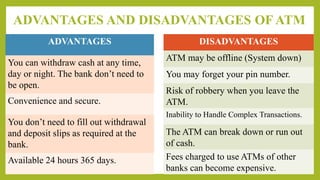

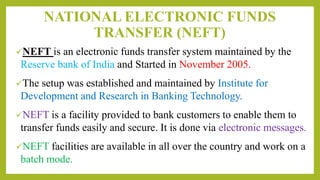

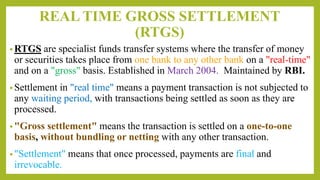

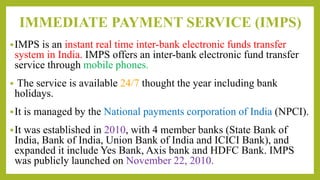

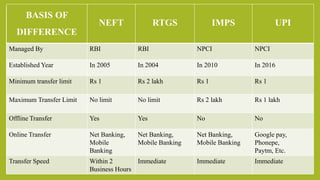

This document provides an overview of electronic banking, including its introduction, advantages, disadvantages and types. Electronic banking allows funds to be transferred electronically rather than through cash or checks. It was first conceptualized in the 1970s and introduced in some banks in 1985. Common types of electronic banking include automated teller machines (ATMs), internet banking, mobile banking, and electronic funds transfer. ATMs allow customers to access cash 24/7 using debit or credit cards. Internet and mobile banking provide banking services via websites and apps. Electronic funds transfer enables electronic money transfers between bank accounts in real-time.