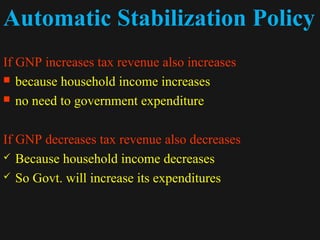

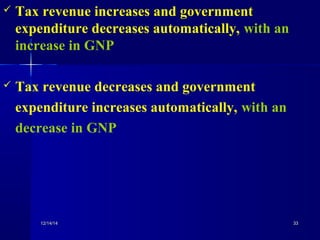

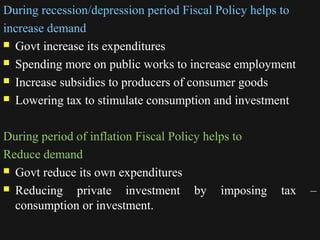

Fiscal policy involves the government making discretionary changes to taxation, expenditures, and borrowings to achieve macroeconomic goals. It is an essential tool for overcoming recessions and inflation as well as promoting economic growth. Fiscal policy instruments include changes to budget deficits or surpluses, the level and composition of government expenditures, taxation levels and types, public debt, and deficit financing. The government uses these tools to target variables like disposable income, consumption, savings and investment to influence the overall economy.