Embed presentation

Downloaded 23 times

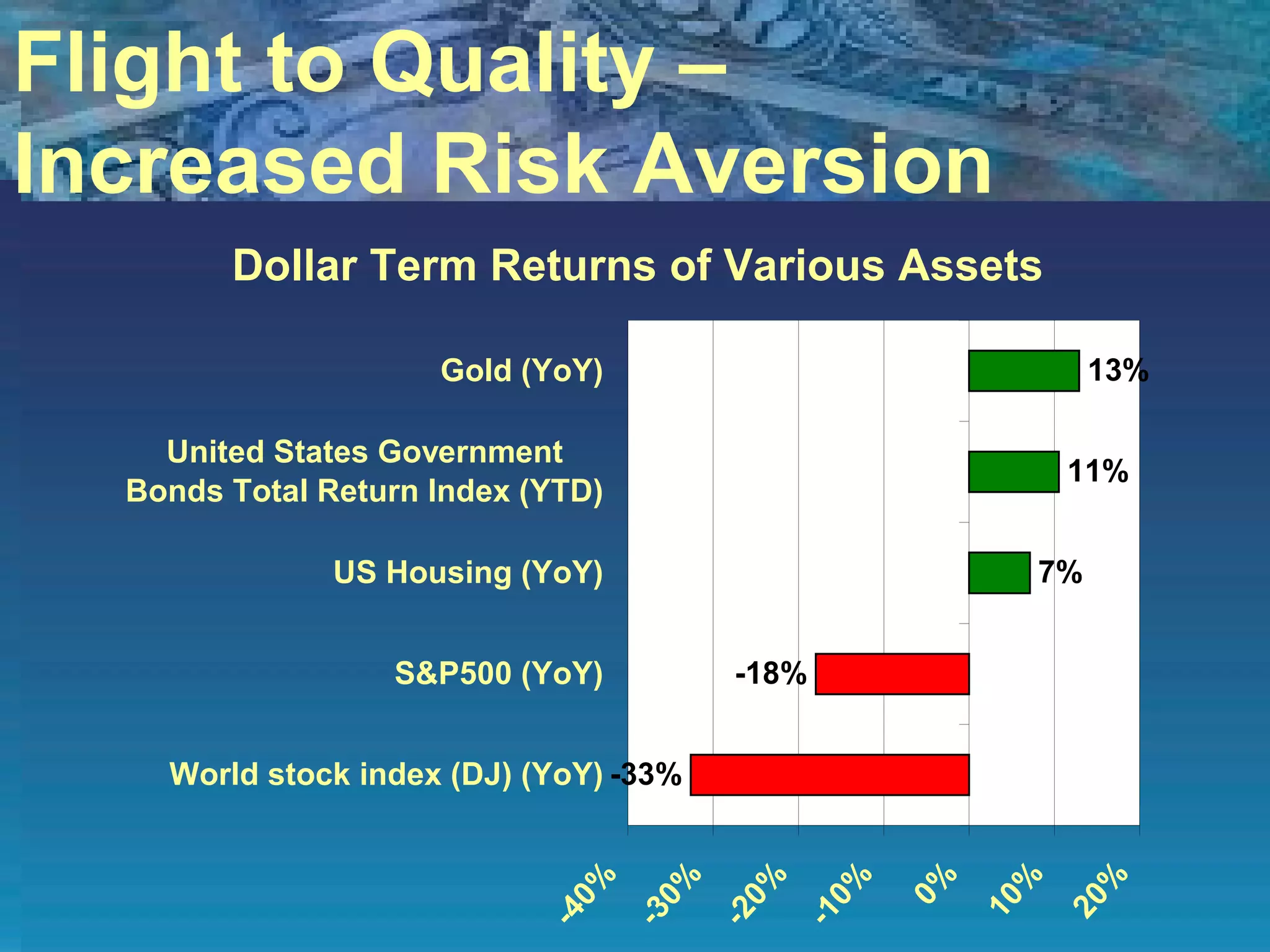

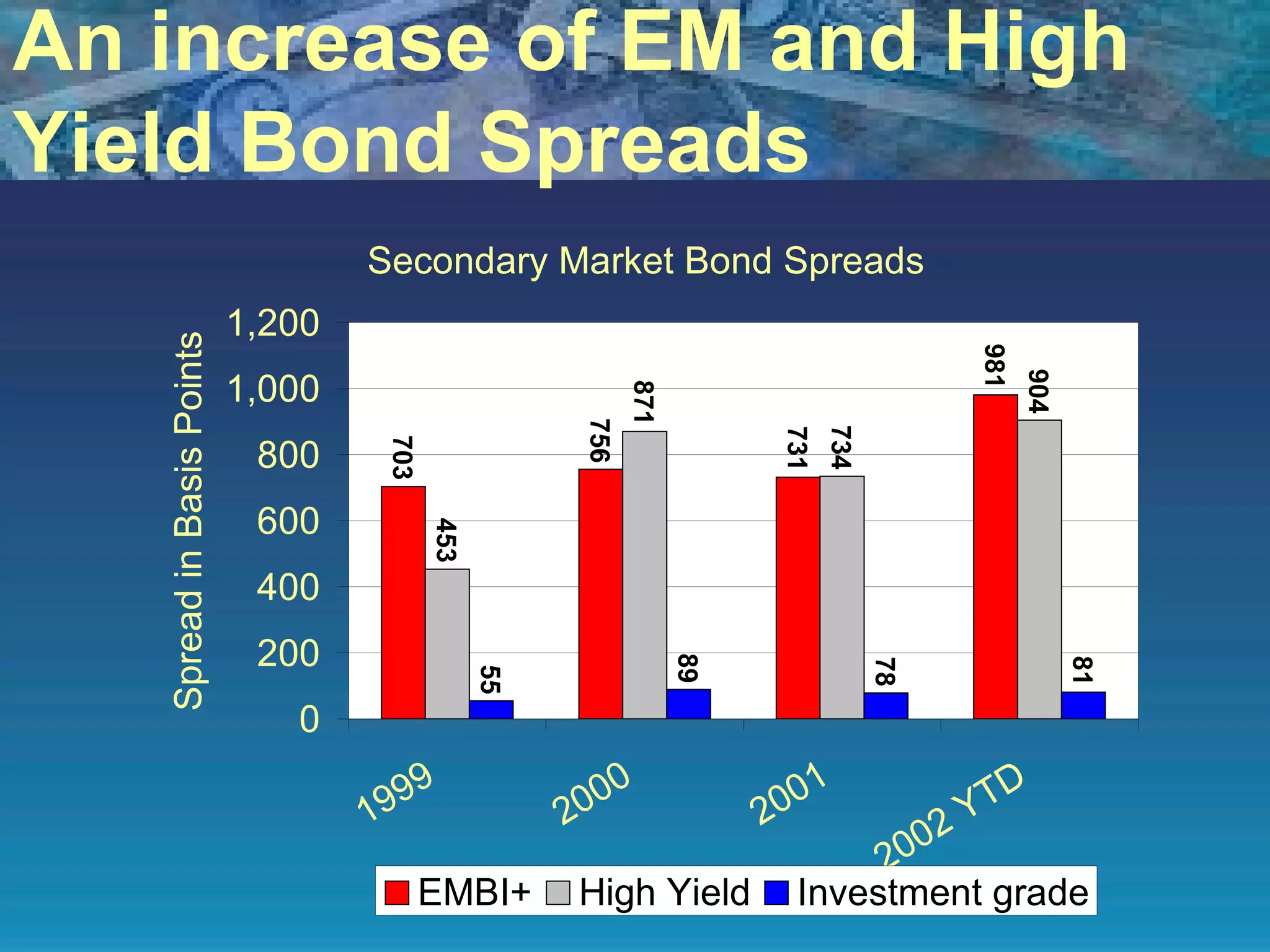

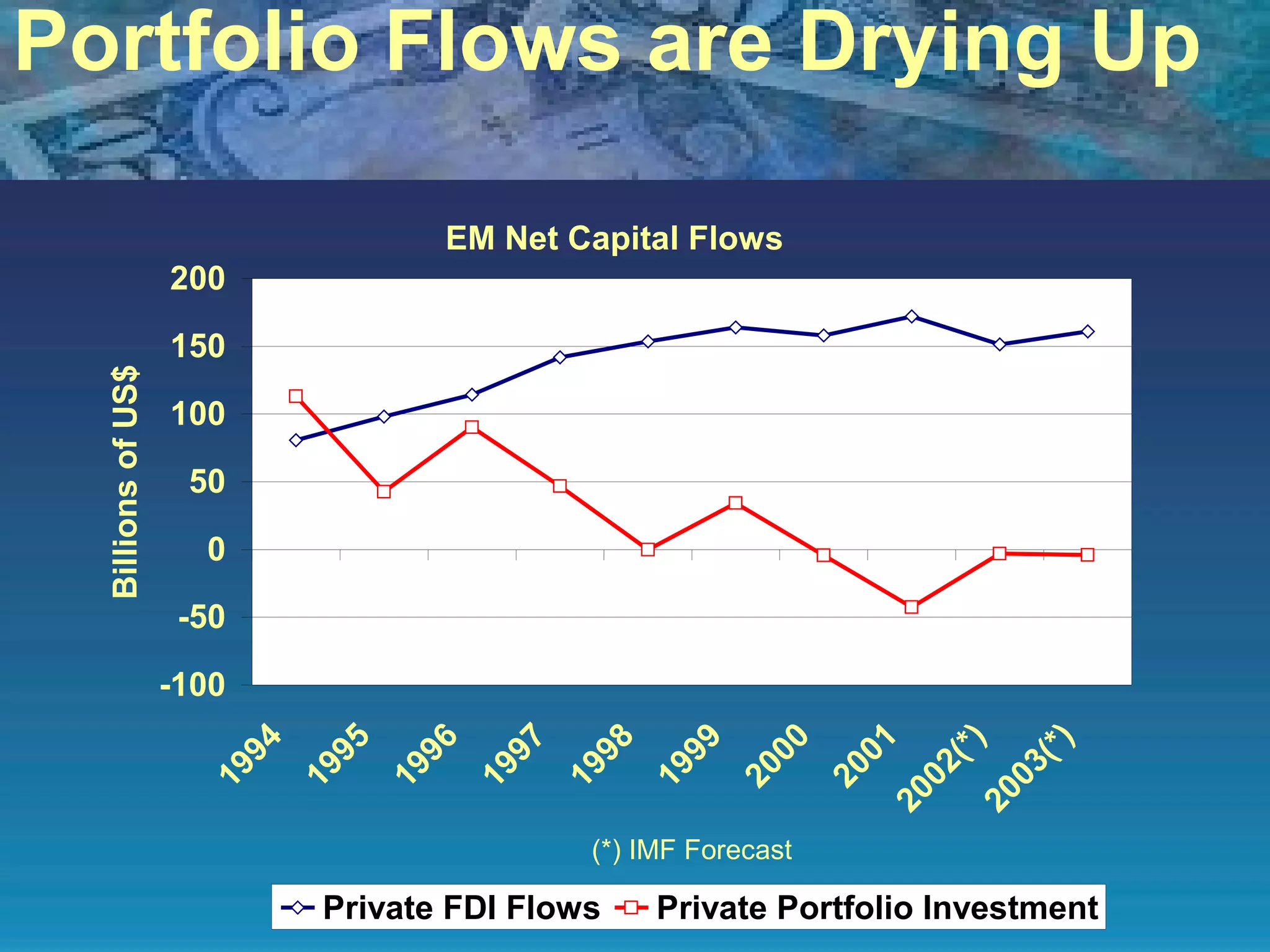

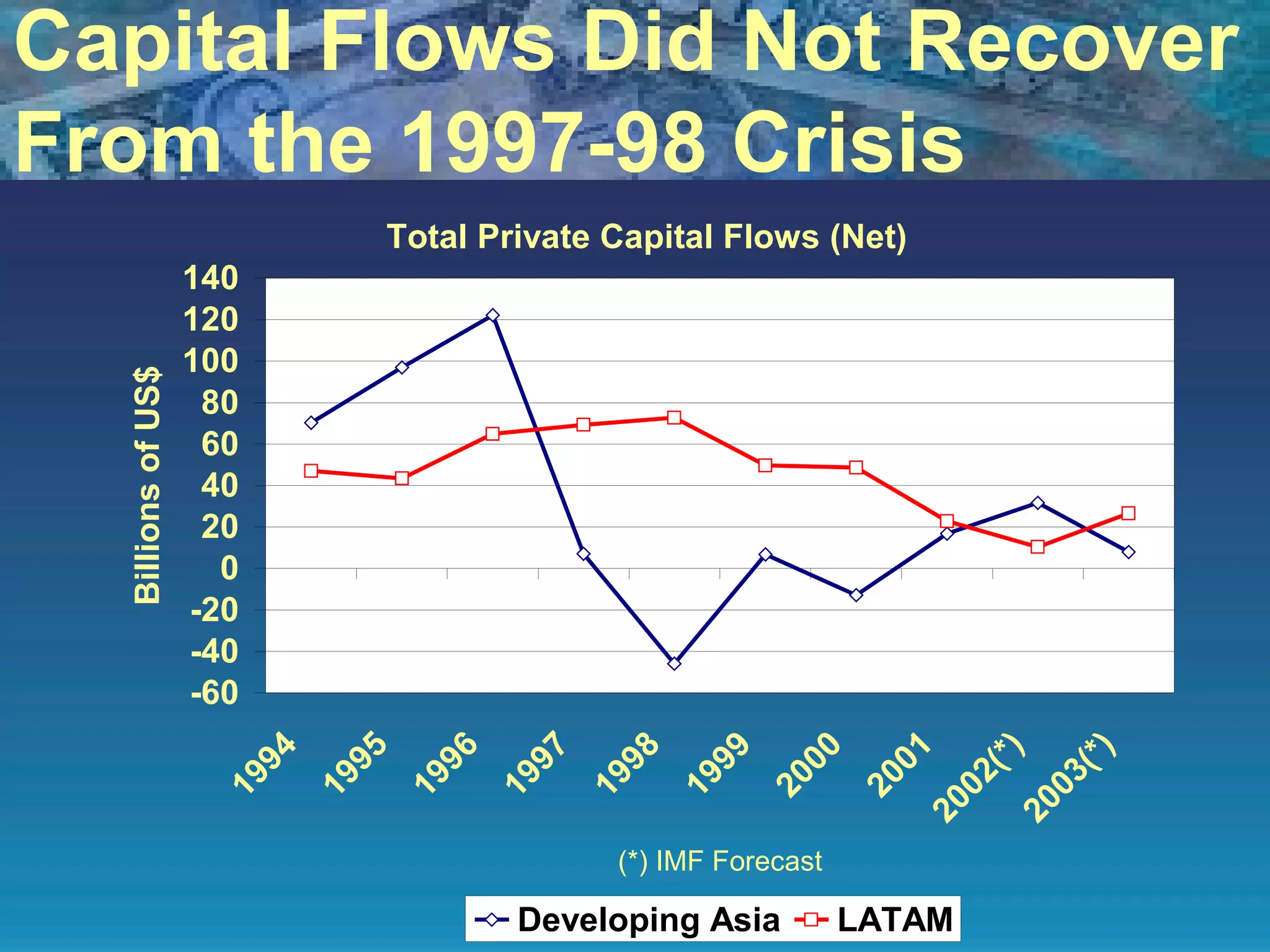

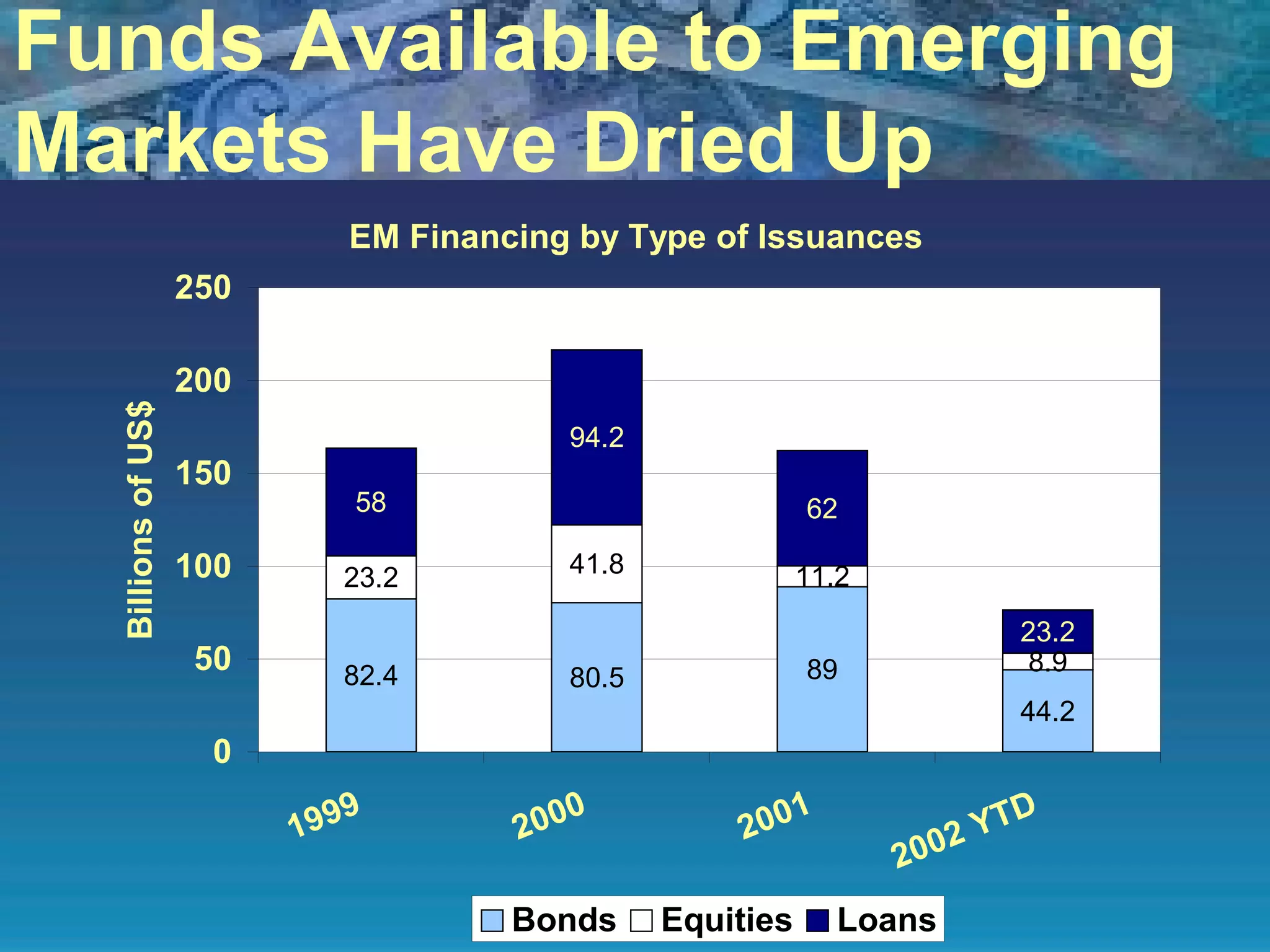

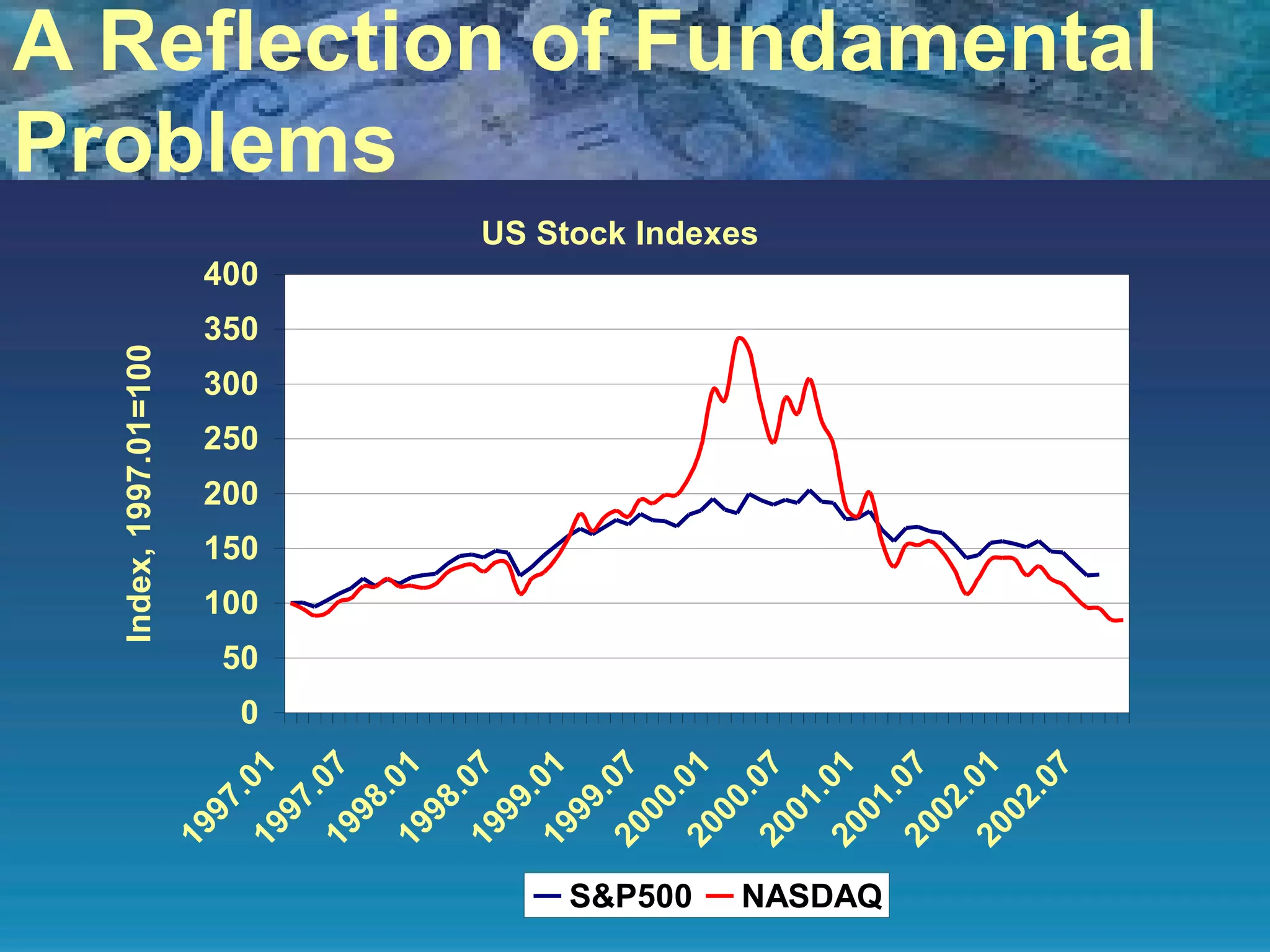

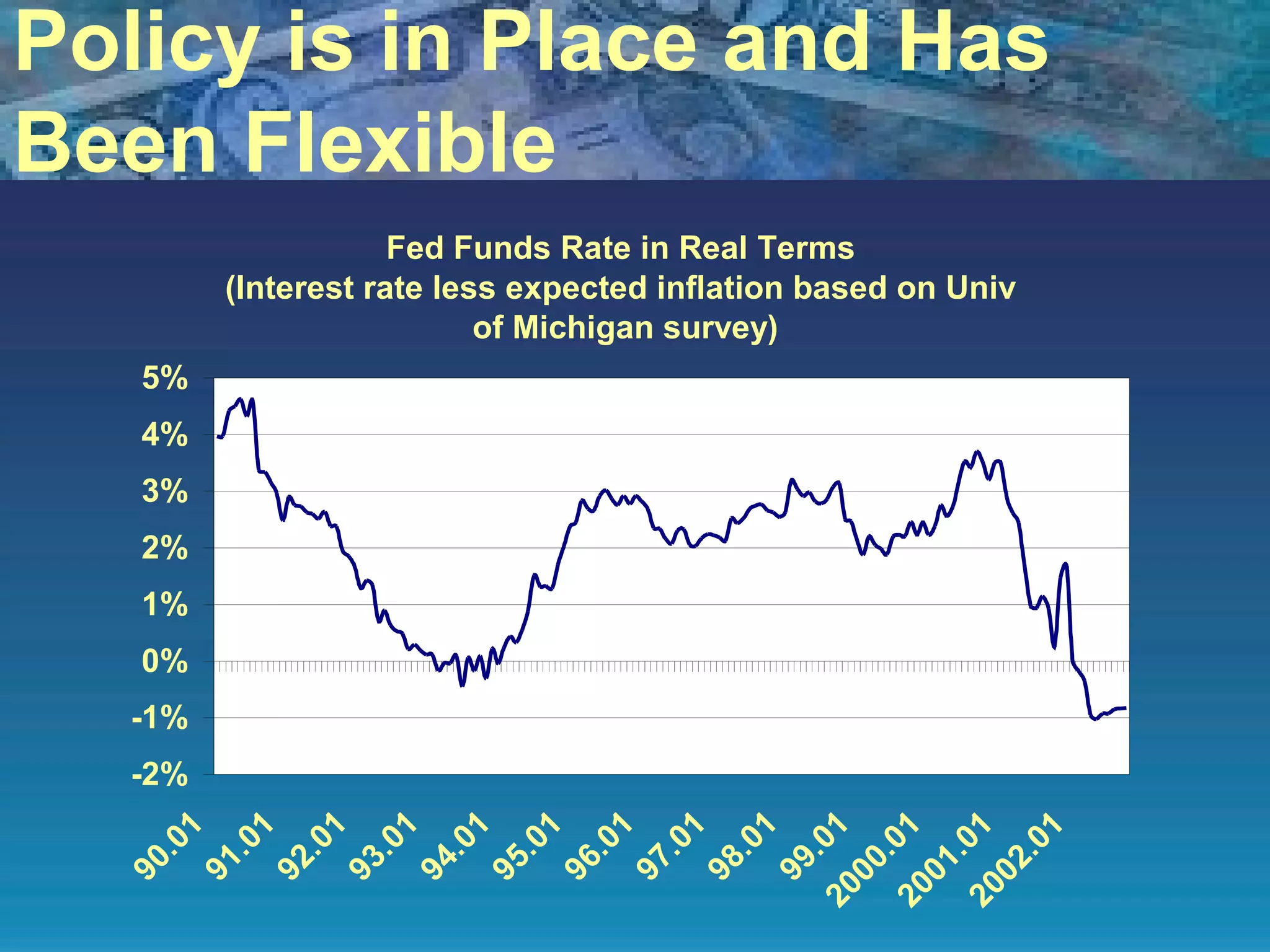

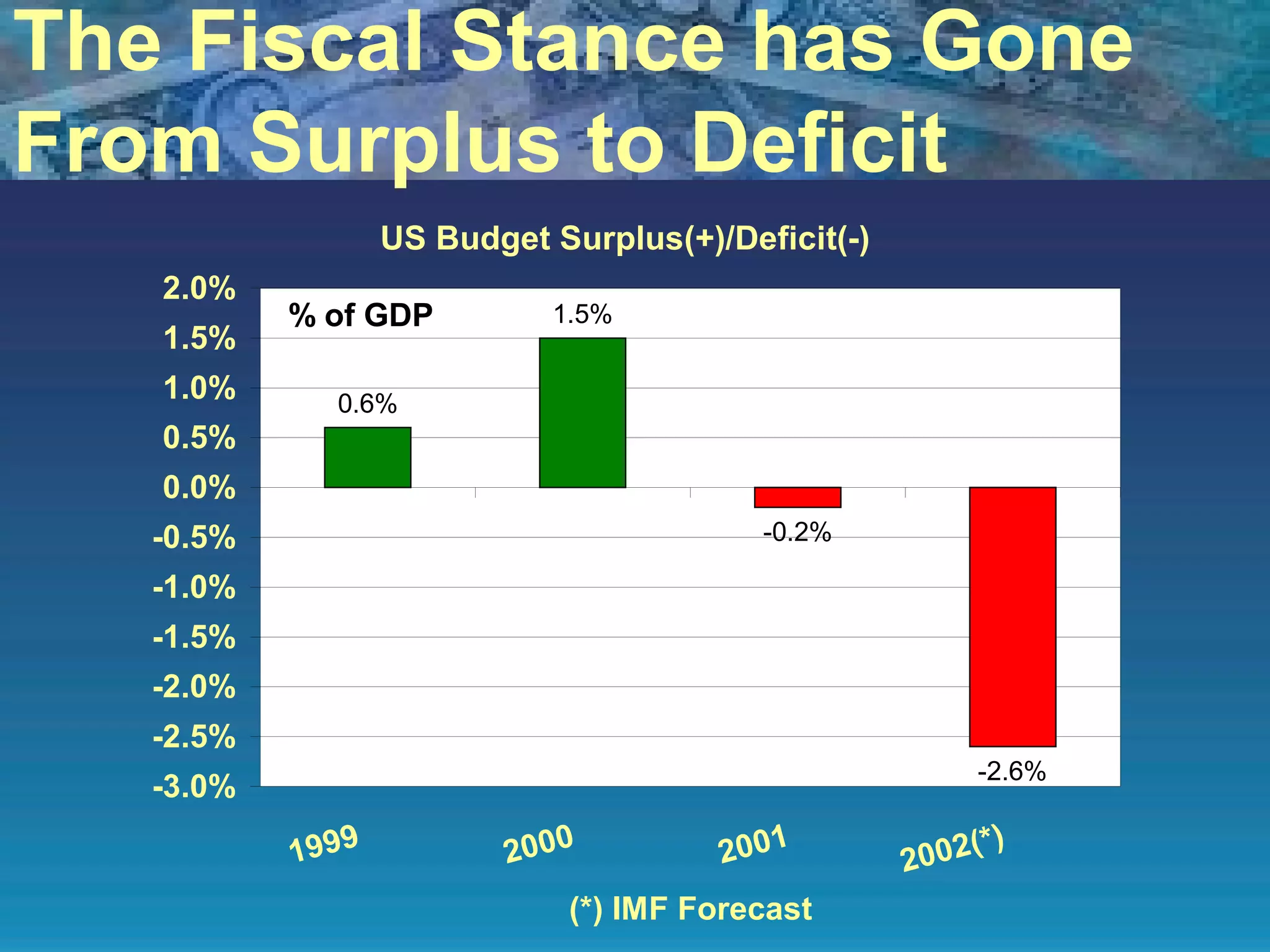

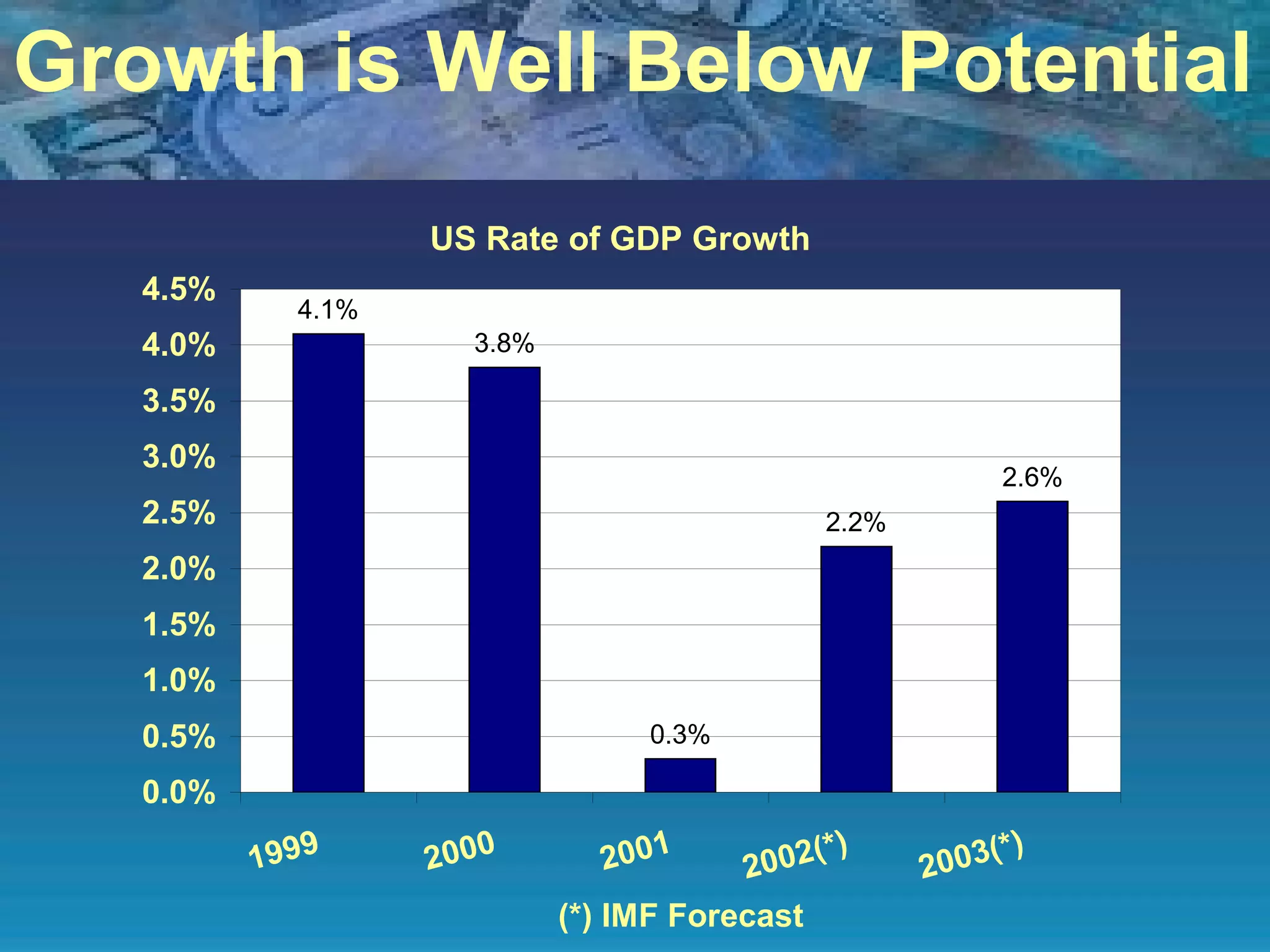

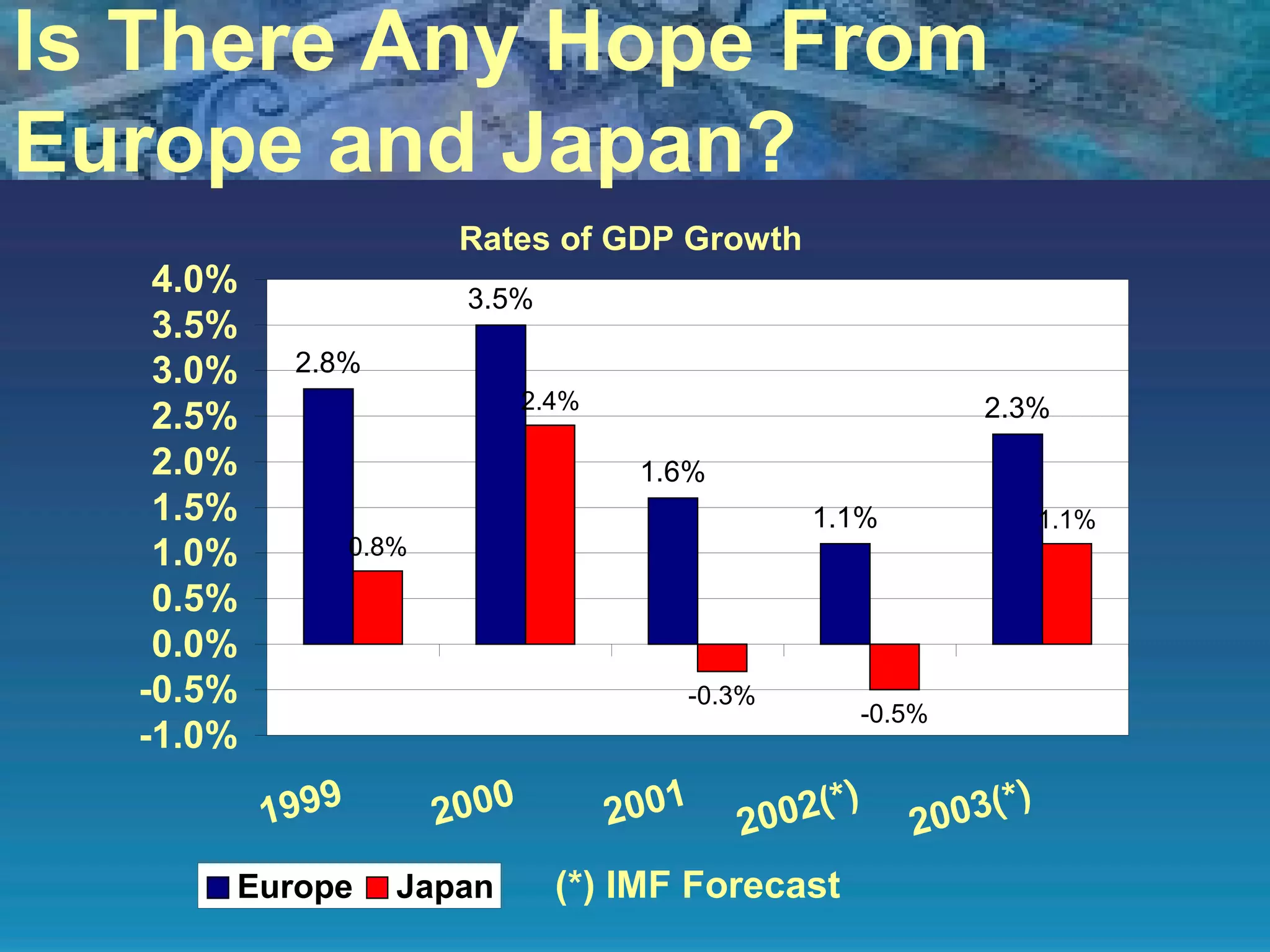

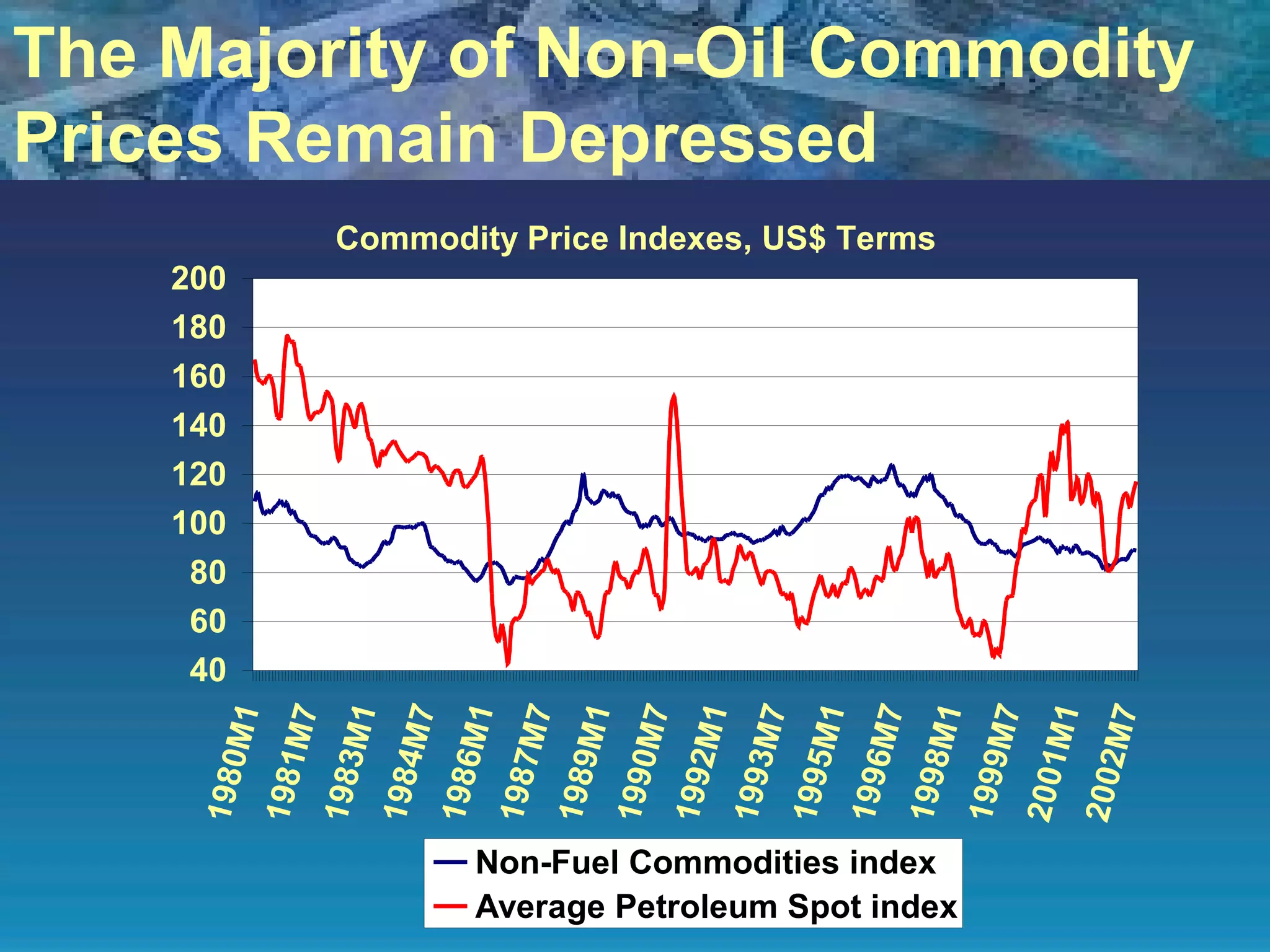

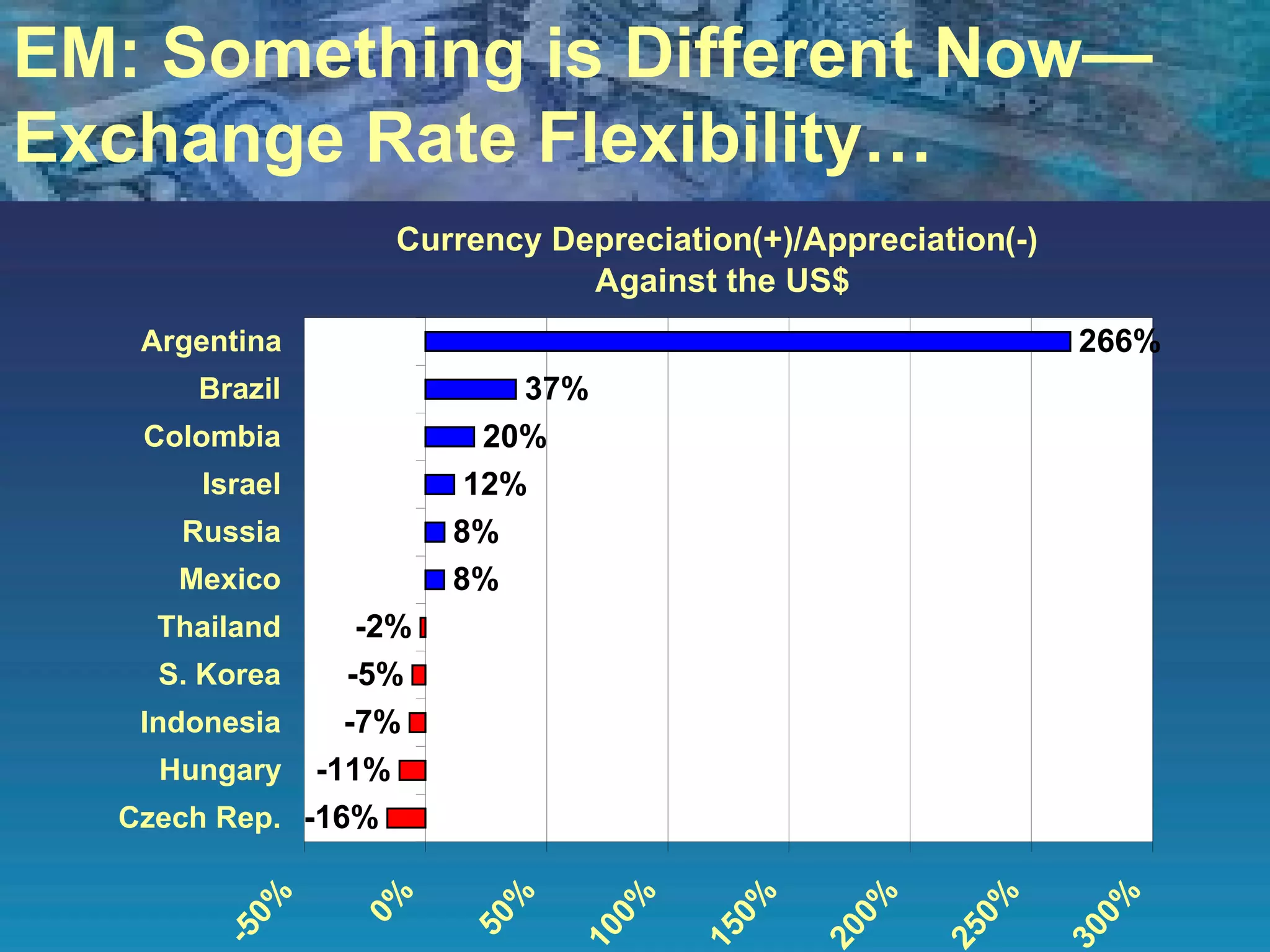

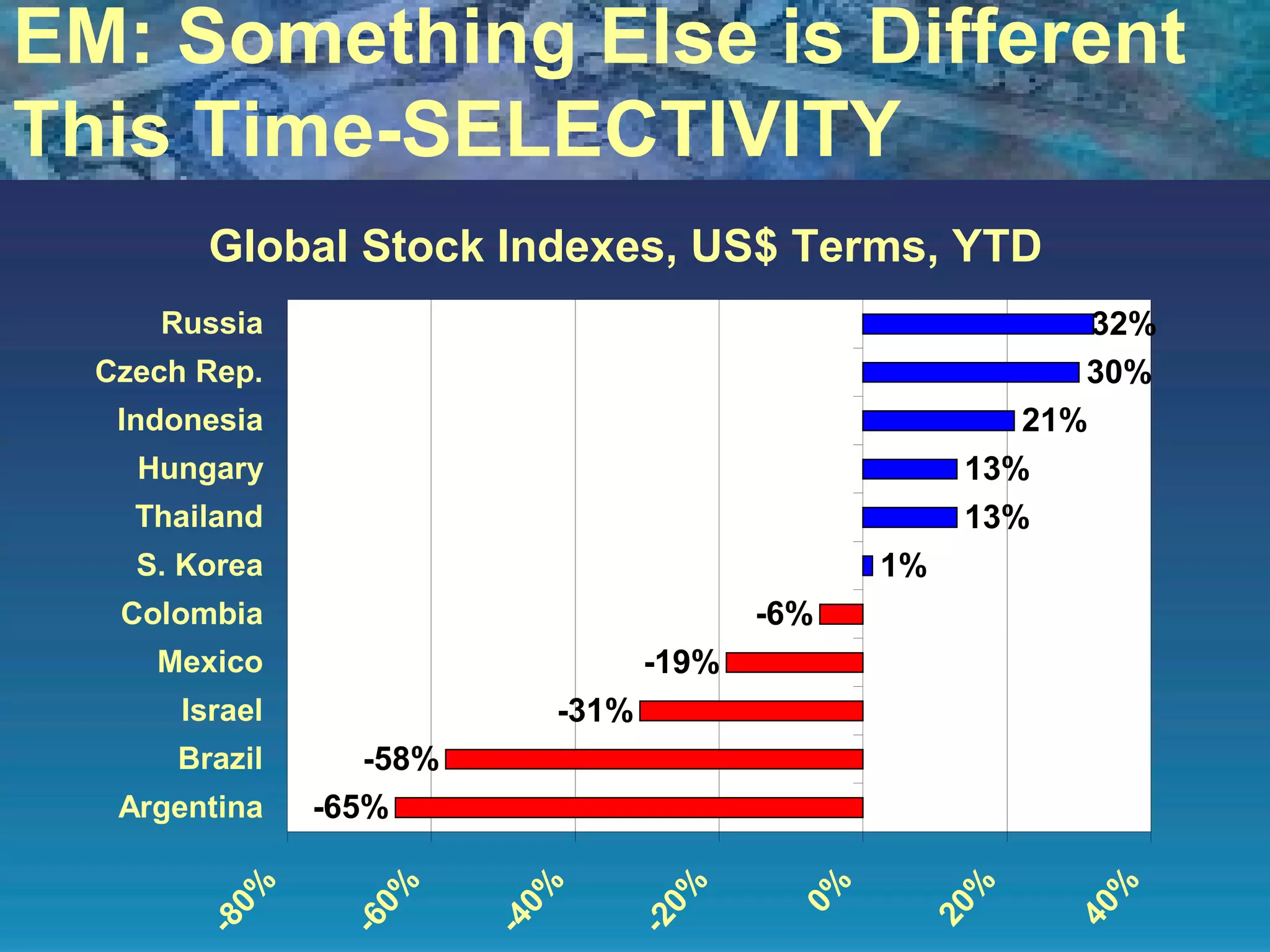

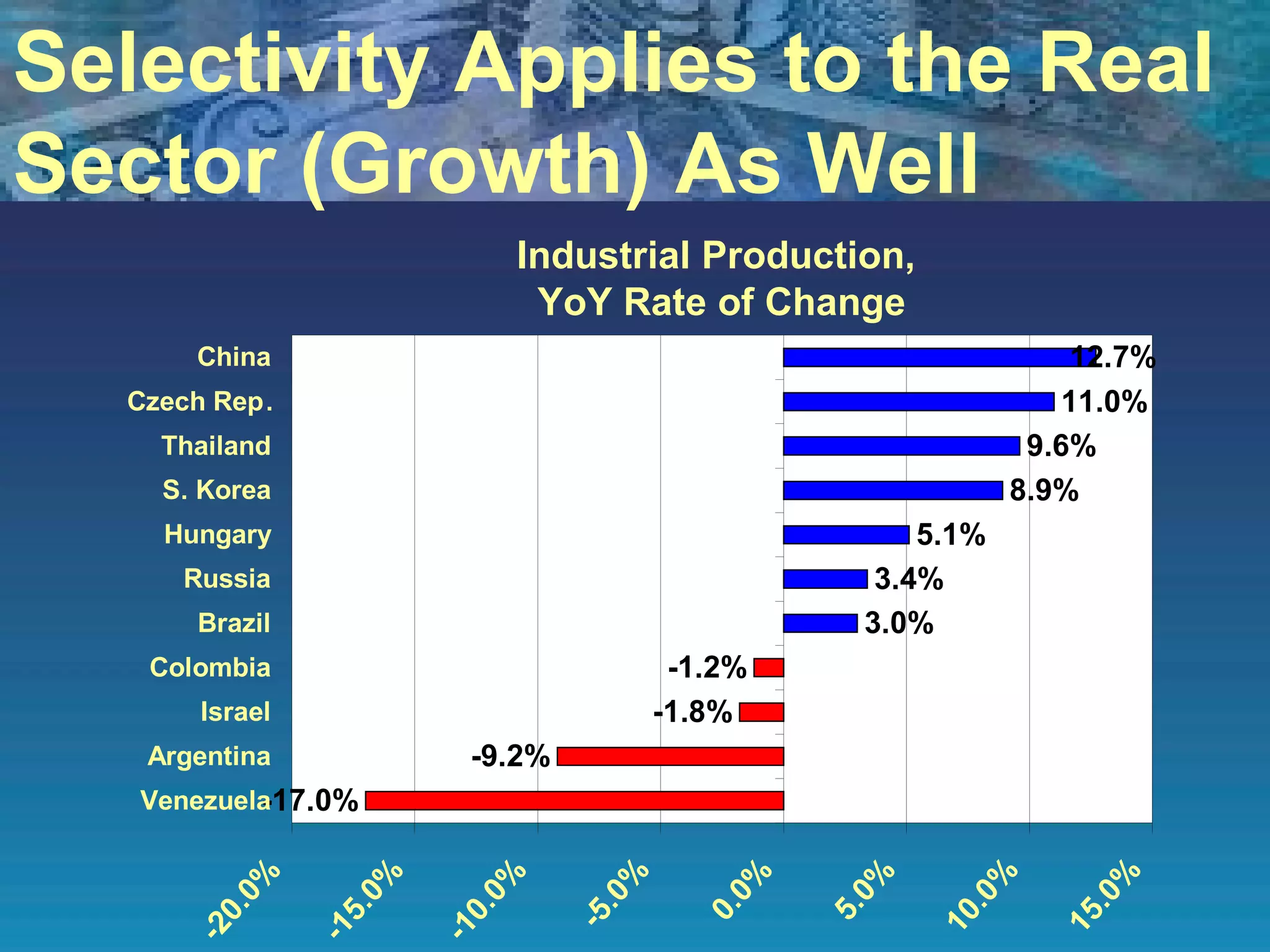

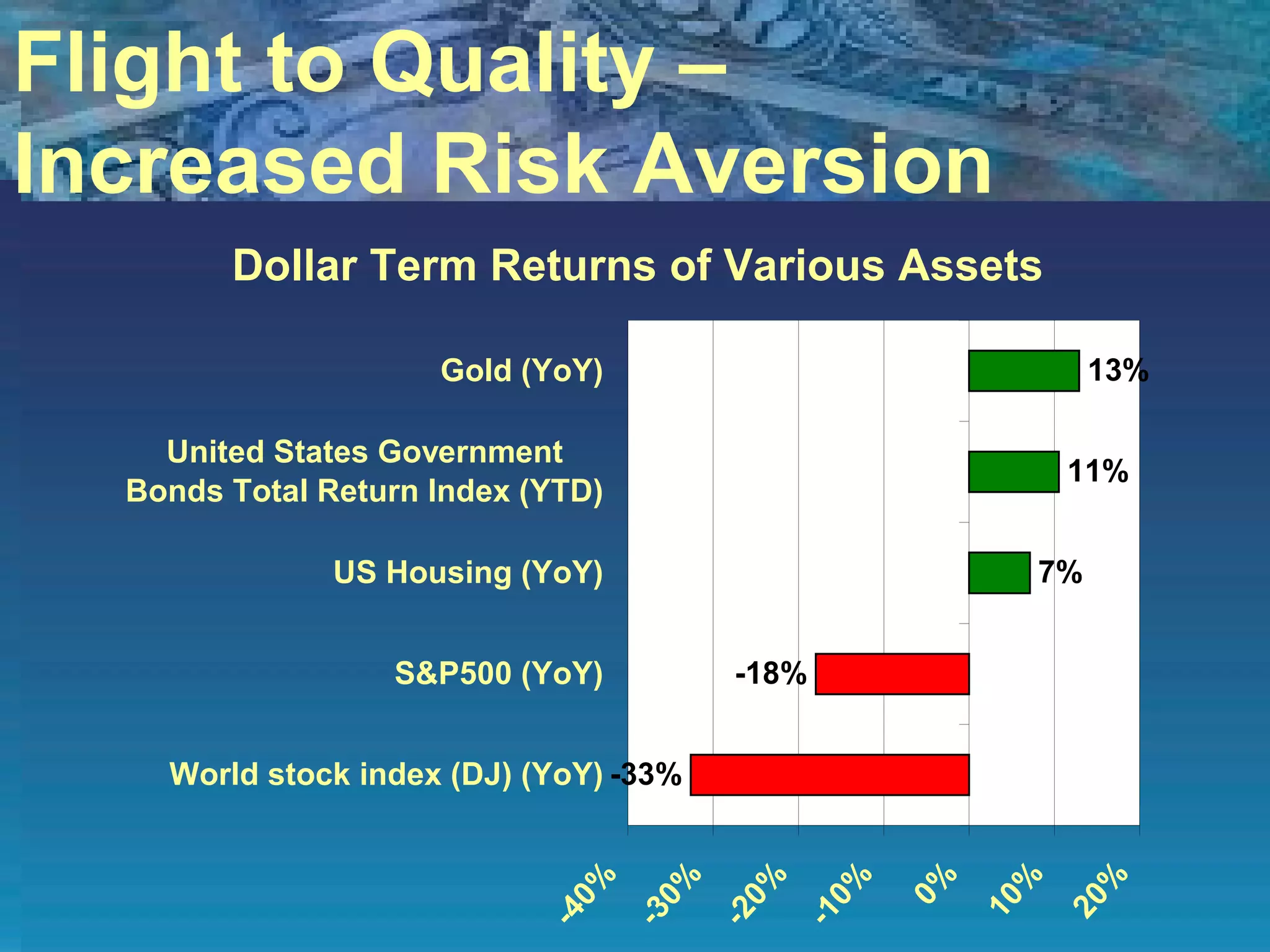

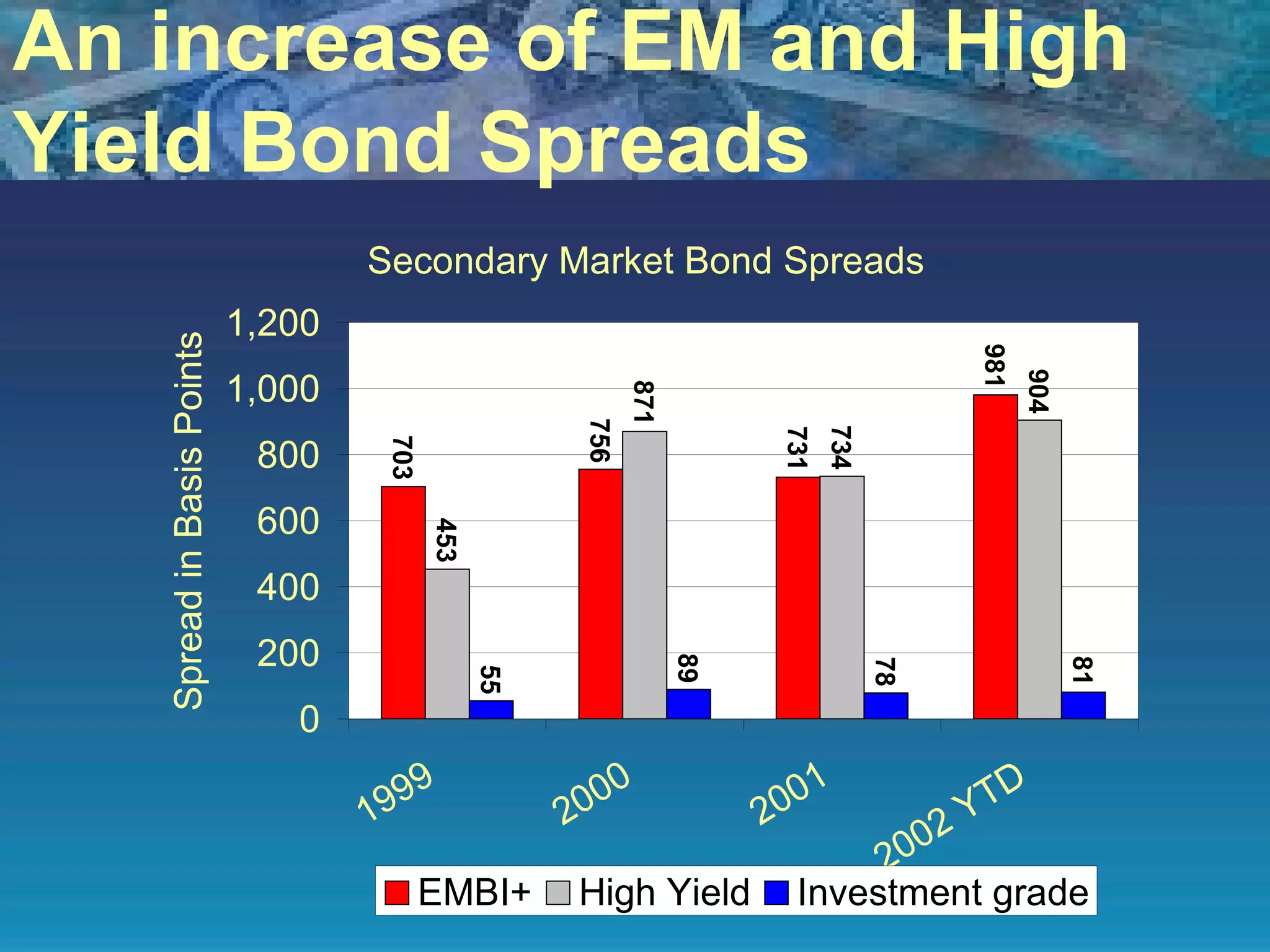

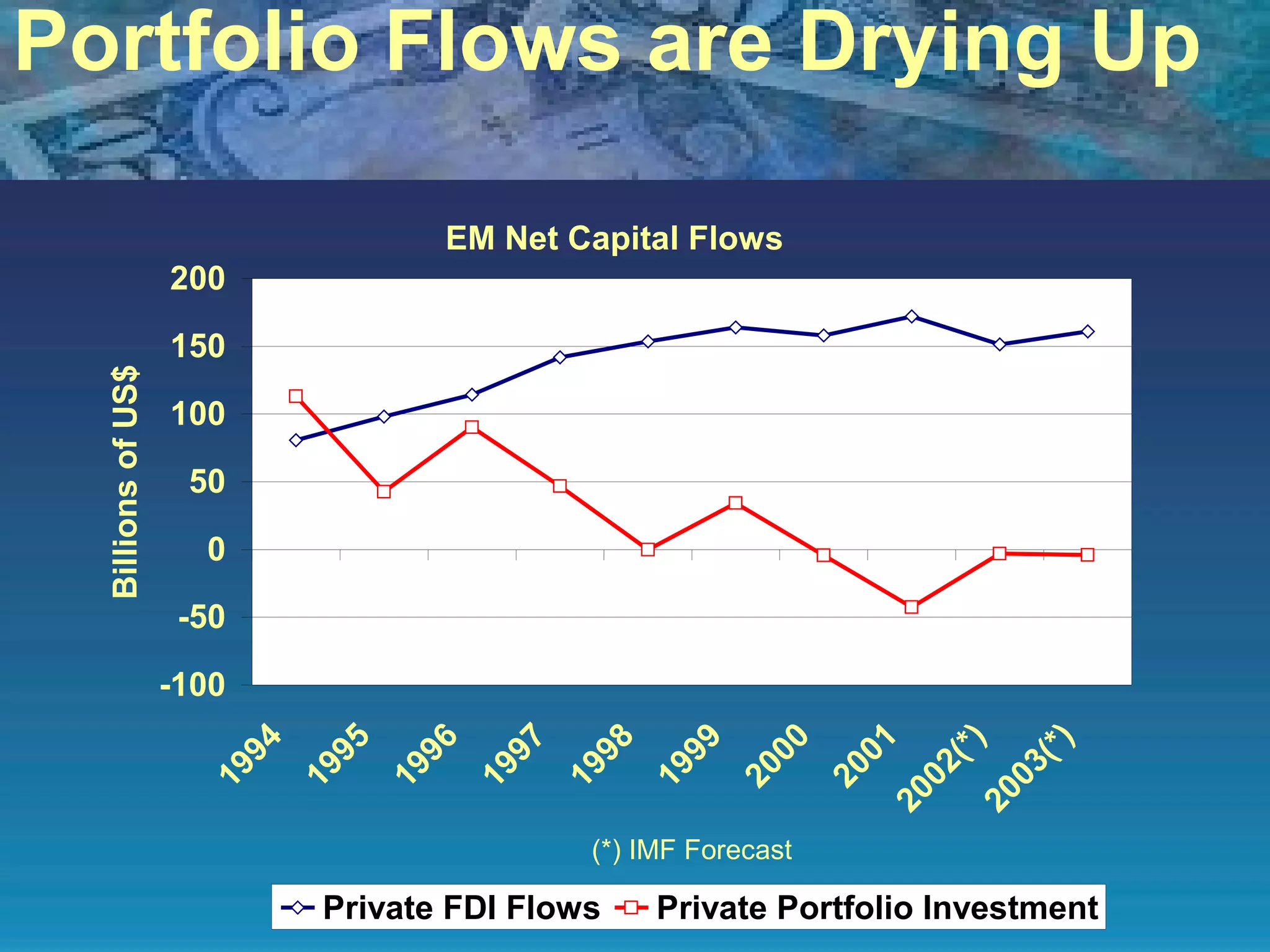

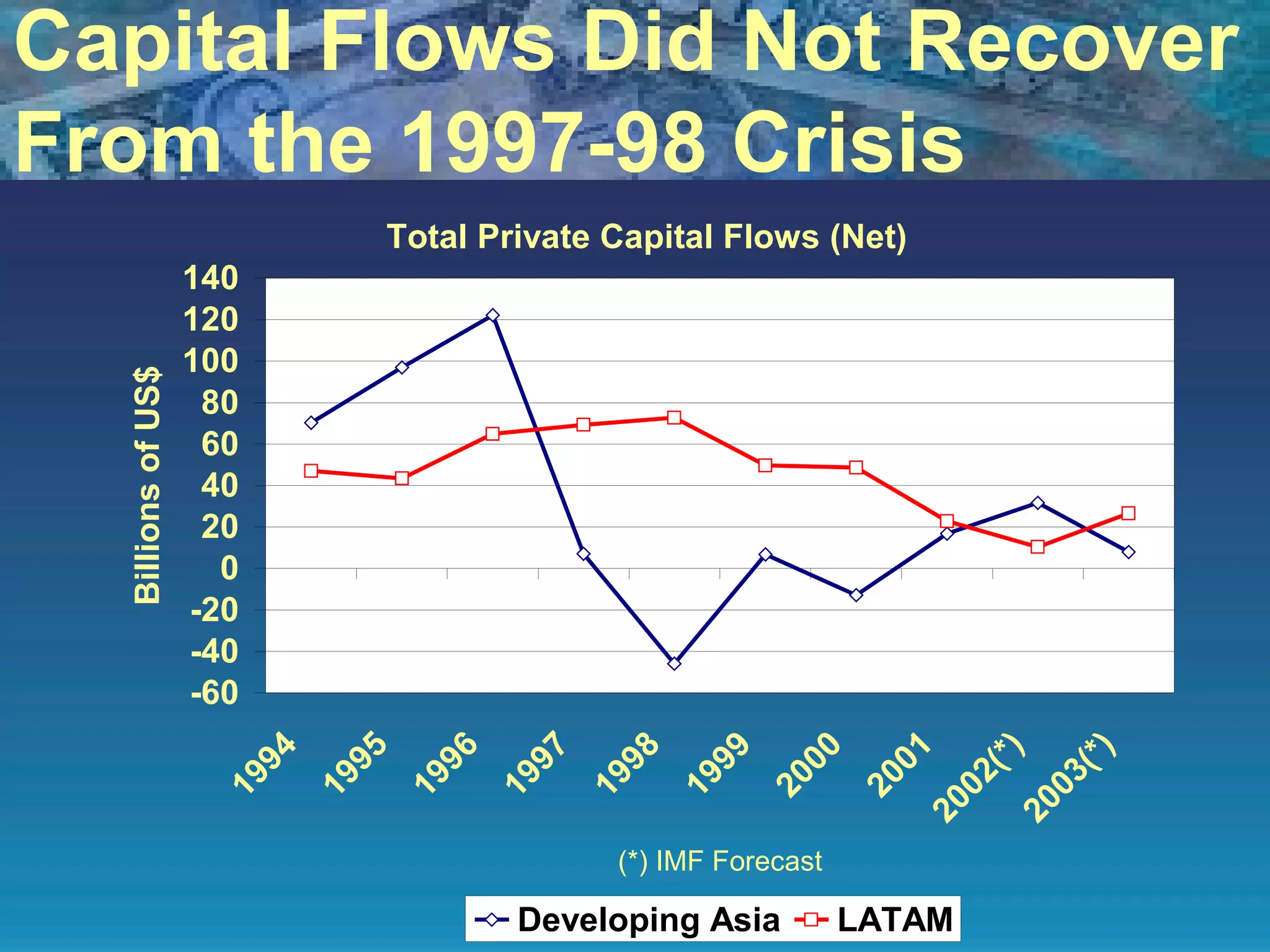

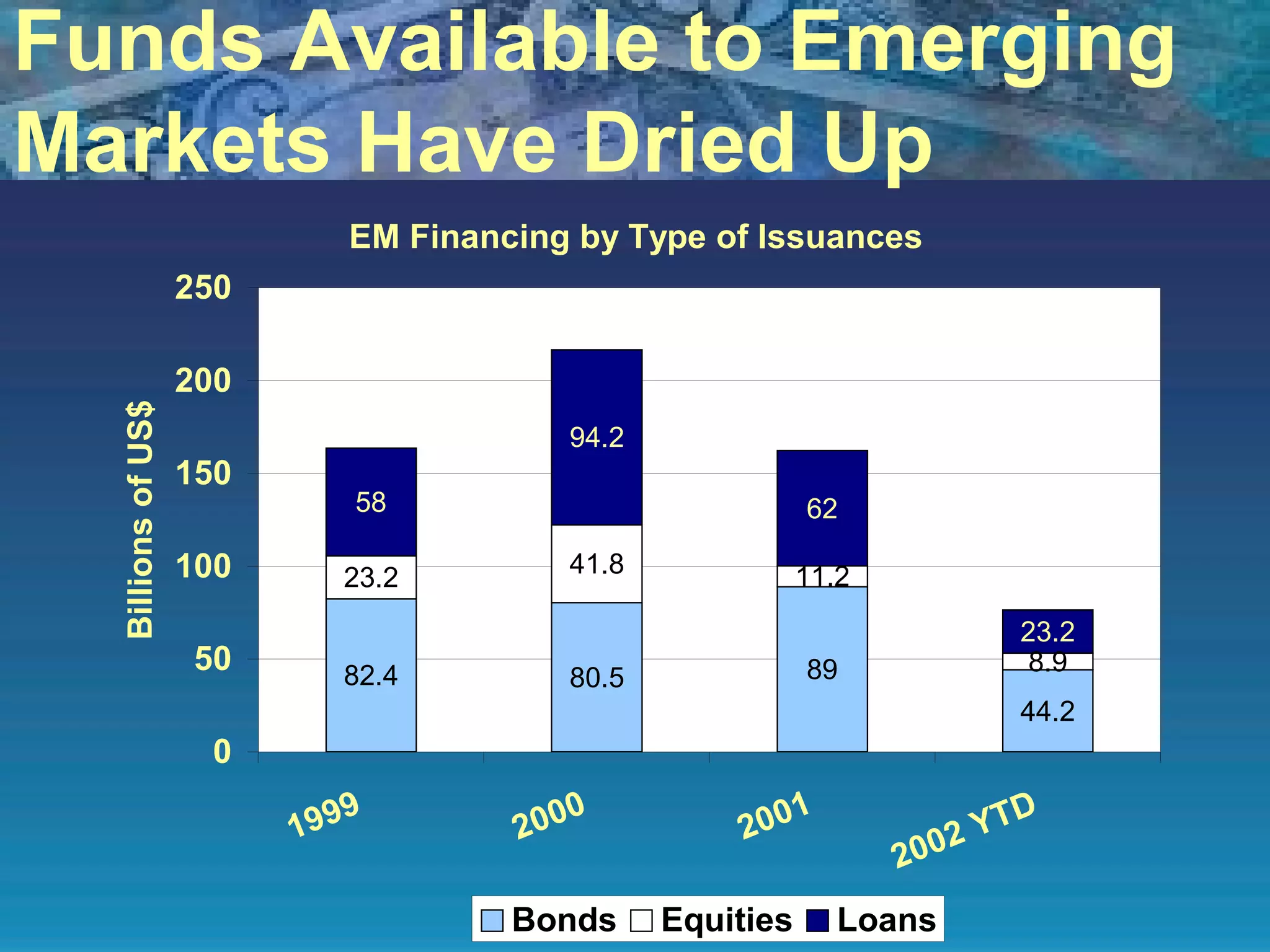

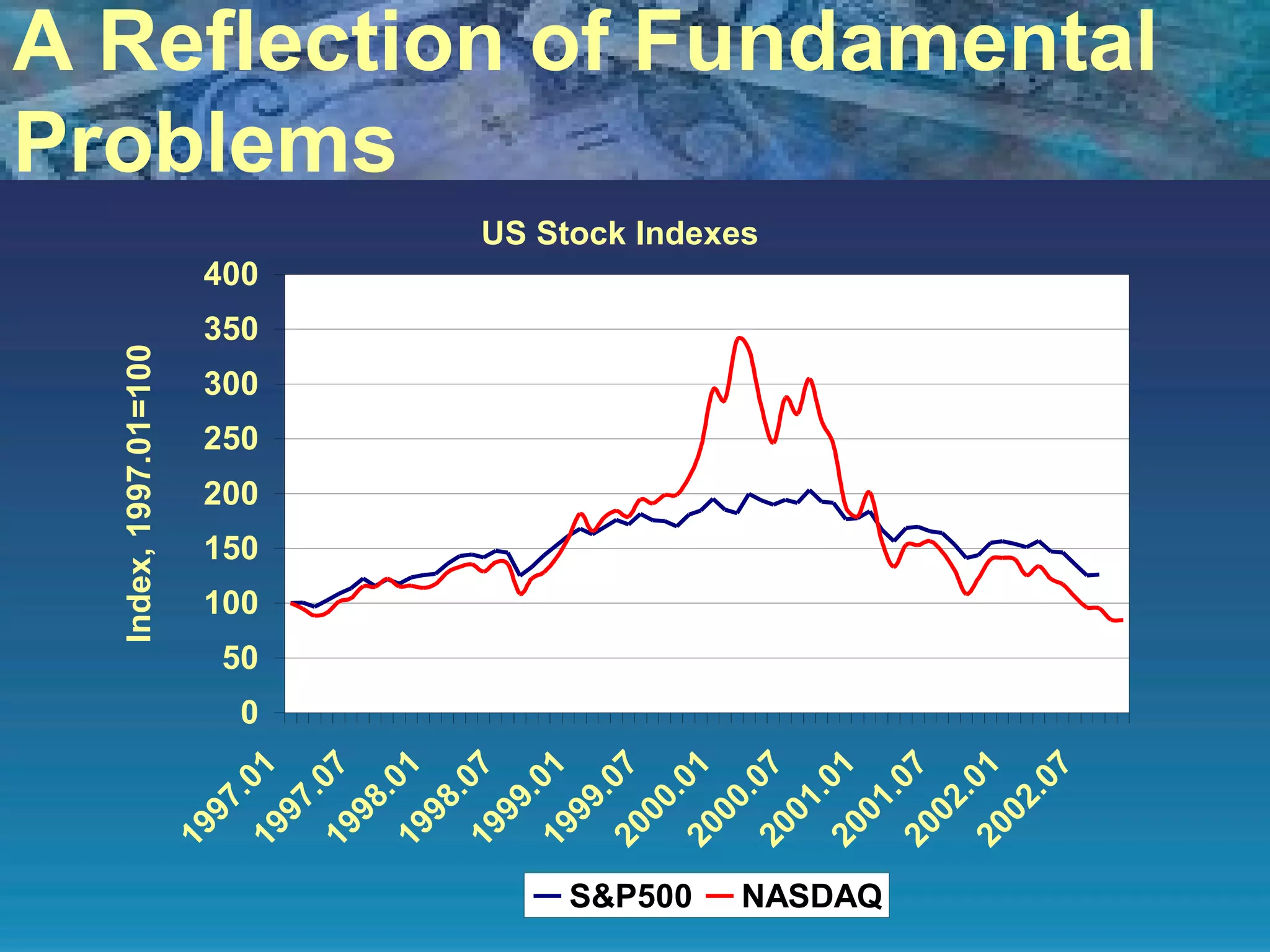

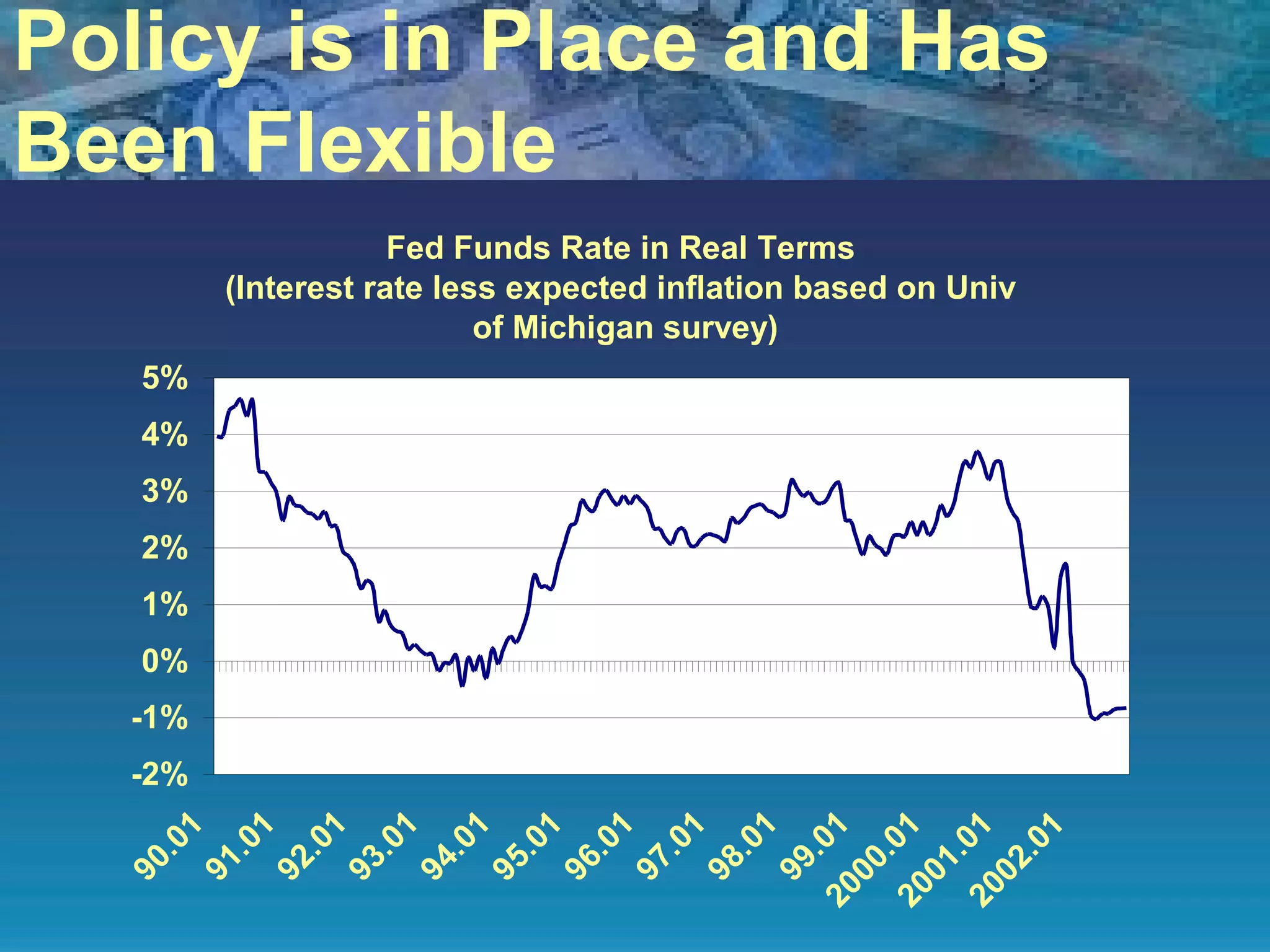

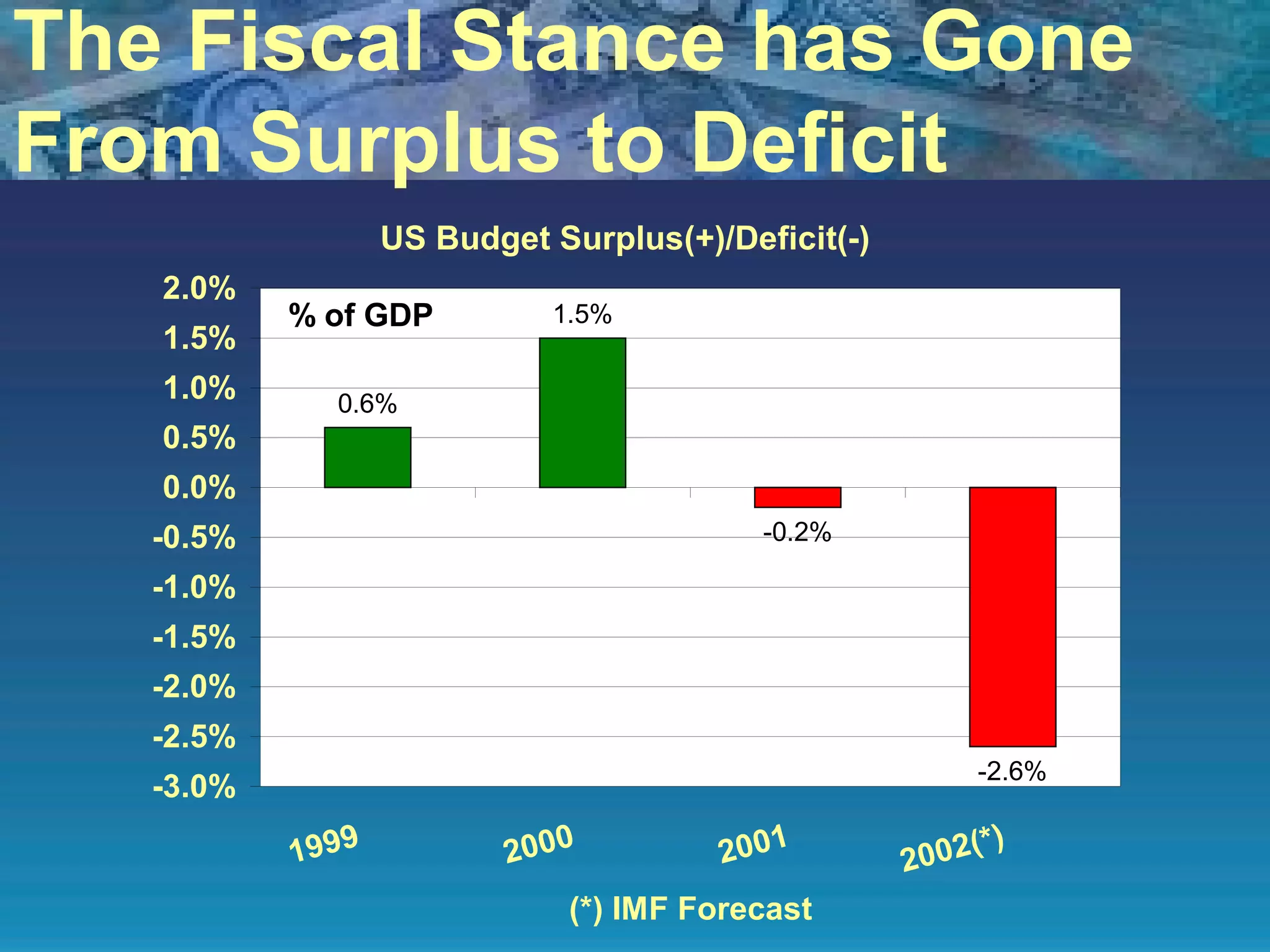

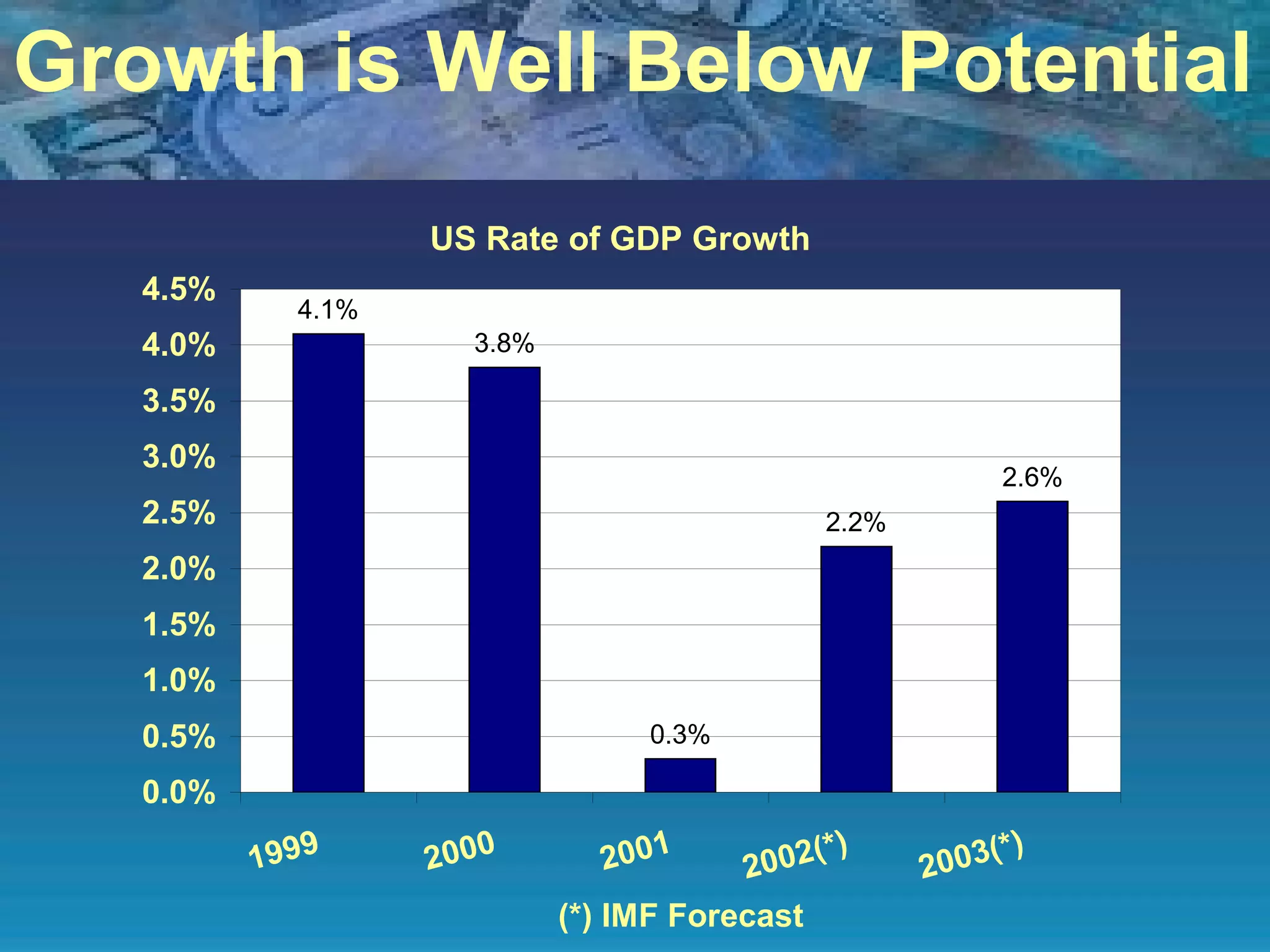

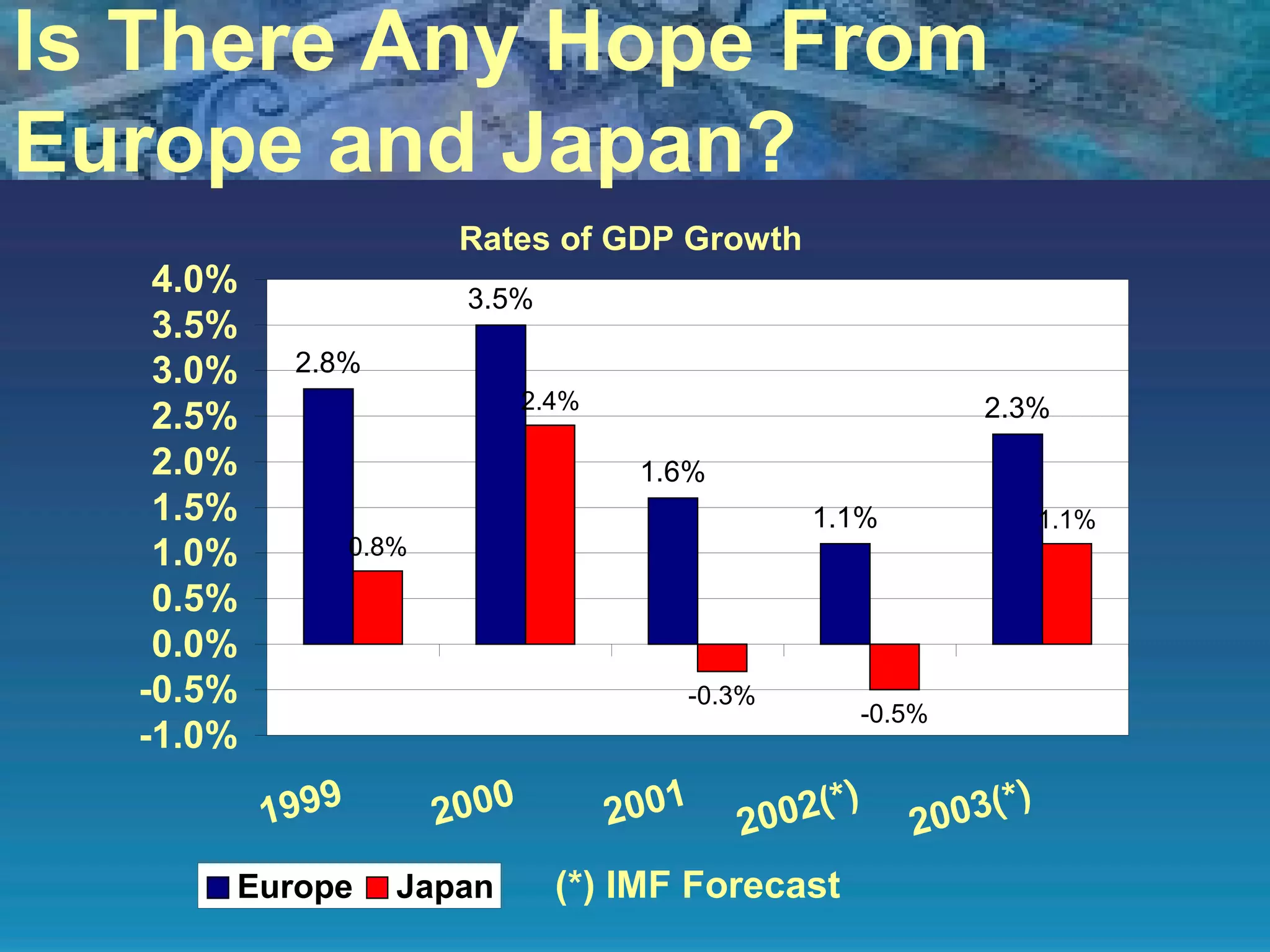

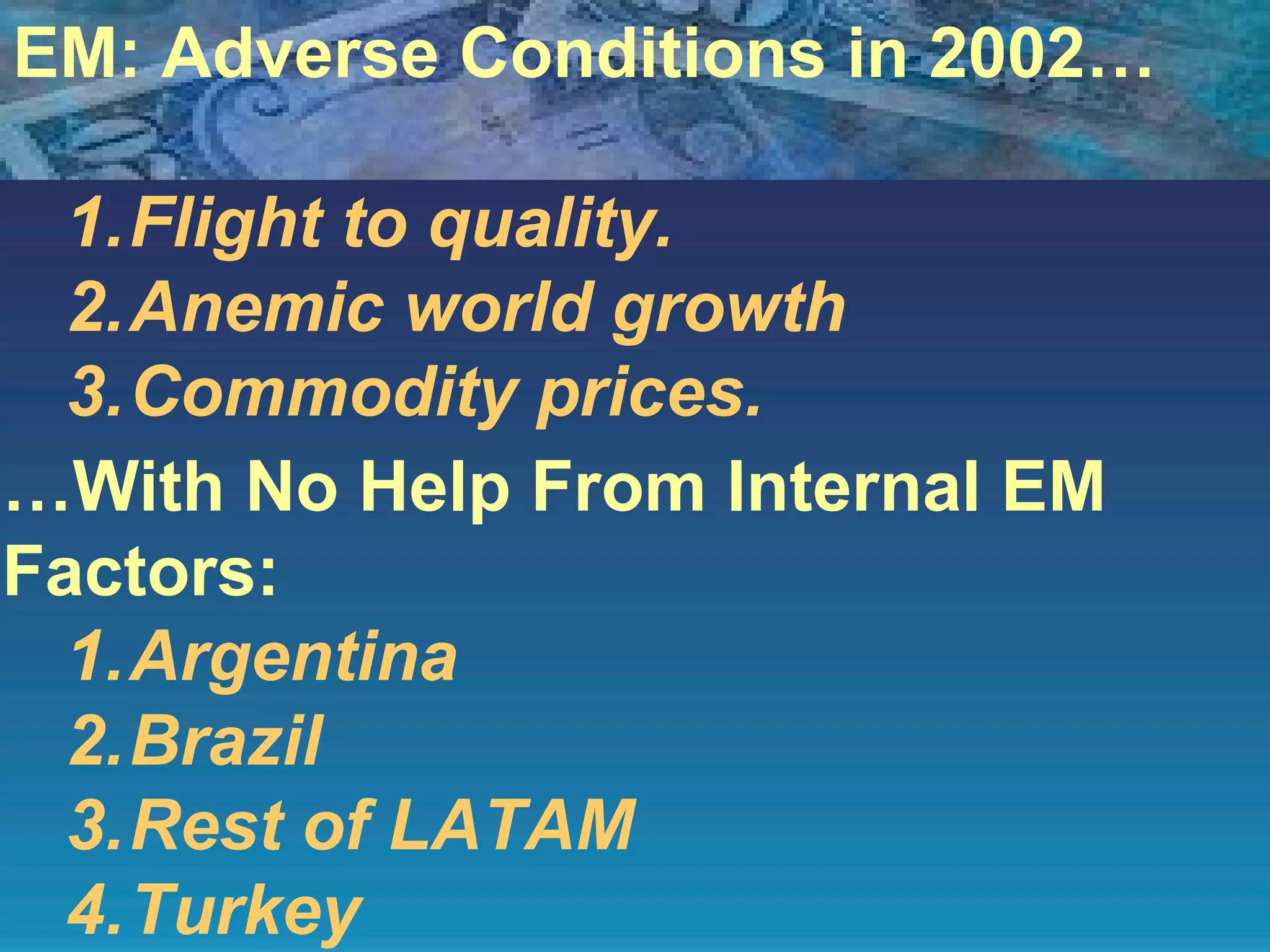

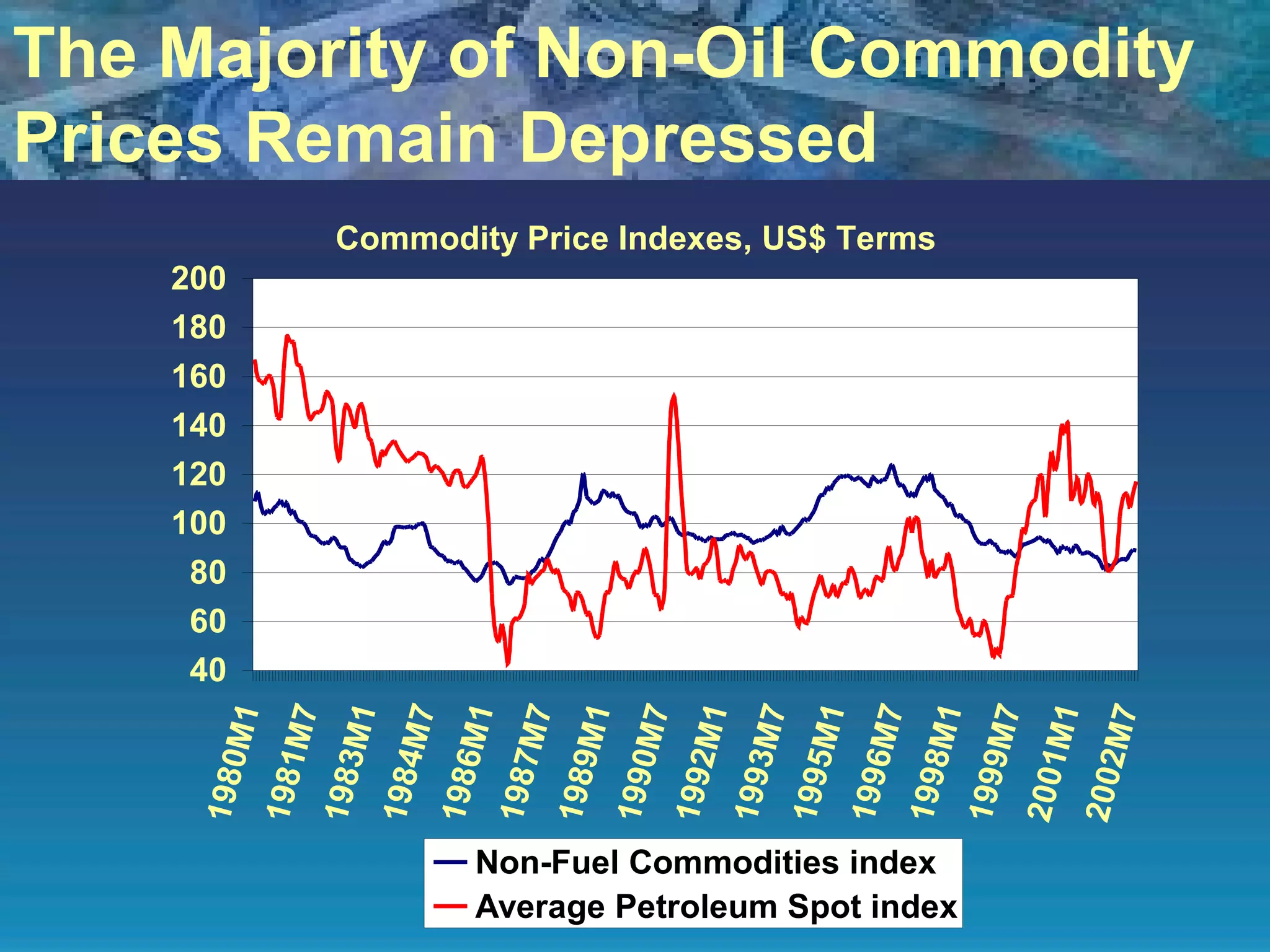

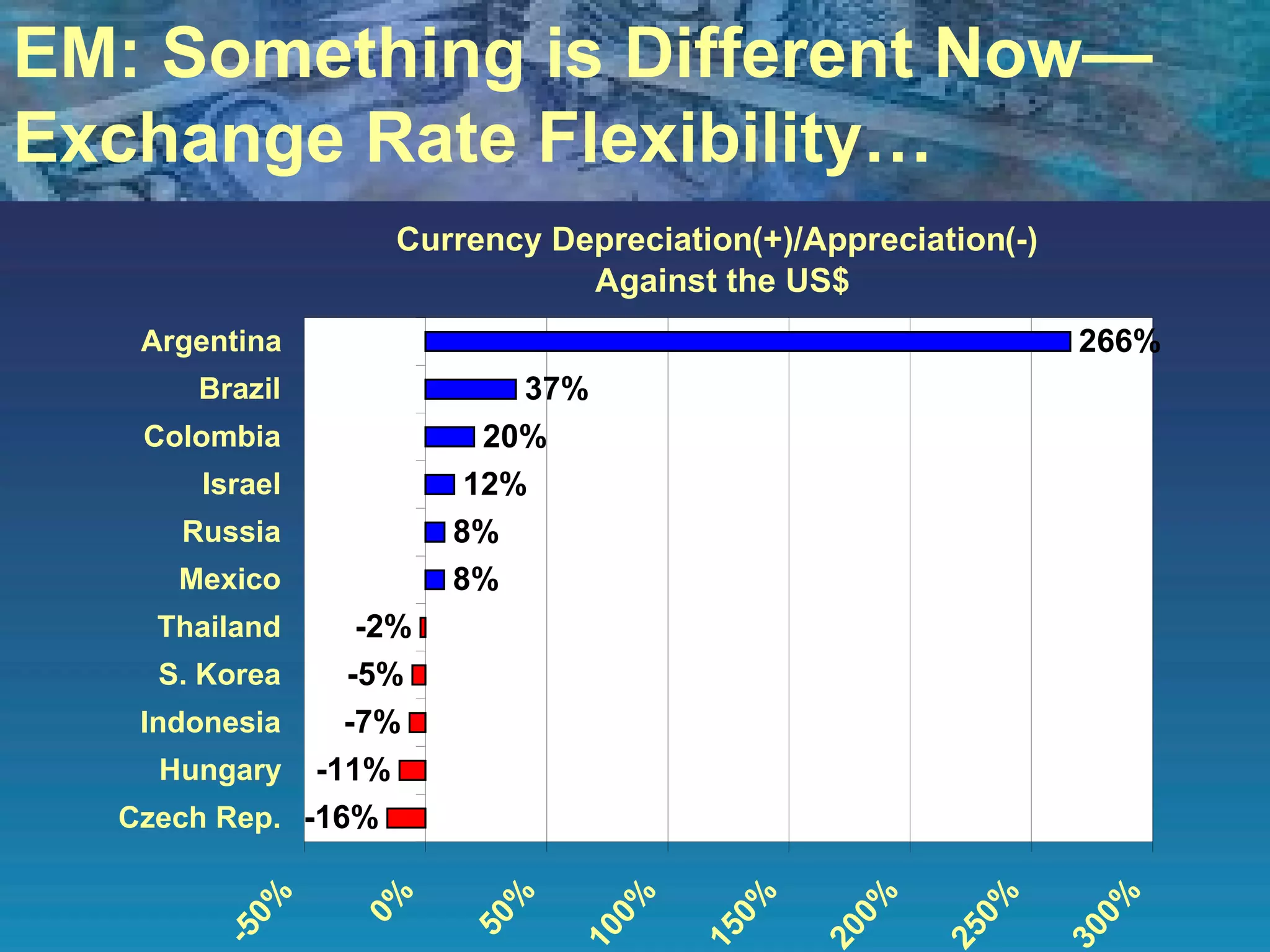

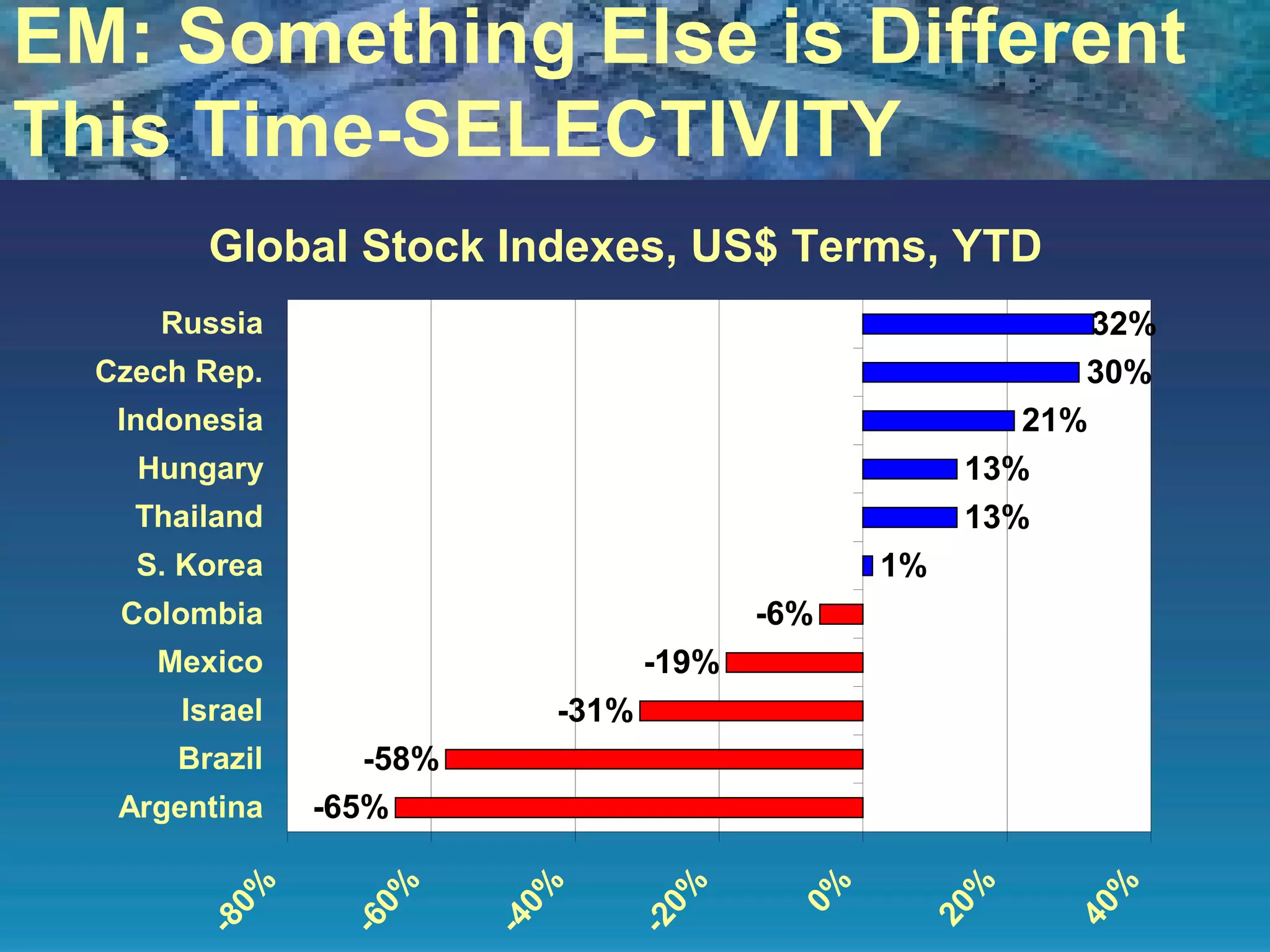

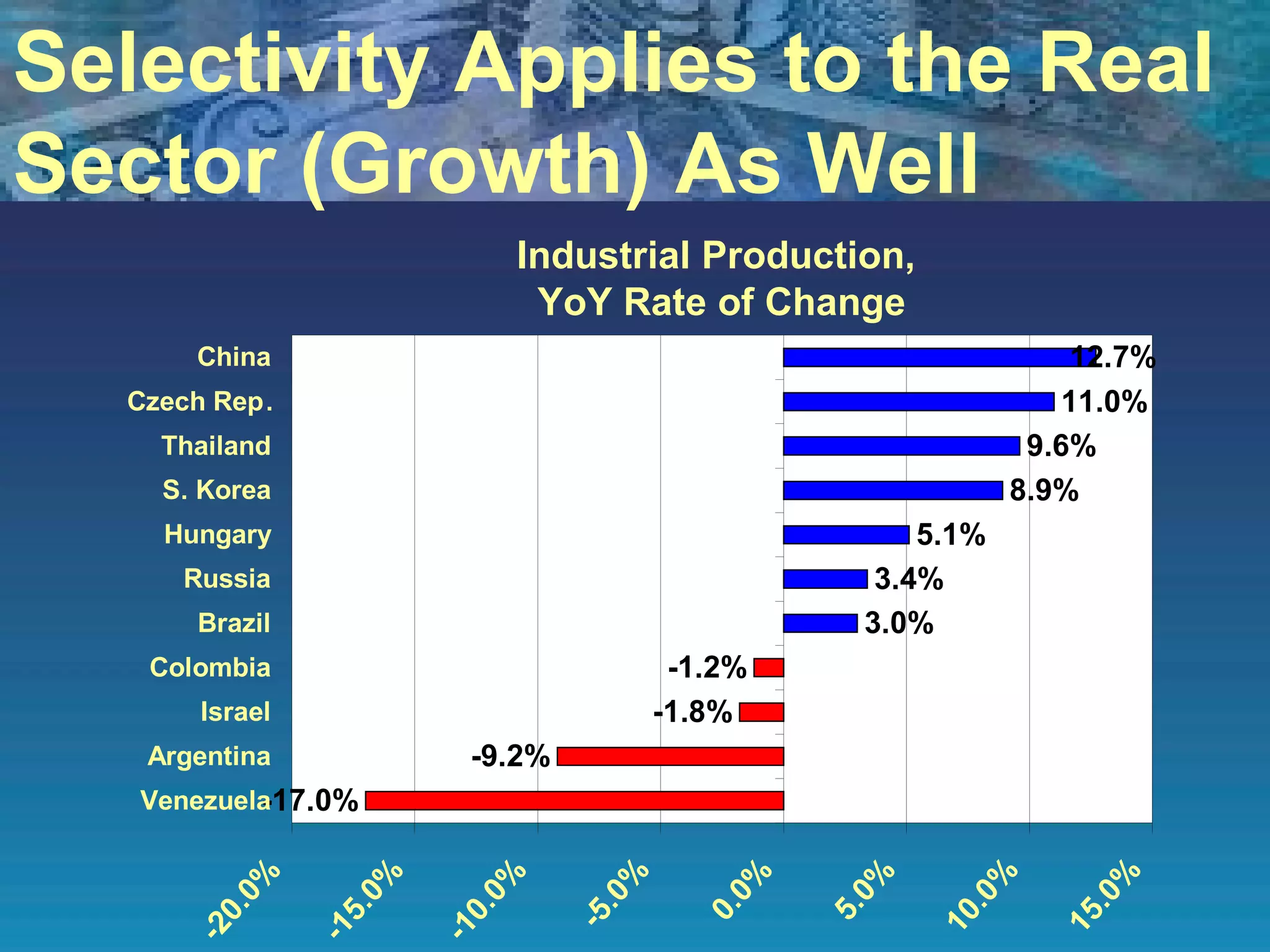

The document discusses how emerging markets are facing difficulties due to changes in the global economy. It notes an increase in emerging market bond spreads and drying up of portfolio flows as funds available to emerging markets have decreased. Reasons given include the bursting of the Nasdaq bubble, geopolitical risks, and loss of investor confidence from accounting scandals. While emerging market policies have been flexible, growth remains well below potential with no signs of help from Europe, Japan or internal emerging market factors like Argentina and Brazil. The document concludes that something is different now for emerging markets, with exchange rate flexibility and selectivity becoming more important.