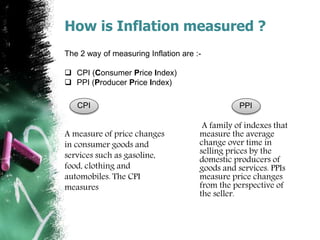

This document defines inflation as a sustained increase in price levels or decrease in the value of money. Inflation occurs when the currency supply exceeds production levels. It discusses different types of inflation like open, suppressed, galloping, and hyper inflation. Causes of inflation include increased money supply, income, deficit financing, and foreign reserves. Effects are inefficiencies, uncertainty, negative trade impacts, and higher taxes. Inflation is measured by changes in consumer and producer price indexes. Ways to control inflation discussed are monetary policies like credit and currency controls, fiscal policies like spending cuts and tax increases, and other measures like boosting production and implementing price controls.