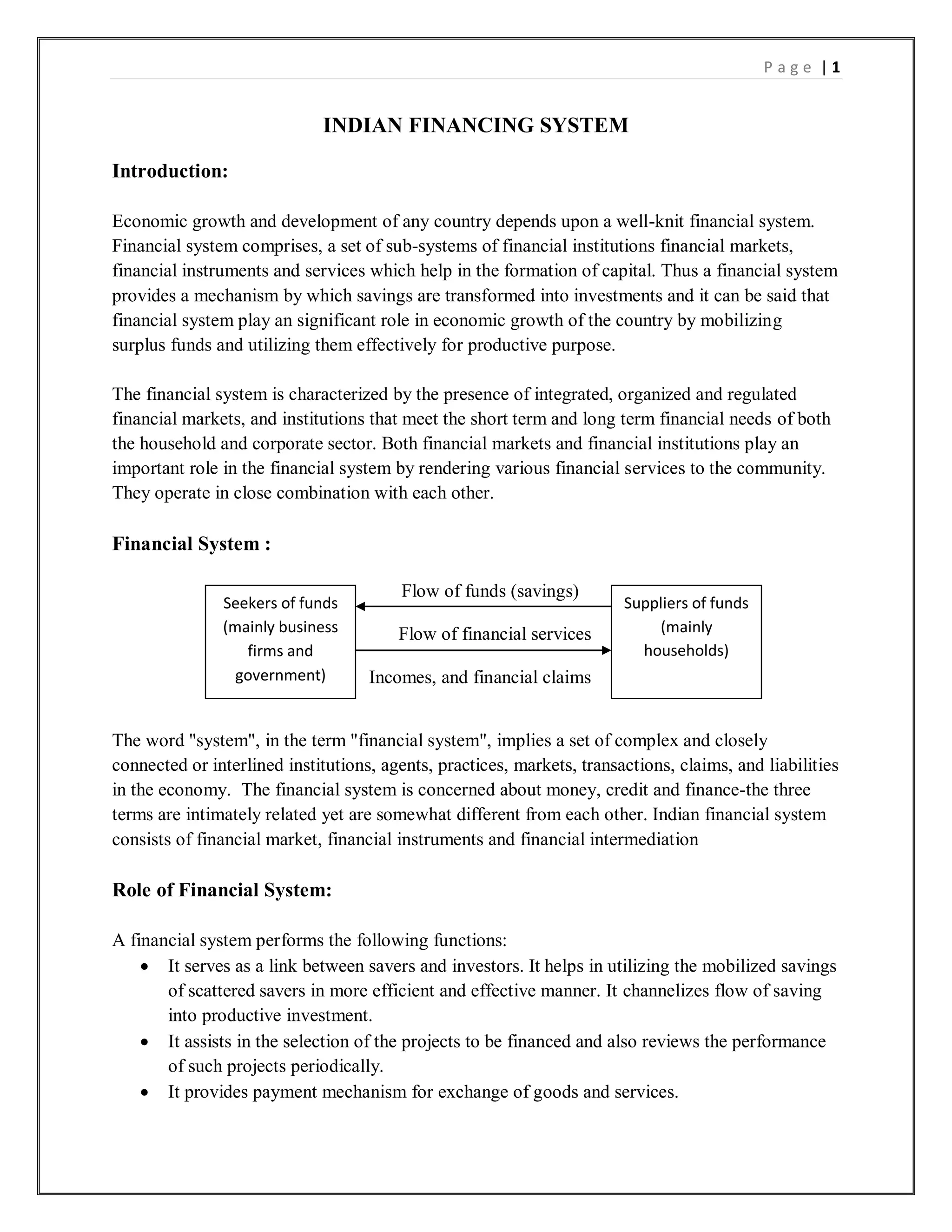

The Indian financial system consists of financial institutions, markets, instruments, and services that facilitate the flow of funds between savers and borrowers. It mobilizes savings and channels them into productive investments. The key components include commercial banks, insurance companies, stock and money markets. Financial institutions intermediate between surplus and deficit units, while markets allow trading of instruments like stocks, bonds, and currencies. Together they perform vital roles like maturity transformation and risk sharing. Over time, India's financial system has grown in strength, efficiency, and stability through measures like competition, consolidation, and regulation.