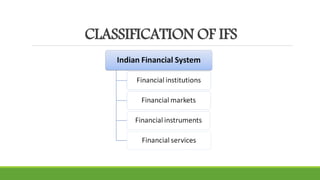

The Indian financial system is comprised of financial institutions, markets, and instruments. Financial institutions like banks mobilize savings from individuals and institutions and lend them out. They are classified as banking or non-banking institutions. Financial markets facilitate the buying and selling of financial claims and services. Capital markets help raise resources through instruments like stocks and bonds. Financial services also emerged to intermediate and facilitate transactions for investors. Overall, the financial system plays a vital role in economic development by encouraging savings and investment, linking savers to investors, and helping with capital formation and risk allocation.