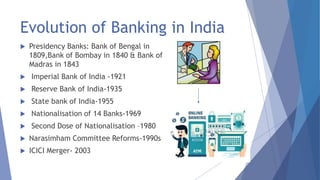

The document discusses the challenges of modern banking. It outlines the evolution of banking in India from presidency banks in the early 1800s to nationalization efforts in the late 20th century. The modern banking system is described as two-tiered with commercial banks at the bottom level managed by a central bank. The main challenges of modern banking discussed are macroeconomic risk, excessive regulation, political interference, outdated IT systems, cybercrime, and increasing competition from fintech companies.