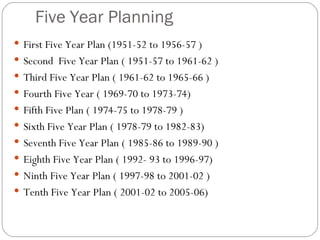

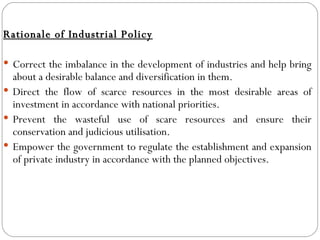

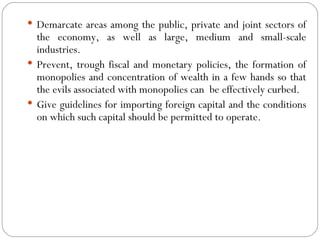

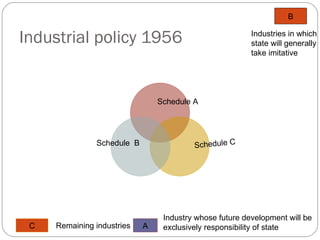

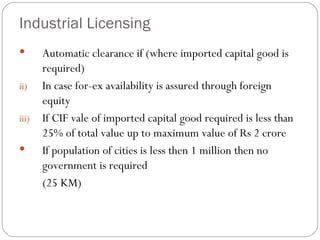

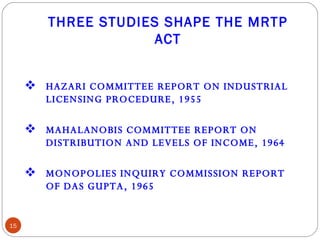

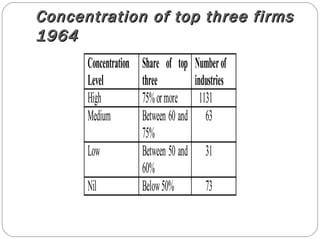

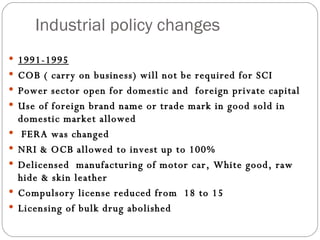

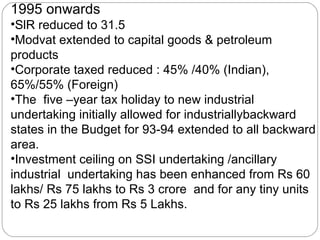

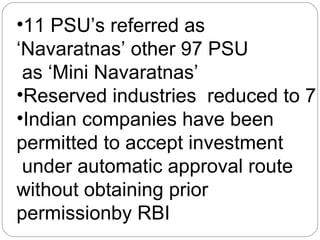

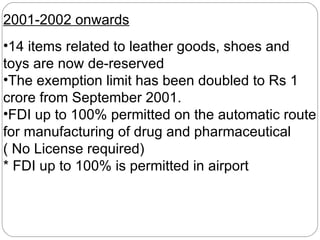

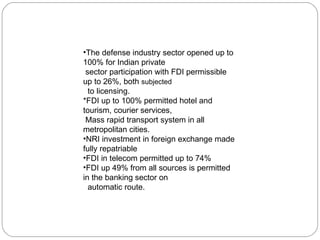

The document outlines India's industrial policies from the First Five Year Plan in 1951 to recent changes in the early 2000s. It discusses the rationale for industrial policies, including balancing development, efficient use of resources, and preventing monopolies. Key aspects of industrial policies over the decades included the public, private, and joint sectors, licensing, foreign investment rules, and the Monopolies and Restrictive Trade Practices Act. Major changes in the 1990s included deregulation, liberalization, allowing higher foreign investment, and reducing the number of reserved industries.