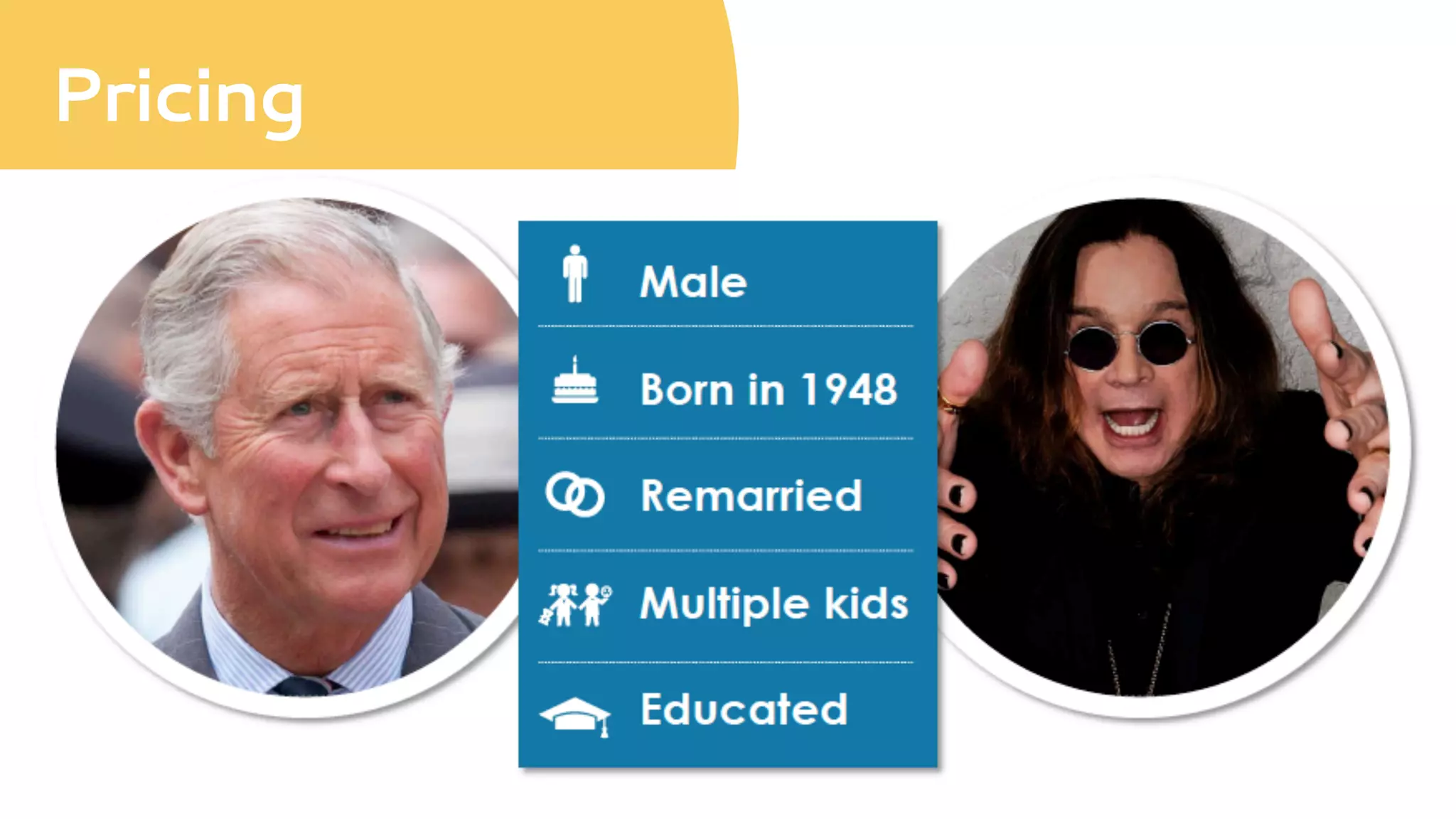

The document discusses the impact of big data on the insurance sector and the actuarial profession, emphasizing the need for education and the adoption of good practices in handling big data. It outlines how big data can enhance underwriting processes, pricing strategies, and claims management while addressing challenges like fraud detection. Additionally, it highlights the growing importance of using analytics and innovative technologies to improve customer satisfaction and operational efficiency in insurance.