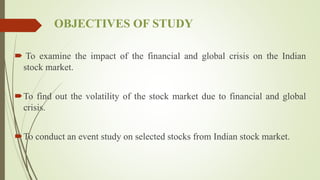

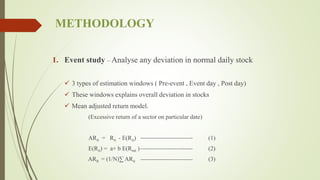

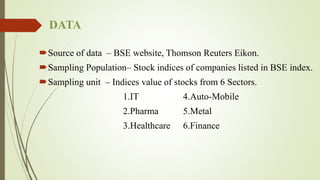

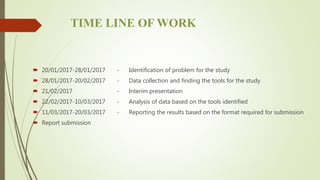

This document discusses the impact of financial and global crises on the Indian stock market. It aims to examine the volatility of the Indian stock market due to events like the 2008 subprime crisis, the 2008 Mumbai terrorist attacks, the 2015-16 Chinese stock market turbulence, and Brexit in 2015. The study will use an event study methodology to analyze the deviation of stock returns during crisis periods. It will also perform statistical analysis and regression analysis to compare the stock market between pre-crisis and post-crisis periods. The study seeks to understand how external events influence the Indian market and aid investors in making informed decisions.