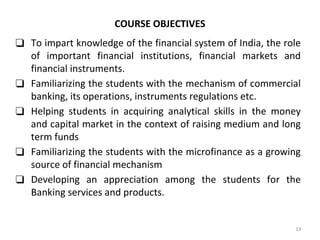

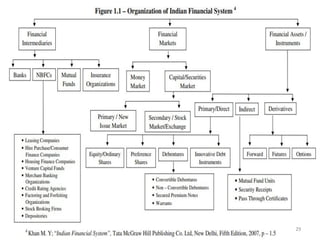

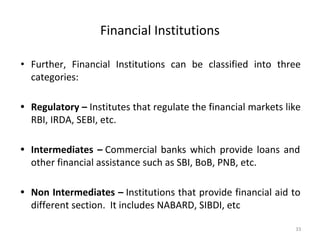

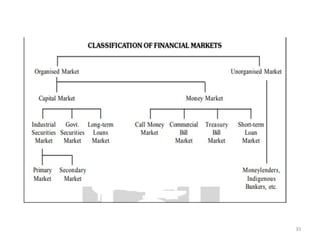

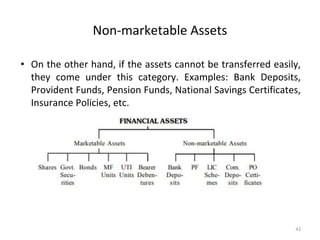

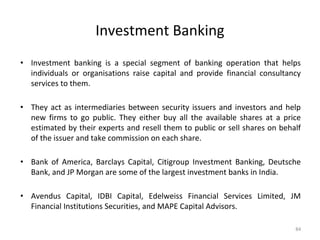

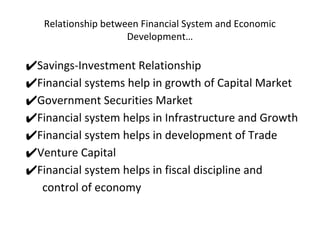

The document outlines a course on banking and financial services, focusing on the understanding of various financial institutions, markets, and their regulatory environment. It highlights key topics including commercial and investment banking, microfinance, venture capital, and the structure of the Indian financial system. Additionally, it emphasizes the importance of financial systems in economic development and the roles played by intermediaries and financial assets.